Q1 2023 Heavy Goods Vehicle Registrations

Q1 2023 Heavy Goods Vehicle Registrations

Best first quarter for HGV fleet renewal since pandemic

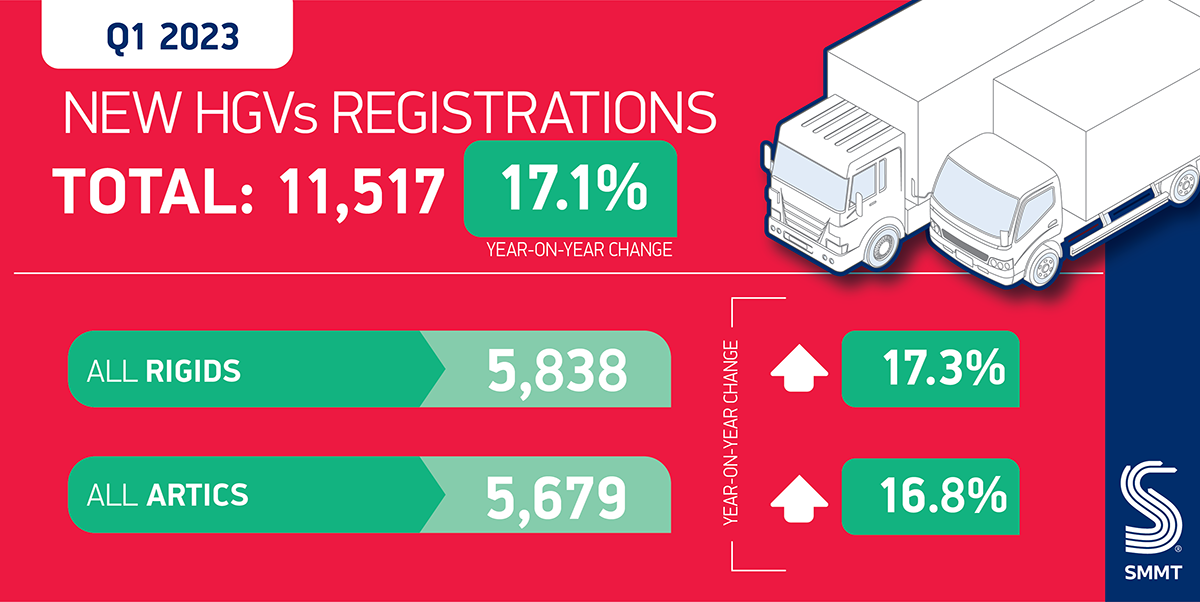

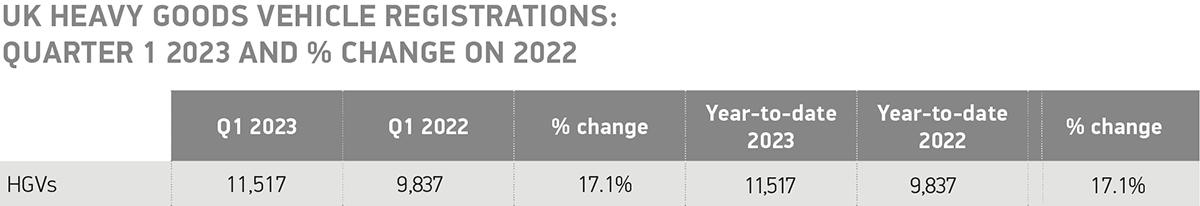

- UK new HGV registrations rose by 17.1% to 11,517 units in Q1 2023, the best start to a year since pre-pandemic 2019.

- Double digit growth for rigid and articulated trucks, with volumes up 17.3% and 16.8% respectively.

- Industry calls for long-term strategy for HGV infrastructure and incentives to deliver zero emission goals.

Wednesday 17 May, 2023

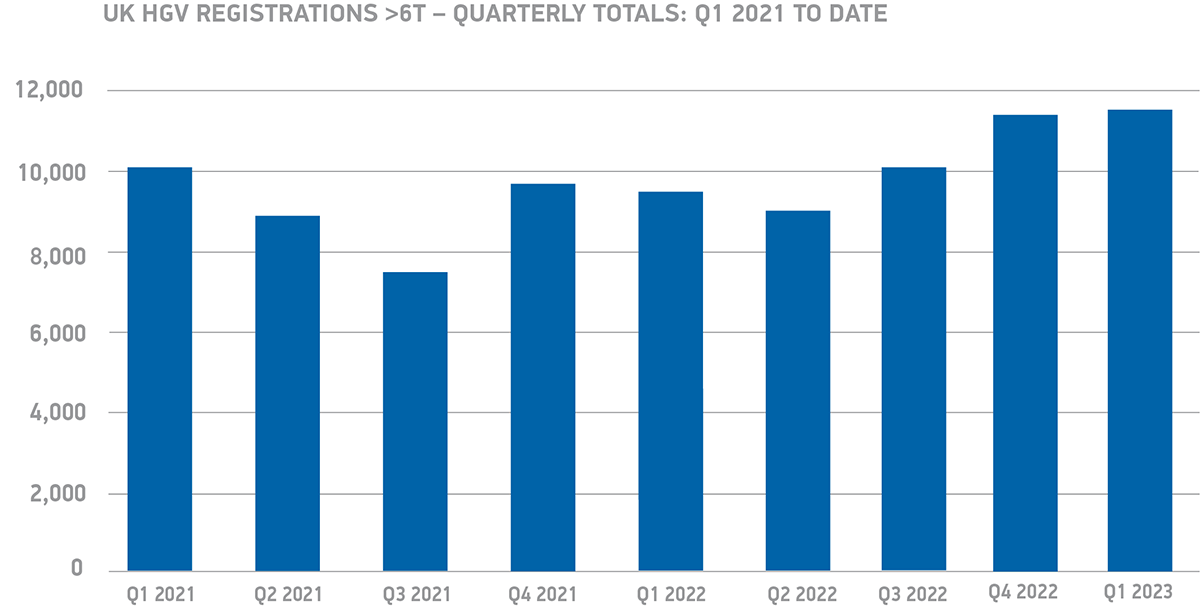

UK demand for heavy goods vehicles (HGVs) grew by 17.1% to 11,517 registrations in the first three months of 2023, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). The fourth consecutive quarter of growth, driven by high demand from the haulage, construction and distribution sectors as well as an easing of long-term global supply chain disruptions, means the market is now just -2.9% below Q1 20191.

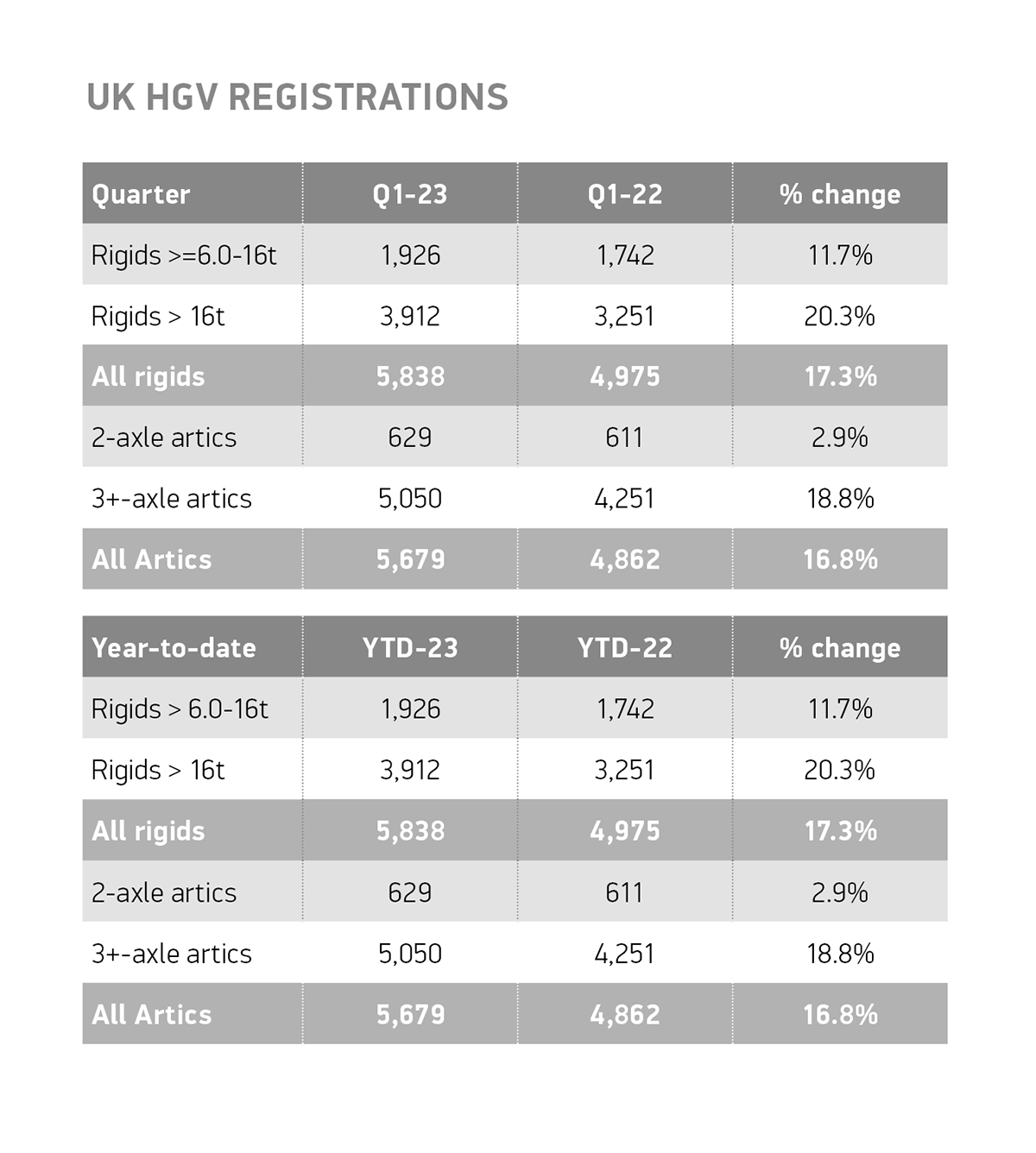

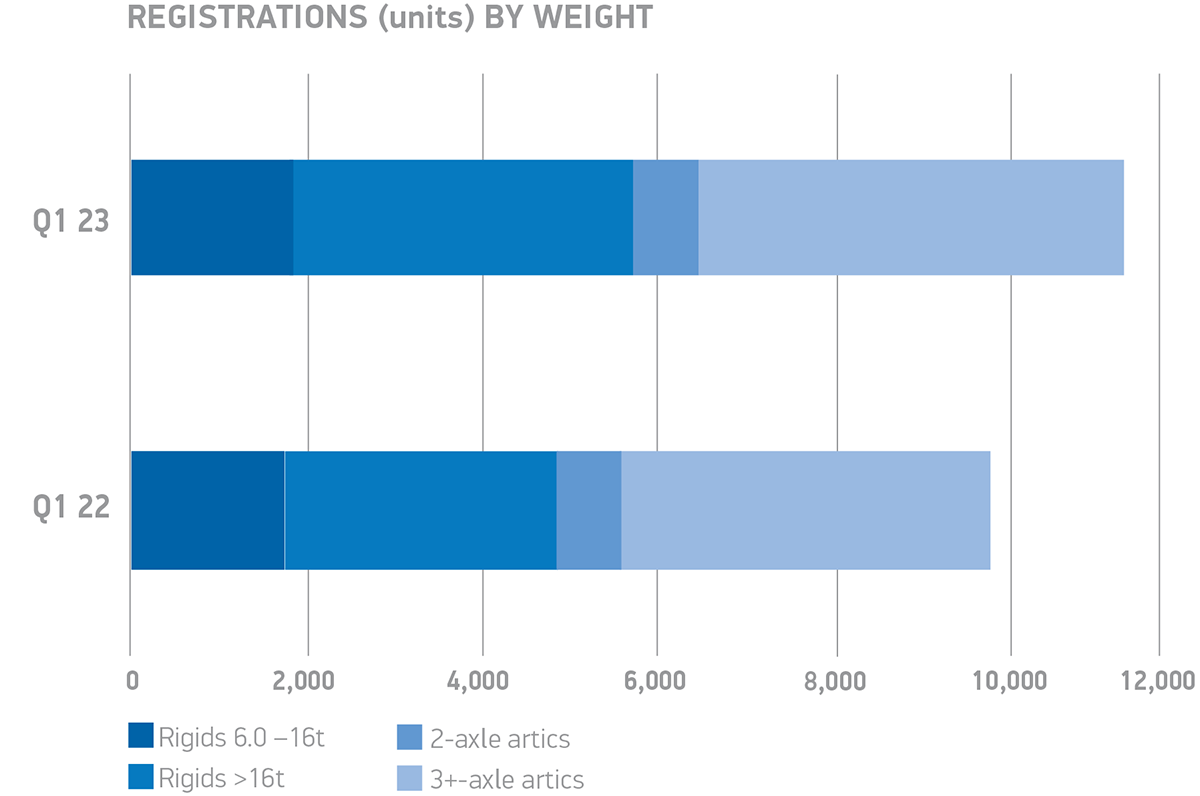

The rise in registrations was led by double-digit increases of rigids and articulated trucks. The number of new rigid models joining UK roads rose by 17.3% to 5,838 units, representing the highest Q1 demand for new rigid HGVs since 2019,2 at 50.7% of all new truck registrations. Newly registered articulated trucks, meanwhile, rose by 16.8% to 5,679 units.

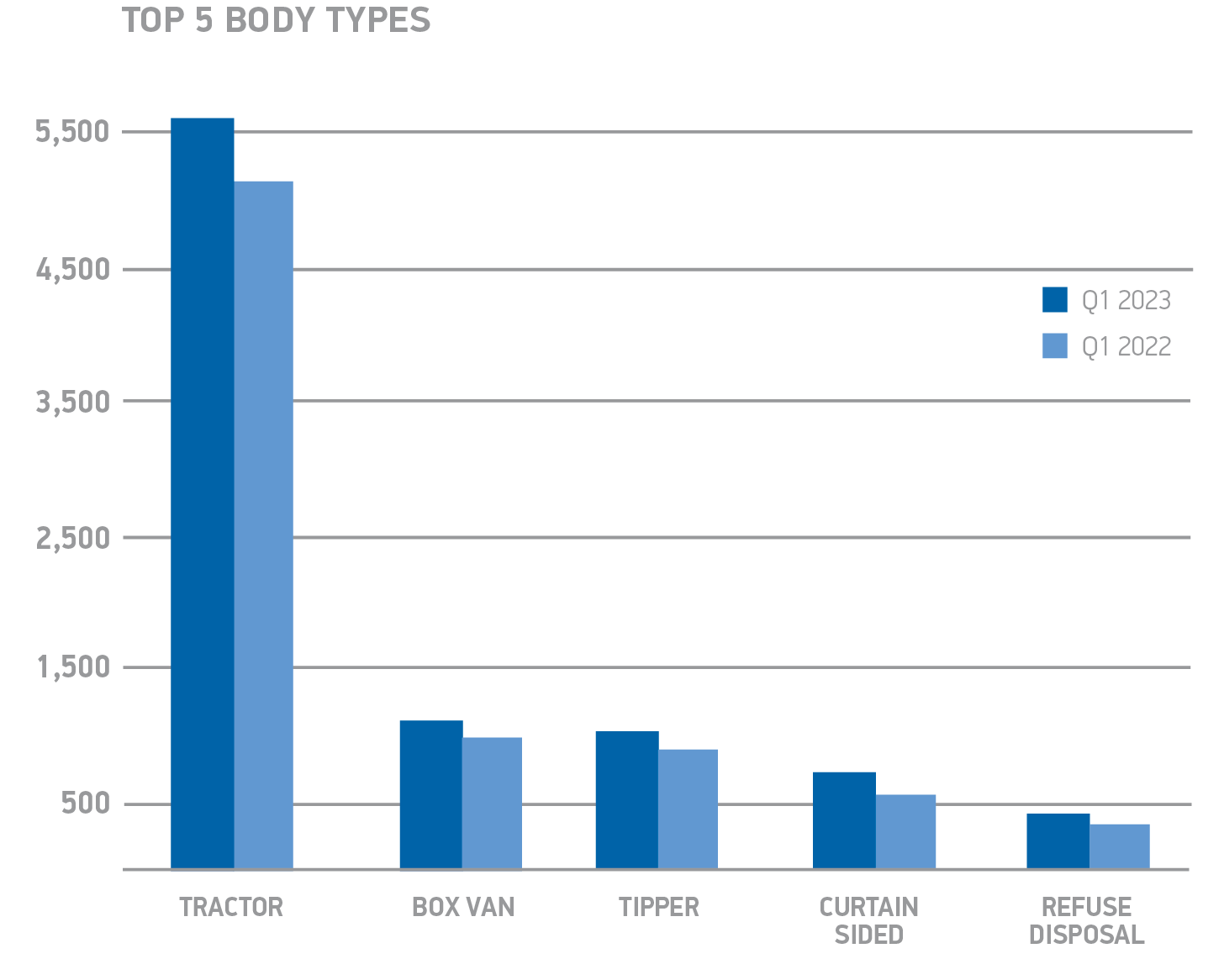

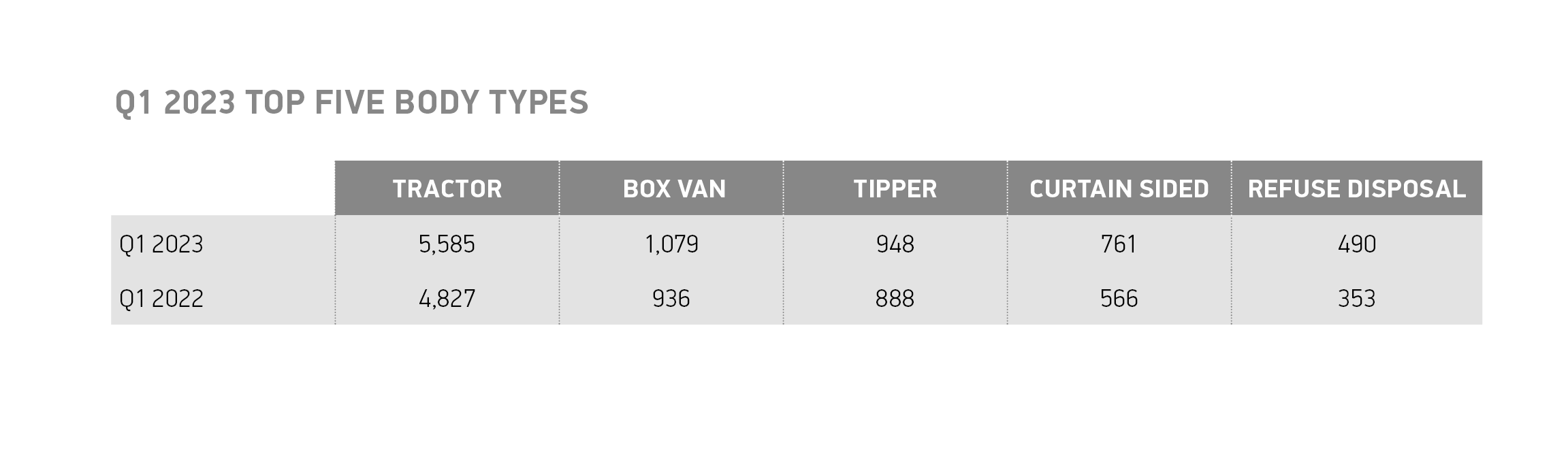

There was a rise in demand for trucks in all major segments, with tractors by far the most popular, up by 15.7% to 5,585 units, while some 1,079 new box vans were registered, up 15.3%. New registrations of tippers increased by 6.8%, curtainsiders by 34.5% and dropside trucks by 38.8%.

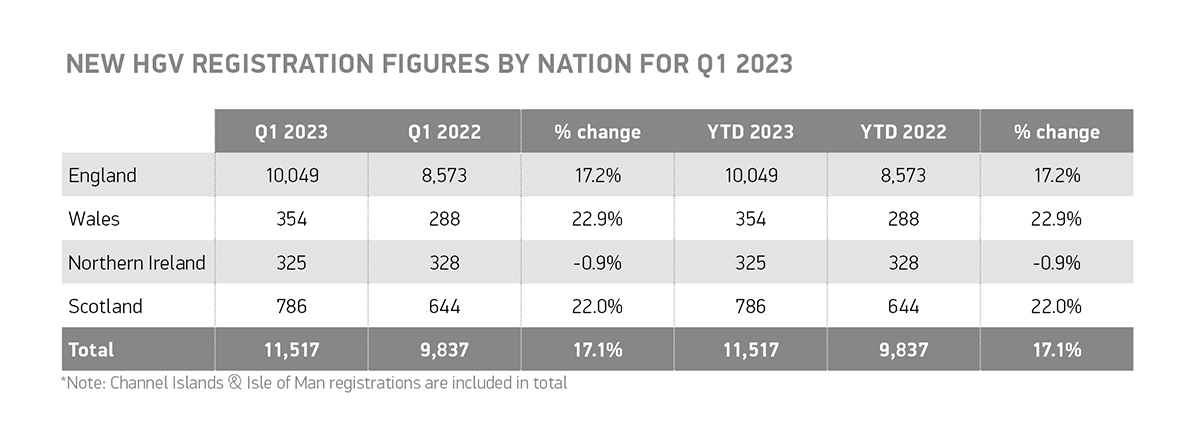

HGV uptake grew across Great Britain, with registrations in England up 17.2%, representing 87.3% of the UK market. Meanwhile, demand in Scotland and Wales increased by 22.0% and 22.9% respectively. South East England welcomed the most (21.0%) newly registered HGVs, followed by other key UK logistics regions including the North West (13.7%) and East Midlands (12.5%).

As truck manufacturers invest heavily to introduce new zero emission vehicles (ZEVs) with 20 models currently available in the UK, the latest electric and hydrogen HGVs represented just 0.3% of the market. Given the absence of a single HGV-dedicated public charging or hydrogen refuelling station in the UK, and with the sale of new non-ZEV trucks under 26 tonnes due to end in 2035, further measures are needed for operators across the UK to make the switch.

The industry is therefore calling on the government to provide a long-term HGV infrastructure strategy that matches Britain’s world-leading ambitions for truck decarbonisation, delivering sufficient public charging and refuelling points in the right locations, ahead of need. Globally competitive incentives for the higher cost of ZEV fleet renewal and required depot upgrades is also essential, enabling many operators that naturally face tight margins to commit to the latest high-performing green trucks.

Mike Hawes, SMMT Chief Executive, said,

The fourth quarter of growth shows that the HGV sector’s recovery from pandemic and supply chain shocks now has momentum. For truck fleet renewal to drive UK economic growth and decarbonisation in the long term, however, the zero emission HGV market must gather speed – but operators still need greater certainty that Britain is serious about becoming a globally competitive location for zero emission logistics. With an abundance of new electric and hydrogen truck models now ready to join UK roads, a plan is urgently needed to deliver HGV-dedicated public infrastructure, along with incentives for net zero vehicle and depot investments that contend with the world’s major decarbonising nations.

Notes to editors

1 HGV registrations, Q1 2019: 11,859 units.

2 Rigid registrations, Q1 2019: 6,339 units.

File Downloads

- Q1 2023

Q1 2023

| Title | Description | Version | Size | Download |

|---|---|---|---|---|

| UK HGV registrations Q1 2023 and % change | 69.54 KB | DownloadPreview | ||

| Top 5 HGV body types chart | 27.66 KB | DownloadPreview | ||

| SMMT quarterly HGVs Q1 2023-01 | 209.03 KB | DownloadPreview | ||

| SMMT News Release – Q1 New HGV Registrations – May 2023 – APPROVED | 913.77 KB | Download | ||

| Q1 YTD BY WEIGHT chart | 53.23 KB | DownloadPreview | ||

| Q1 2023 UK HGV registrations table | 212.57 KB | DownloadPreview | ||

| Q1 2023 UK HGV registrations 6T quarterly totals – Q1 2021 to date chart | 55.85 KB | DownloadPreview | ||

| New HGV registration figures by nation for Q1 2023 table | 103.70 KB | DownloadPreview | ||

| MH Q1 HGV quote | 499.47 KB | DownloadPreview | ||

| HGV headline | 119.49 KB | DownloadPreview | ||

| 2023 Q1 Top 5 HGV body type table | 36.29 KB | DownloadPreview | ||

| 7_HCV_PRESS_RELEASE WITH REGIONS 2023 Q1 | 16.65 KB | Download |

Comments are closed.