UK Automotive Trade Report 2023

UK Automotive Trade Report 2023

Agreement with Europe needed to avoid £3,400 electric vehicle tax hike

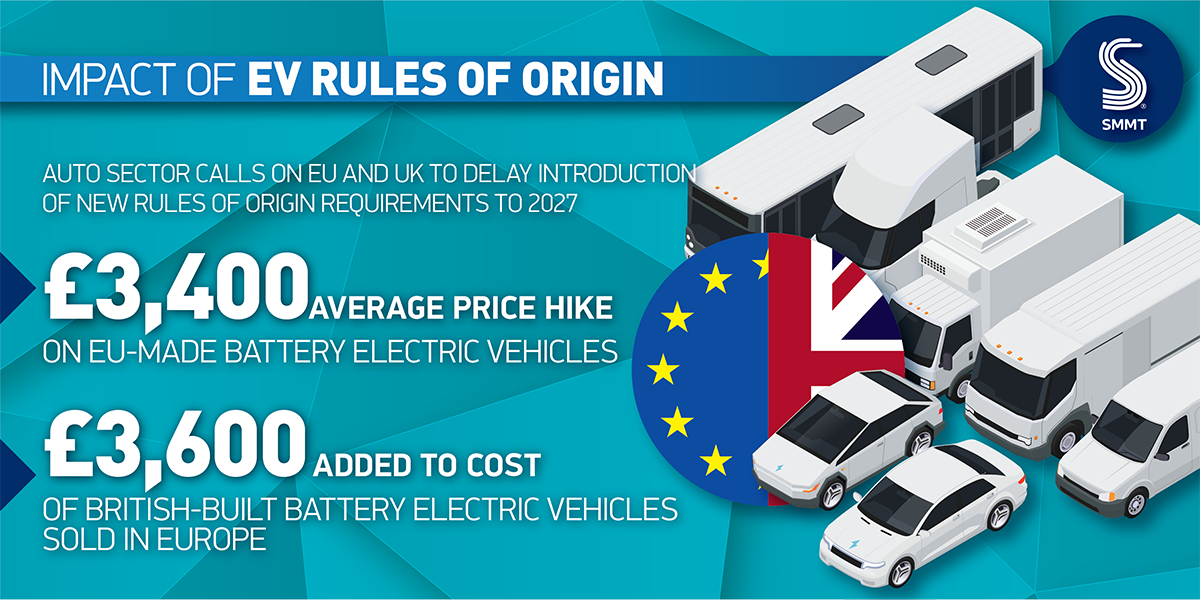

- New figures reveal tariff threat to EU-made battery electric vehicles could result in a £3,400 average price hike if unworkable rules of origin are implemented in January.

- 10% tariffs would also add £3,600 to cost of British-built BEVs sold in Europe, with conventional ICE models unaffected on both sides.

- Auto sector calls on EU and UK to delay introduction of new rules of origin requirements to 2027 or put competitiveness, the EV transition and net zero ambitions at risk.

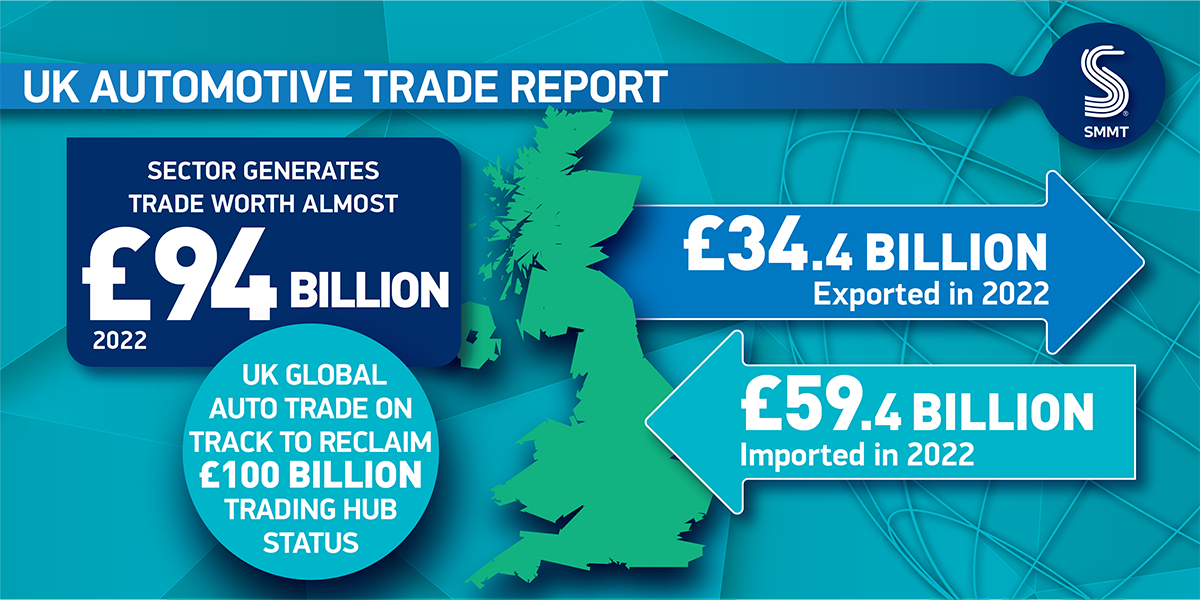

- News comes as latest SMMT Automotive Trade Report shows UK global auto trade on track to reclaim £100 billion trading hub status.

Wednesday 18 October, 2023

The Society of Motor Manufacturers and Traders (SMMT) is today urging the EU and UK to strike an immediate agreement to avoid damaging Brexit tariffs on electrified vehicles. The plea, echoed by the EU auto sector, is to delay the implementation of tougher new Rules of Origin (ROO) requirements on batteries which could render EU and UK made electrified vehicles uncompetitive in each others’ markets.

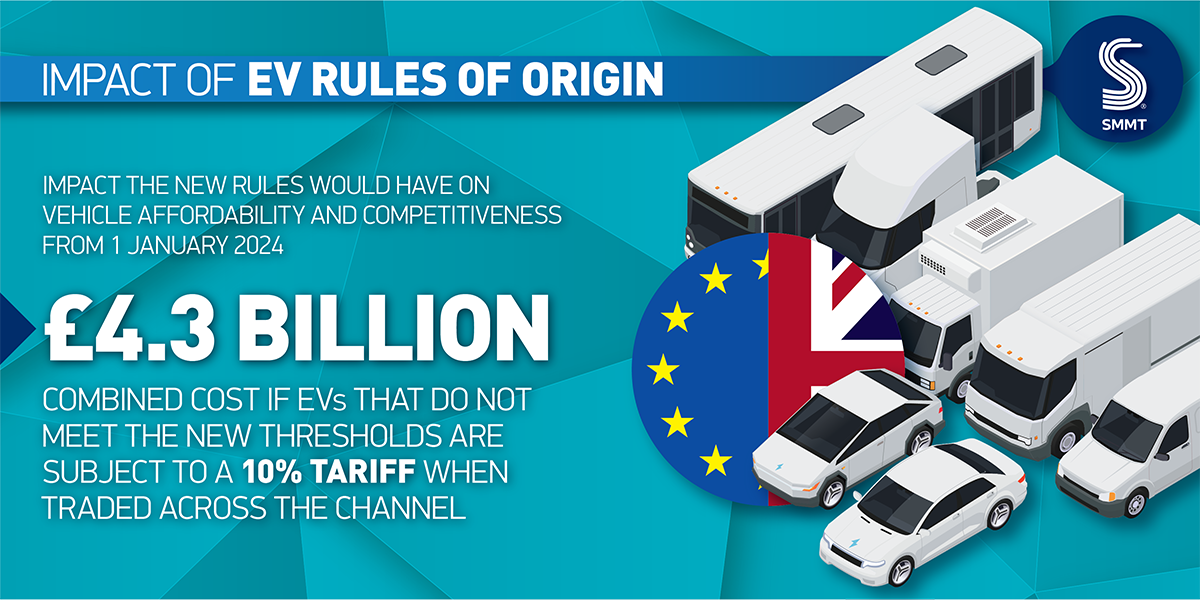

As the clock ticks down to the 1 January 2024 ROO introduction, new calculations lay bare the impact the new rules, set under the EU-UK Brexit deal, would have on vehicle affordability and competitiveness. Electrified vehicles that do not meet the new thresholds will be subject to a 10% tariff when traded across the Channel, resulting in a combined cost of £4.3 billion.1 For the consumer, this could mean an average price hike of £3,400 on EU-manufactured battery electric vehicles (BEVs) bought by British buyers, and a £3,600 rise on UK-made BEVs sold in Europe.2

Even against a backdrop of the pandemic, crippling semiconductor shortages and trade tensions, EU-UK electrified vehicle trade has more than doubled recently, enabled by the EU-UK Trade and Cooperation Agreement (TCA). It has grown 104% in the three years since the TCA was signed, up from £7.4 billion at the end of 2020 to £15.3 billion last year, although much of this uplift has been in the last 12 months.3

The situation has helped total UK automotive global trade in finished vehicles and components get back on track following the pandemic, and it is currently on course to be worth more than £100 billion by the end of 2023, according to the latest SMMT report, Open Roads – Driving Britain’s global automotive trade, published today.

This growth is now threatened, however, as rules that were agreed before the pandemic, war in Ukraine and supply shortages come into force in just 75 days’ time. With almost half (49.1%) of all new BEVs registered in the UK in the first half of the year coming from the EU, any cost increase would act as a barrier to uptake, undermining their competitiveness in an important and growing market. Furthermore, the application of a 10% tariff on electrified vehicles alone would undermine shared ambitions to be global leaders in zero emission mobility, holding back markets and undermining the drive to deliver net zero, given road transport remains the biggest contributor to overall carbon emissions.

Conventional petrol and diesel vehicles would escape tariffs, meanwhile, which would have the perverse effect of incentivising the purchase of fossil fuel-powered vehicles. Such a scenario would not only steer British car buyers away from buying the very vehicles needed to hit net zero, it could also lead to a reduction in consumer choice if any electrified models become uncompetitive in the marketplace overnight. The challenge comes at a crucial time, with manufacturers also facing the UK Zero Emission Vehicle Mandate, which is likely to come into force on the same 1 January 2024 date and compel them to sell ever-increasing numbers of zero emission models, starting at 22% next year and rising to 80% by 2030.4

A three-year delay to the introduction of the stricter rules of origin is a pragmatic solution. It would provide the necessary time for EU and UK gigafactories to come on stream as well as helping the development of local battery parts and critical mineral supply chains. The postponement is also something that can be readily achieved within the existing TCA framework, avoiding formal re-negotiation and delivering a boost to EU and UK manufacturers.

Speaking ahead of a major SMMT global trade conference today, Mike Hawes, Chief Executive, said,

UK Automotive is a trading powerhouse delivering billions to the British economy, exporting vehicles and parts around the world, creating high value jobs and driving growth nationwide. Our manufacturers have shown incredible resilience amid multiple challenges in recent years, but unnecessary, unworkable and ill-timed rules of origin will only serve to set back the recovery and disincentivise the very vehicles we want to sell. Not only would consumers be out of pocket, but the industrial competitiveness of the UK and continental industries would be undermined. A three-year delay is a simple, common-sense solution which must be agreed urgently.

Launched at the conference, Open Roads – Driving Britain’s global automotive trade, outlines the critical importance of worldwide trade to the UK automotive sector with key recommendations to assure growth, jobs and prosperity in the coming years, including:

- Modernisation of current continuity agreements combined with the negotiation of new FTAs setting realistic content requirements for batteries and related components.

- The renewal of agreements with South Korea, Mexico and Canada as well as negotiations with India and the Gulf Cooperation Council could offer enhanced market access and commercially meaningful opportunities.

- With few exceptions, international trade diplomacy is shifting its focus from traditional FTA negotiations to other priorities, including trade-related investment measures, level playing field instruments and new corporate sustainability obligations – these must be considered in future negotiations.

- Strengthening the UK and broader European supply chain for batteries and critical raw and refined minerals and embedding recycling and remanufacturing as part of a sustainable and resilient automotive business model.

- Regulatory challenges and taxation can greatly reduce market access and even offset FTA benefits, with producers of luxury and sports vehicles particularly exposed to non-tariff barriers and behind the border measures. This must also be considered in all future trade deals.

Notes to editors

1: Covering all electrified cars, BEV, PHEV and HEV, and via SMMT member survey.

2: SMMT calculations covering BEVs (cars) only. The 10% tariff applies to the factory gate cost of the vehicle. Import costs based on JATO overall market average price, export value based on SMMT own estimates.

3: SMMT calculations – Open Roads – Driving Britain’s global automotive trade

4: UK Government – https://www.gov.uk/government/news/government-sets-out-path-to-zero-emission-vehicles-by-2035

File Downloads

- Trade report 2023

Trade report 2023

| Title | Description | Version | Size | Download |

|---|---|---|---|---|

| Trade report summary 2023 | 388.98 KB | DownloadPreview | ||

| SMMT News Release 18.10.23 – Agreement with Europe needed to avoid £3400 EV tax hike – FINAL | 82.97 KB | Download | ||

| SMMT Automotive Trade Report 2023 | 4.59 MB | DownloadPreview | ||

| Regional map | 562.21 KB | DownloadPreview | ||

| MH trade EV quote | 483.64 KB | DownloadPreview | ||

| Impact of EV rules of origin 4.3bn | 520.79 KB | DownloadPreview | ||

| Impact of EV rules of origin 3,400 | 536.21 KB | DownloadPreview | ||

| Exec summary | 435.12 KB | DownloadPreview |

Comments are closed.