December 2023 UK Car Manufacturing

December 2023 UK Car Manufacturing

UK Auto makes one million vehicles and welcomes £23.7 billion investment boost

- UK vehicle production tops one million units, up 17.0% in best year since 2019.

- 905,117 cars and 120,357 commercial vehicles made, with record electrified model output.

- £23.7 billion of private and public investment commitments announced in 2023.

- UK must now ramp up EV supply chain and deliver return on investments.

Thursday 25 January, 2024

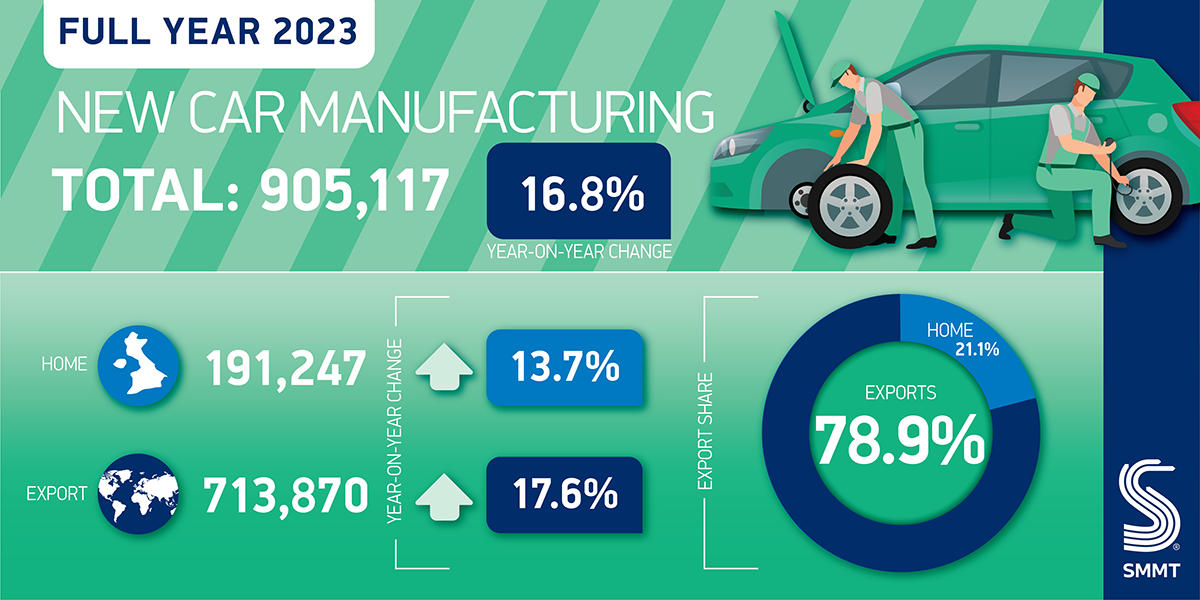

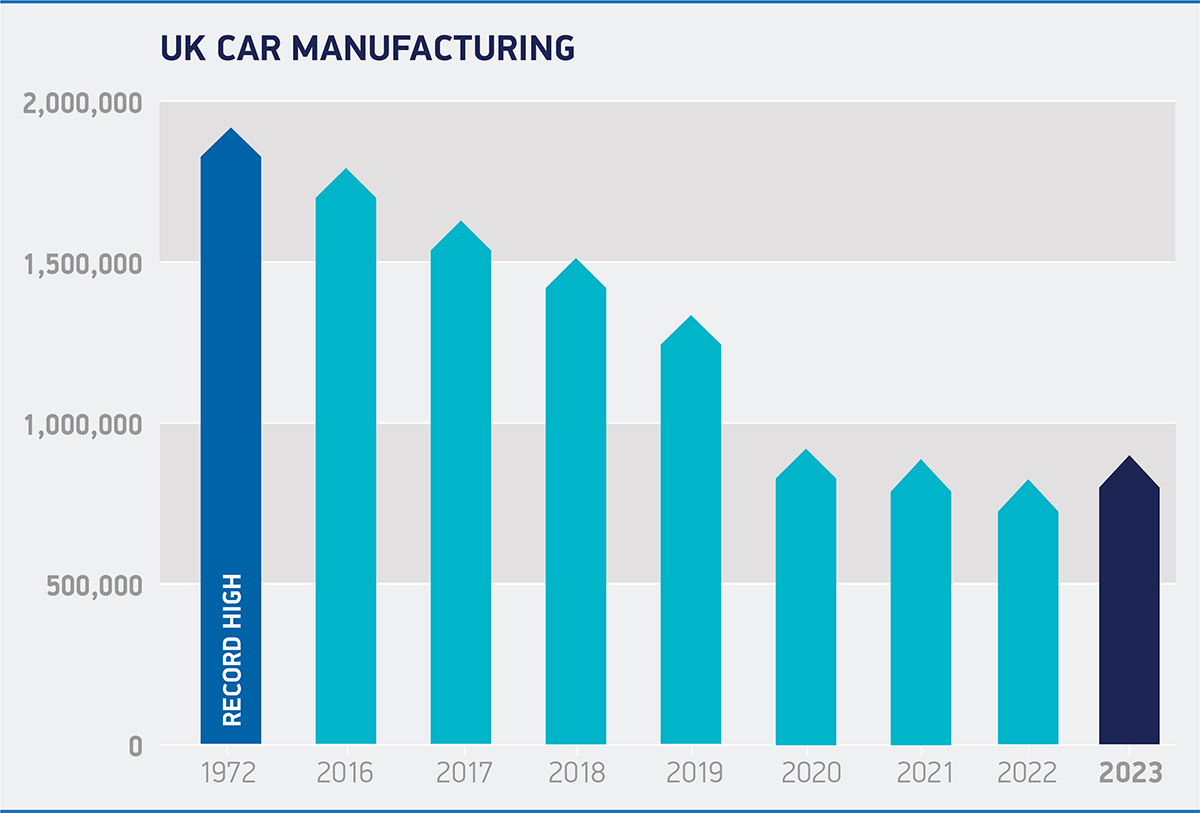

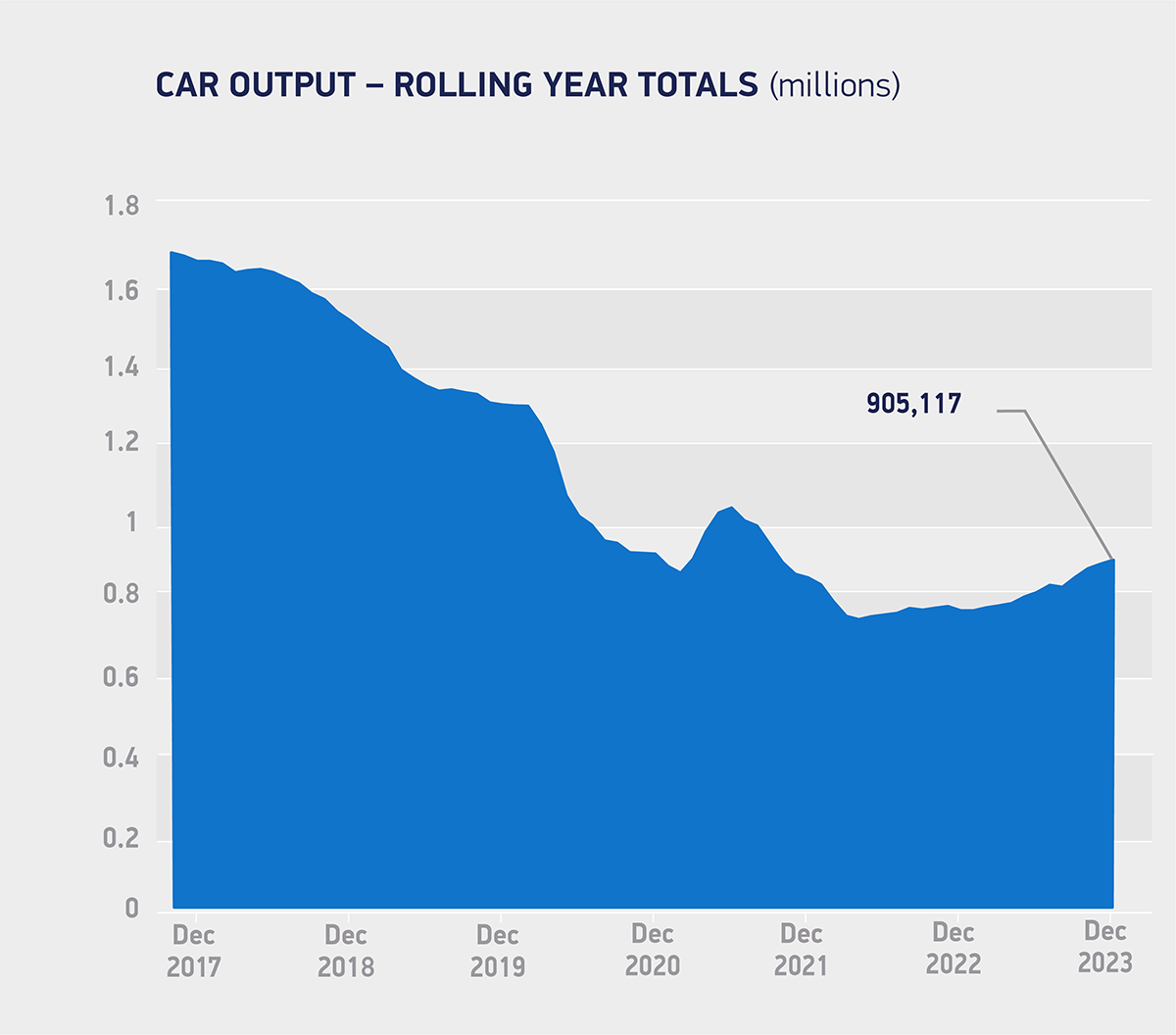

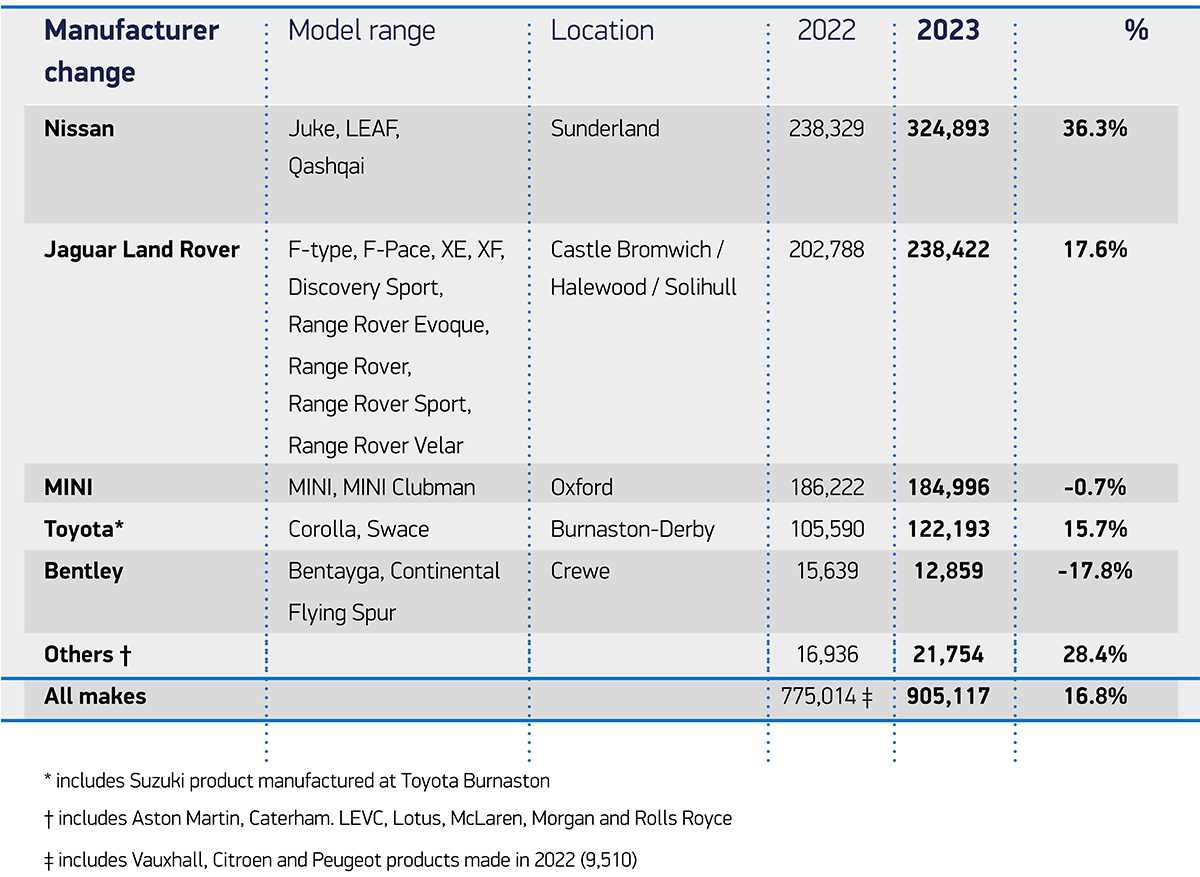

UK vehicle production hit 1,025,474 units in 2023, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). With 905,117 cars and 120,357 commercial vehicles (CVs) produced, output was up 17.0% on the previous year. The easing of pandemic-related challenges, from chip shortages to lockdowns, and increasing electrified model production, combined to drive annual output above one million for the first time since 2019.1

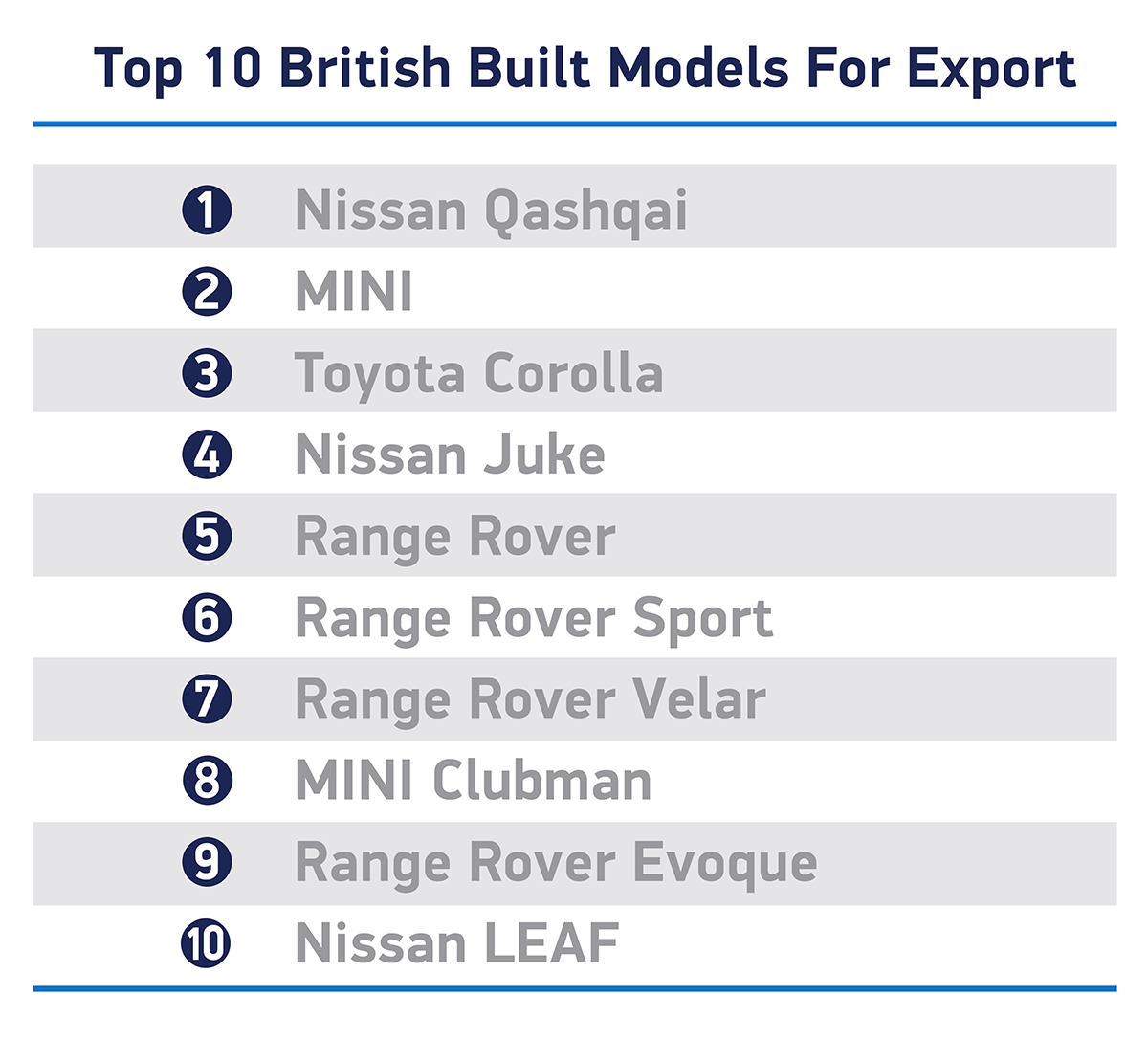

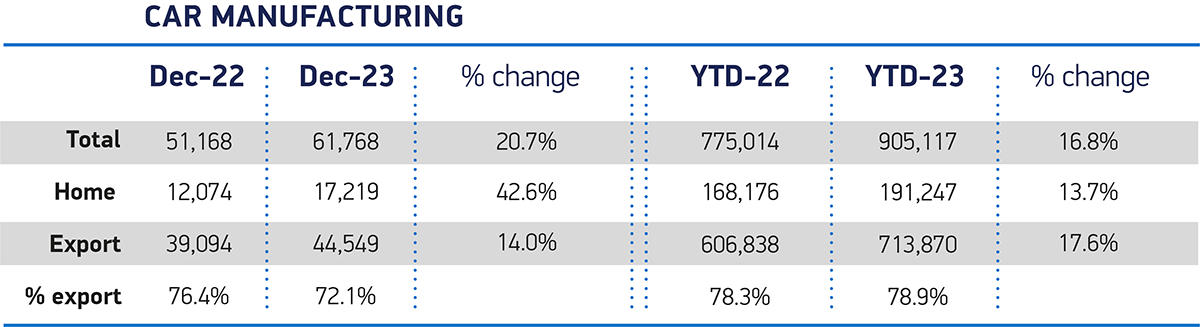

Strong December performances for both car manufacturing, up 20.7% year on year, and CV volumes, up 80.3%, rounded off a positive year, which saw a revival of the industry’s fortunes. Eight all-new cutting-edge models entered production in 2023, including at the newly reopened Ellesmere Port EV only plant,2 while some £23.7 billion of private and public investment commitments were made – more than in the previous seven years combined – from Cowley to Sunderland; gigafactories to R&D facilities.3

These commitments will drive green economic growth, create jobs nationwide and transition the sector to electrified vehicle manufacturing, which has already hit record levels in 2023. UK production of battery electric (BEV), plug-in hybrid (PHEV) and hybrid (HEV) vehicles surged to 346,451 units, up 48.0% on the year before to account for almost two fifths (38.3%) of overall output.

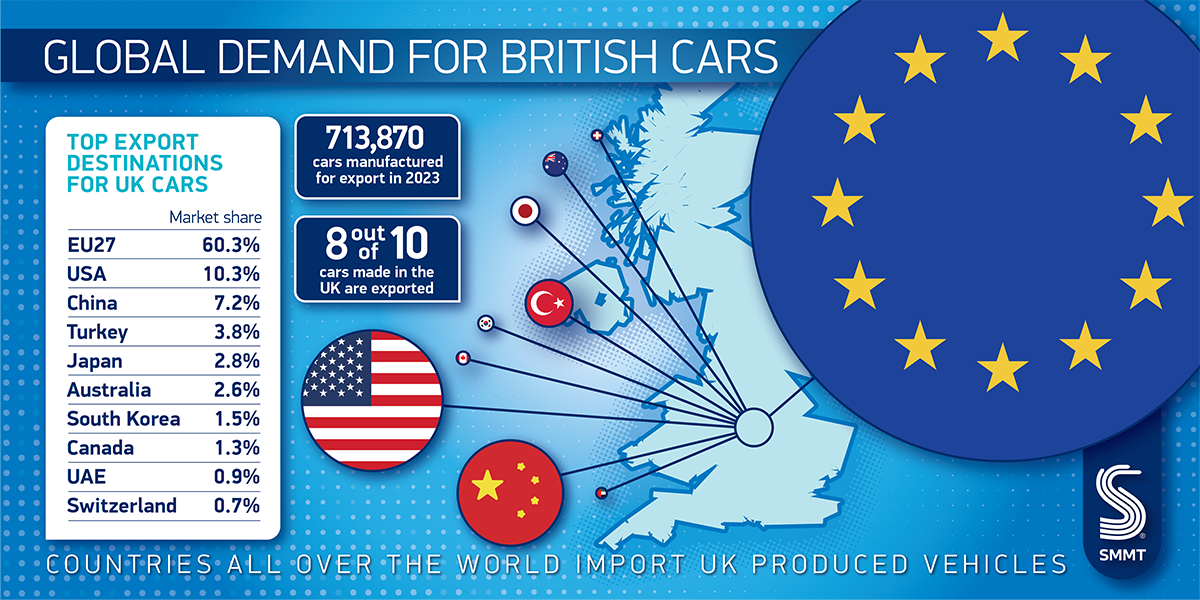

Overall, UK car production rose 16.8% in 2023, its best growth rate since 2010, with the total retail value of all models made coming in at more than £50 billion.4 While 191,247 cars were built for domestic buyers, the lion’s share of output was shipped overseas, evidence of the contribution automotive exports make to the UK economy. Year on year, exports rose 17.6% compared with a 13.7% rise in output for the British market.

The EU remained by far the sector’s largest global market, taking 60.3% of exports, with shipments up almost a quarter (23.2%) to 430,411 units. The US was the next biggest destination with a 10.3% share of exports (73,571 units), followed by China with 7.2% (51,202 units), despite shipments to both slipping by -9.1% and -2.7% respectively. Turkey, conversely, saw exports surge 223.8% to 27,346 units, making it the UK’s fourth biggest global market ahead of Japan, Australia, South Korea, Canada, UAE and Switzerland.

Mike Hawes, SMMT Chief Executive, said,

Receding supply chain challenges, new model introductions and a massive £23.7 billion of investment put UK vehicle production firmly back on track in 2023. Industry will now focus on the delivery of these commitments, transitioning the sector at pace to electric and scaling up the supply chain. With global competition as fierce as it has ever been and amid escalating geopolitical tensions, both government and industry must remain singularly focused on competitiveness, with all the jobs and growth this will bring. We are in a much better position than a year ago, but the challenges are unrelenting.

Despite challenging market conditions, British specialist, luxury and performance car makers had another bumper year, with combined volumes climbing 6.3% to 34,613 units, worth an estimated £7.1 billion.4 Two high-performance all new electric models entered production, in Goodwood and Hethel, evidence of how electrification is being embraced by manufacturers right across the sector.

The sector also received a boost at the very end of 2023 with the deferral of tougher rules of origin for batteries and EVs traded between the UK and EU. The move will help safeguard the competitiveness of the sector in the UK and Europe, providing valuable time for local battery and associated component production to ramp up.

2024 is a pivotal year to make this happen but headwinds remain, most immediately with attacks on shipping in the Red Sea raising the spectre of delays and cost pressures. However, with the imminent threat of UK-EU rules of origin tariffs overcome, the latest independent outlook foresees UK car and light van output rising by around 3% in 2024 to 1.04 million units with the potential to exceed 1.2 million units by the end of this decade.

To achieve this, the UK must ensure it remains competitive, and so the forthcoming Budget is an opportunity for government to introduce measures that will boost the sector. These should include extending Climate Change Agreements so electric vehicle battery-manufacturing and its associated supply chain are eligible for relief; making green energy widely available and affordable; delivering on commitments to improve grid connections; and taking action to close critical labour and skills gaps.

Rapid delivery of the government’s Advanced Manufacturing Plan, full implementation of the Harrington Review recommendations, plus a trade policy that places automotive at the heart of all future negotiations would also help the UK consolidate its recovery and become a global leader in increasingly electrified vehicle production.

Notes to editors

1: 1,303,135 cars and 78,270 CVs made in 2019

2: Models from brands: Aston Martin, Lotus, Rolls-Royce, Stellantis, Daf and Alexander Dennis

3: SMMT calculations based on publicly announced investment commitments, public and private, in UK automotive production and R&D 2023 from brands including but not limited to: MINI, JLR, Tata and Nissan. Total announced investment 2016-2022 inclusive: £16.2 billion.

4: SMMT calculations based on RRP and publically available information – £51.6 billion.

File Downloads

- December 2023

December 2023

| Title | Description | Version | Size | Download |

|---|---|---|---|---|

| UK new car production Dec 2023 | 490.95 KB | DownloadPreview | ||

| UK new car production Dec 2023 | 102.31 KB | DownloadPreview | ||

| Top ten British built export 2023 | 194.15 KB | DownloadPreview | ||

| Top ten British built export 2023 | 203.49 KB | DownloadPreview | ||

| SMMT UK car manufacturing 1972-2023 | 1.35 MB | DownloadPreview | ||

| SMMT UK car manufacturing 1972-2023 | 78.89 KB | DownloadPreview | ||

| SMMT News Release – UK Car Manufacturing Data – December and FY 2023 FINAL | 1.24 MB | Download | ||

| Manufacturing of cars in the UK by brand table 2023 | 663.29 KB | DownloadPreview | ||

| Manufacturing of cars in the UK by brand table 2023 | 297.04 KB | DownloadPreview | ||

| MH car production Dec quote | 456.98 KB | DownloadPreview | ||

| Global demand for british cars 2023 | 610.83 KB | DownloadPreview | ||

| Car output_rolling year totals Dec 2023 | 495.03 KB | DownloadPreview | ||

| Car output_rolling year totals Dec 2023 | 103.57 KB | DownloadPreview | ||

| Car Manufacturing twitter graphic Dec 2023-01 | 306.81 KB | DownloadPreview |

Comments are closed.