February 2021 UK Car Manufacturing

February 2021 UK Car Manufacturing

February UK car production falls -14.0% as sector grapples with multiple issues

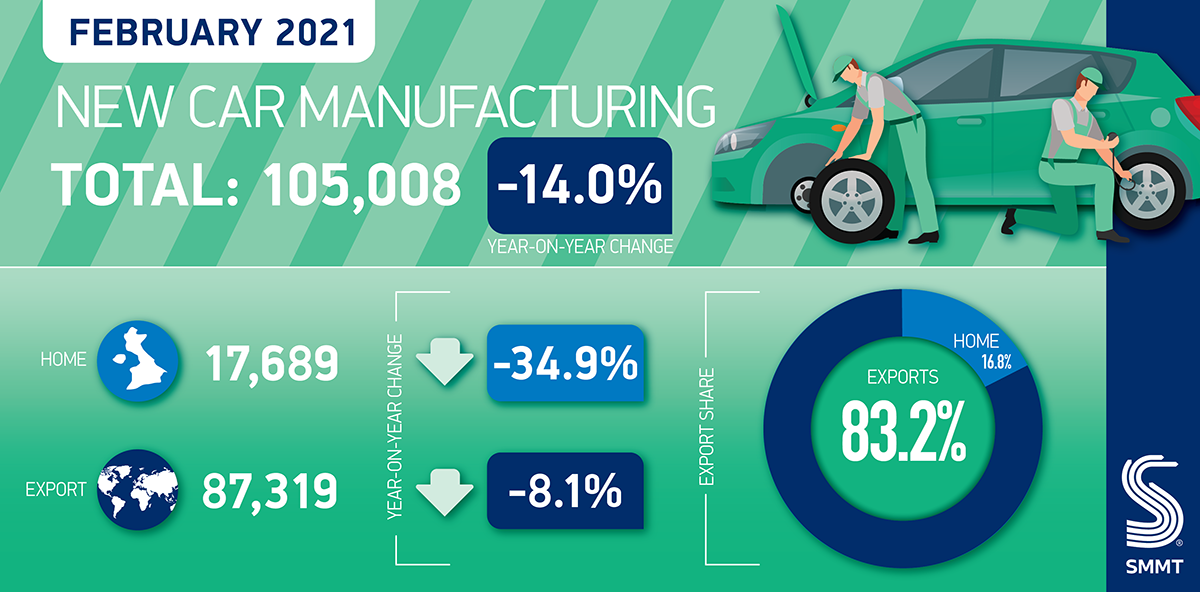

- UK car production declines -14.0% in February, a loss of 17,163 units.

- Output for overseas markets tumbles -8.1%, with home orders down -34.9%.

- Figures highlight critical importance of reopening UK car showrooms on 12 April.

Friday 26 March, 2020

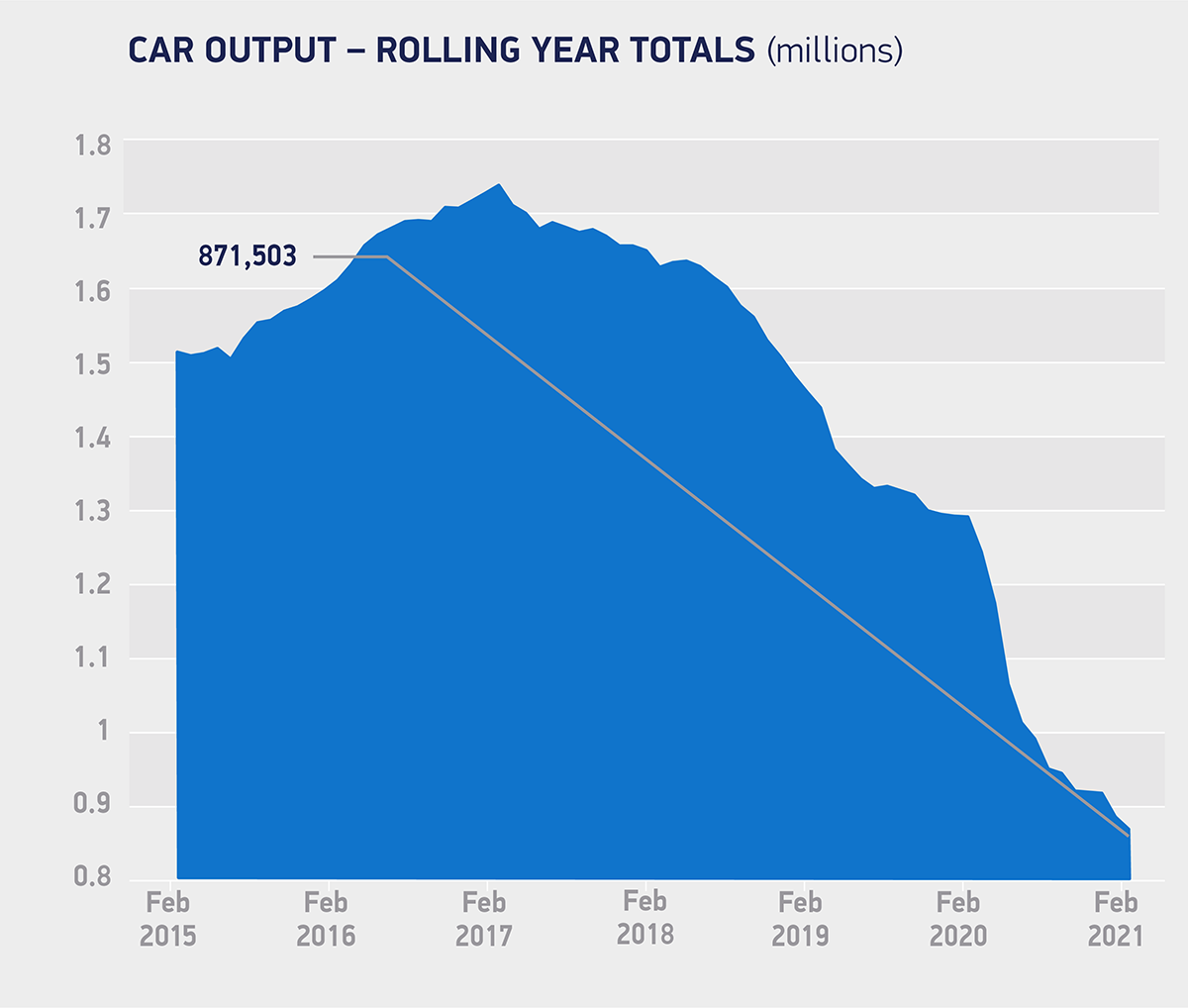

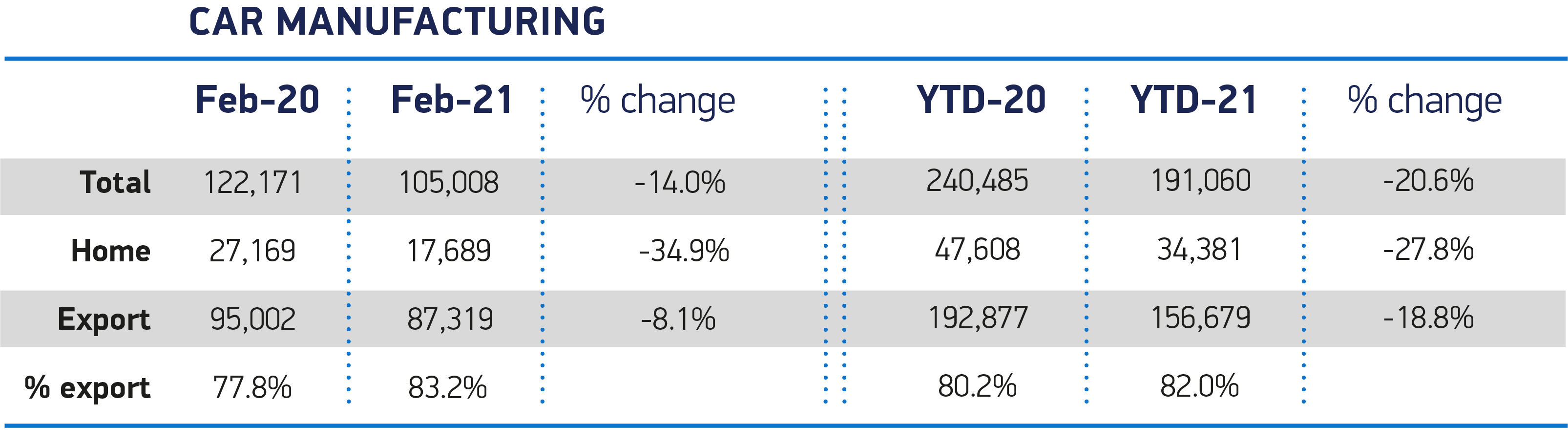

UK car production fell -14.0% in February, with 105,008 units leaving factory gates, according to the latest figures released today by the Society of Motor Manufacturers and Traders (SMMT). 17,163 fewer cars were made, representing an 18th consecutive month of decline and the weakest February performance in more than a decade as the impact of the coronavirus pandemic, in particular shuttered UK showrooms, new customs processes and global supply chain constraints continued to influence output.1

Production for the domestic market fell -34.9%, a loss of 9,480 units, compared with a less severe -8.1% fall in exports, down 7,683 units. Overseas orders still accounted for by far the majority (83.2%) of all cars made in the month, with most of these (53.9%) heading into the EU, demonstrating once again the importance of harmonious trading relationships with the sector’s largest and closest market. February shipments to the US and Asia combined amounted to 30.9% of all UK car exports.

The recent strong growth in UK output of battery electric (BEV), plug-in hybrid (PHEV) and hybrid vehicles (HEV) continued in February, with total production of these vehicle surging 25.3% to 23,019 units. To ensure this trend continues, however, both manufacturing and market competitiveness must be maintained, making the recent decision to cut UK electric car incentives counter intuitive.

The news comes as the UK industry marks a year of the coronavirus epidemic. Whilst manufacturing has, in the main, continued since reopening in the summer, UK car showrooms have been closed for months, supply of some components – notably of semi-conductors – is covid-challenged and the UK’s new trading arrangements are putting additional burdens on operations. The sector is now gearing up for the reopening of UK retailers on 12 April, but it is also mindful of the new lockdown measures coming into force in many parts of Europe.

Mike Hawes, SMMT Chief Executive, said,

A year into the pandemic, these figures are yet more evidence of how badly coronavirus has hit UK car production. Thankfully, there are some rays of light with UK showrooms due to reopen on 12 April, vaccinations progressing and a roadmap to kickstart the economy. The automotive sector can play a crucial role in getting the UK back on its feet, supporting jobs across the country, driving growth and helping the country transition to zero emission mobility. However, the UK is not isolated from global issues and our automotive industry still needs a stable and secure international market in order to prosper.

Meanwhile, the latest independent production base outlook forecasts UK car production to get on the road to recovery in 2021 at 1.05 million units, up 15.8% on the year before, which was, however, the worst annual total since 1984.2 With the right conditions in place, the outlook forecasts car production hitting 1.1 million in 2022, with the potential for additional growth but still below the 1.3 million units turned out in 2019 pre-pandemic.

Notes to editors

1. February 2010 – 97,255 cars produced

2. Independent Production Outlook produced by Auto Analysis March 2021

File Downloads

- February 2021

February 2021

| Title | Description | Version | Size | Download |

|---|---|---|---|---|

| car exporting | 349.62 KB | DownloadPreview | ||

| UK new car production Feb 2021 | 492.18 KB | DownloadPreview | ||

| UK new car production Feb 2021 | 82.33 KB | DownloadPreview | ||

| UK car manufacturing | 242.42 KB | DownloadPreview | ||

| UK Manufacturing | 4.92 MB | DownloadPreview | ||

| SMMT_UK car manufacturing data for February 2021 | 445.53 KB | Download | ||

| Car output_rolling year totals February 2021 | 125.13 KB | DownloadPreview | ||

| Car output_rolling year totals February 2021 | 239.11 KB | DownloadPreview | ||

| Car manufacturing summary graphic Feb 2021 | 306.59 KB | DownloadPreview |

Comments are closed.