February 2022 New Car Registrations

February 2022 New Car Registrations

Car industry calls for VAT fairness on charging as February market gets electric boost

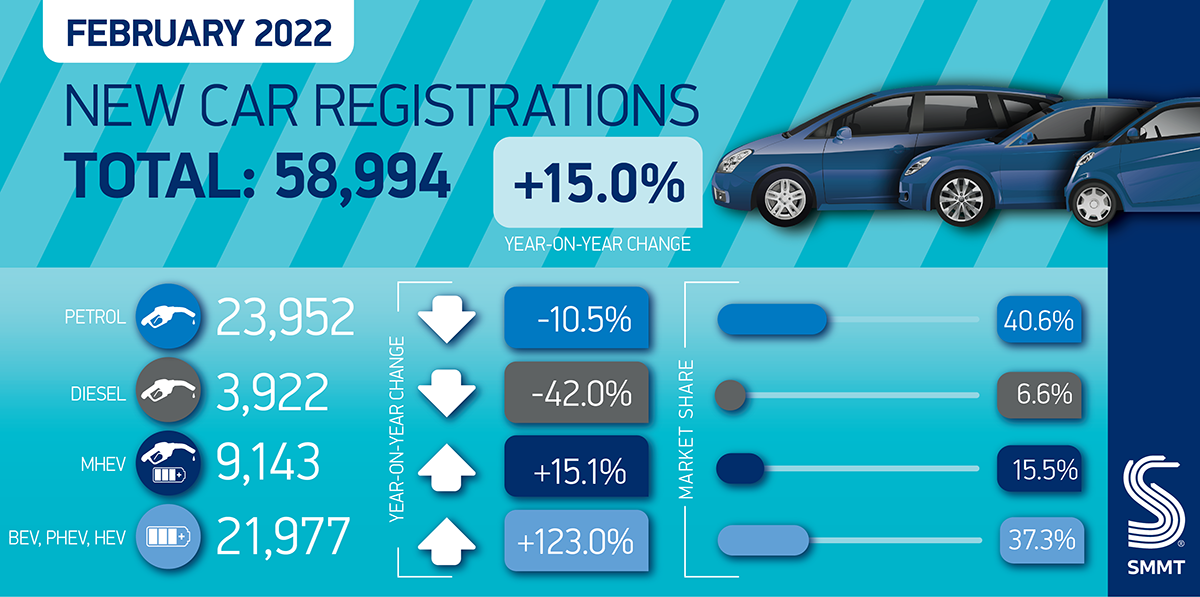

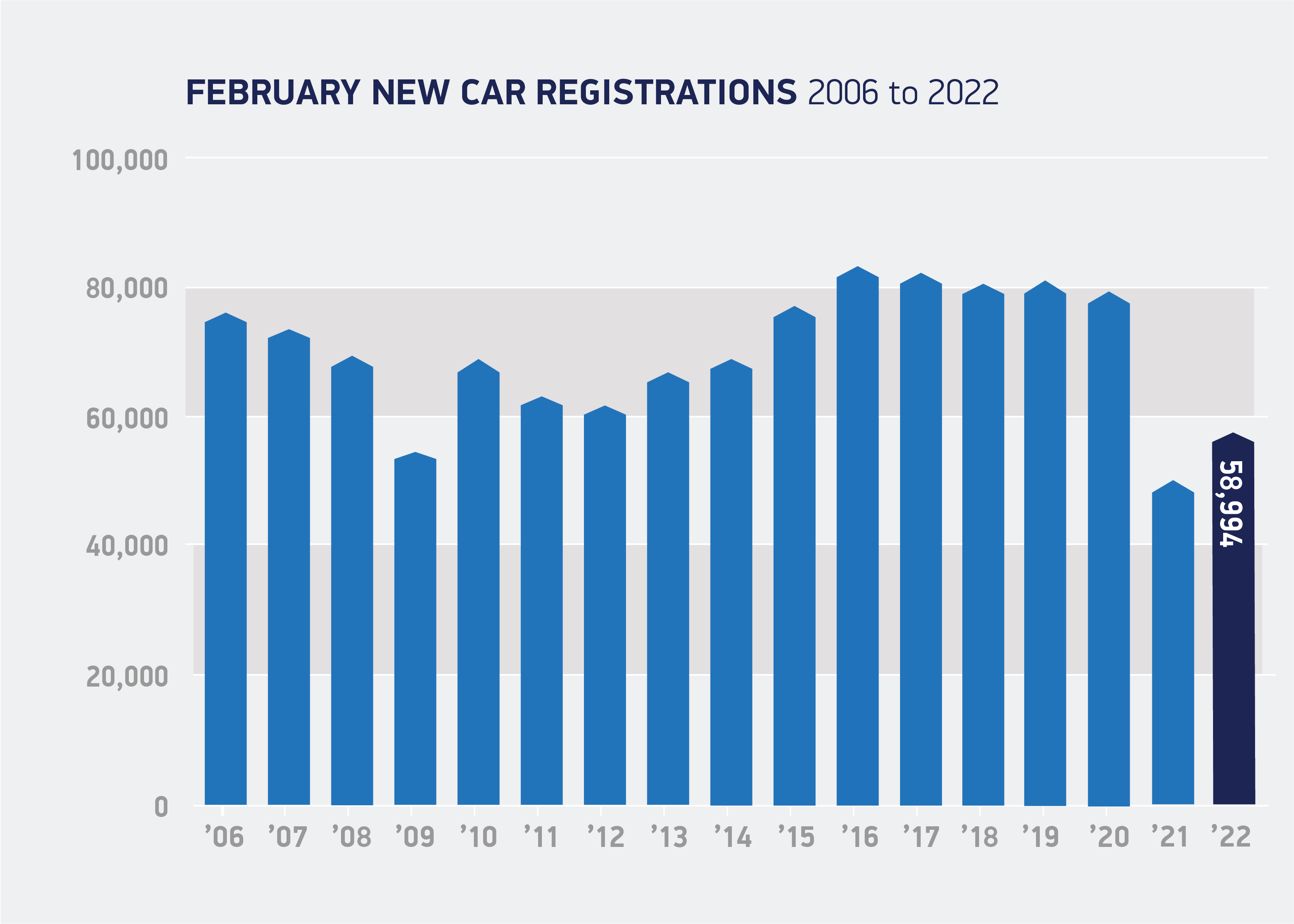

- 58,994 new cars registered during conventionally low volume pre-plate change month.

- Demand up 15.0% on locked-down 2021 but economic uncertainty and supply challenges keep market -25.9% below pre-pandemic February 2020.

- Ahead of Spring Statement, industry calls for action on infrastructure and energy costs as plug-ins take 25.6% market share.

Friday 4 March, 2022

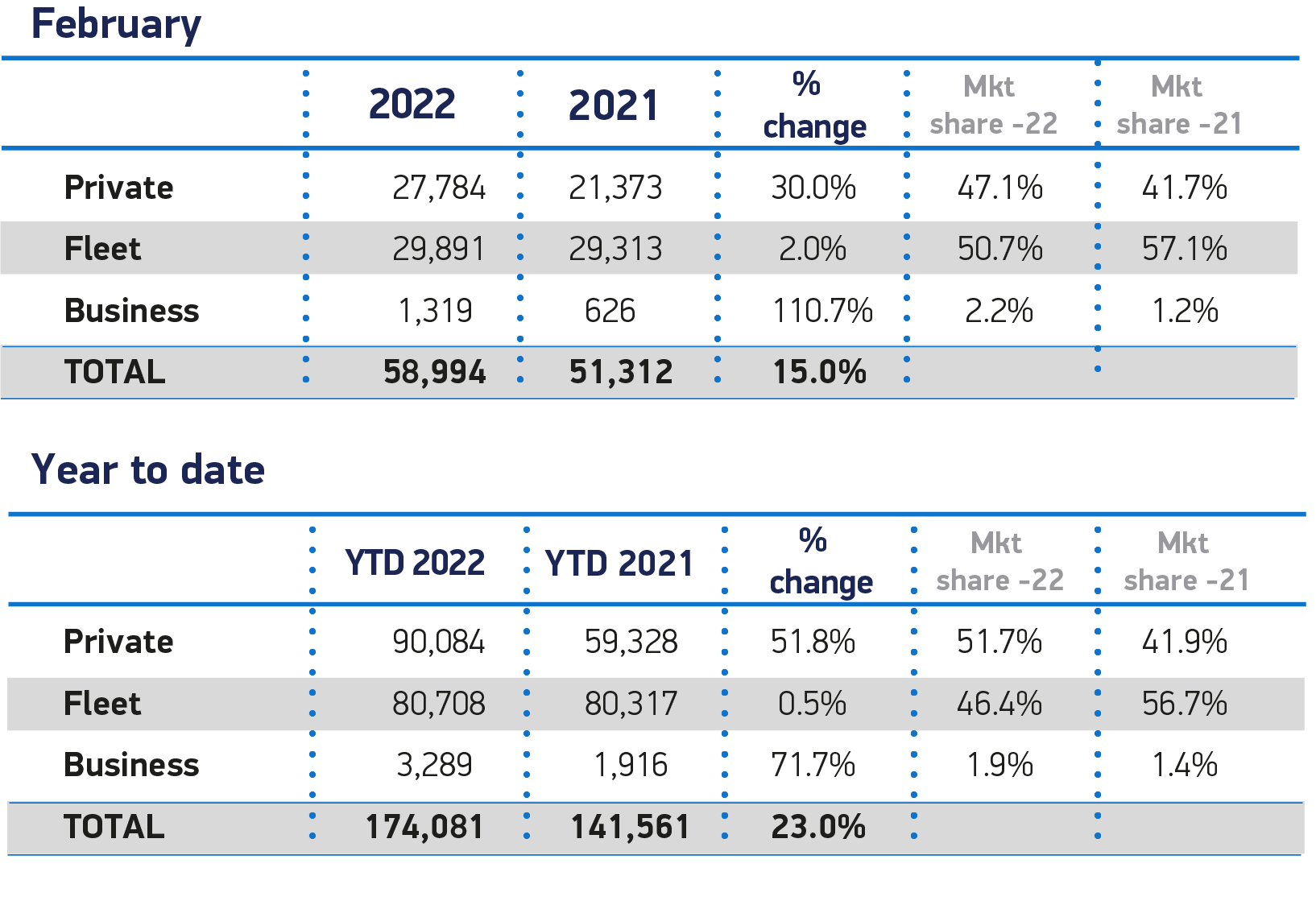

UK new car registrations rose by 15.0% in February as 58,994 new cars joined Britain’s roads, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT). The rise of 7,682 units was in comparison with the same month in 2021, when the pandemic shut car showrooms across the UK. Despite this positive performance, registrations are down -25.9% on pre-pandemic levels, as vehicle supply remains constrained by semiconductor shortages.1

Compared with February 2021, when showrooms were closed and only ‘click and collect’ permitted, private registrations rose by 30.0%. Large fleet registrations remained stable, up just 2.0%, indicating that in a supply-constrained market, manufacturers are also prioritising private customers, which accounted for more than 80% of growth. While business purchases grew by 110.7%, this equates to a rise of just 693 units.

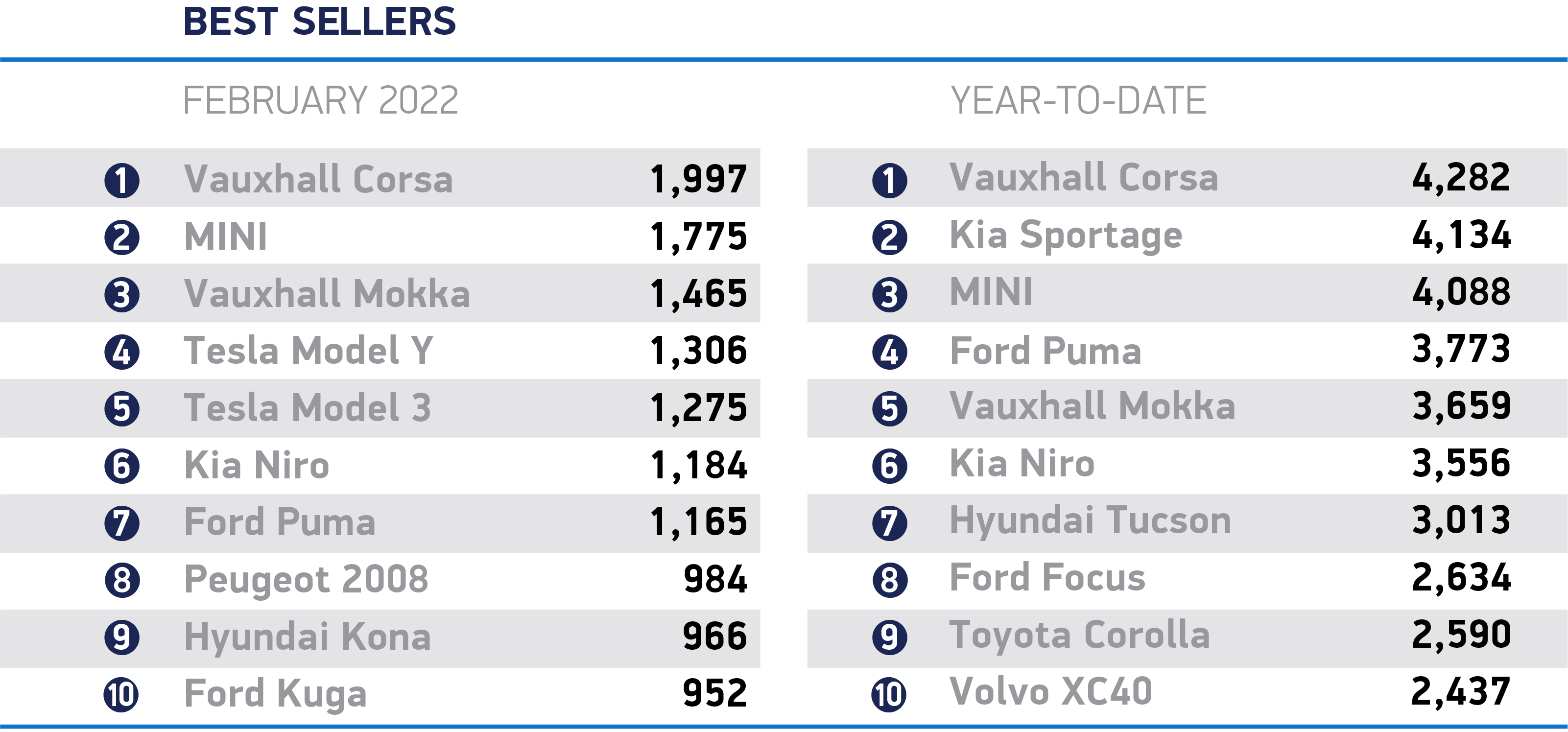

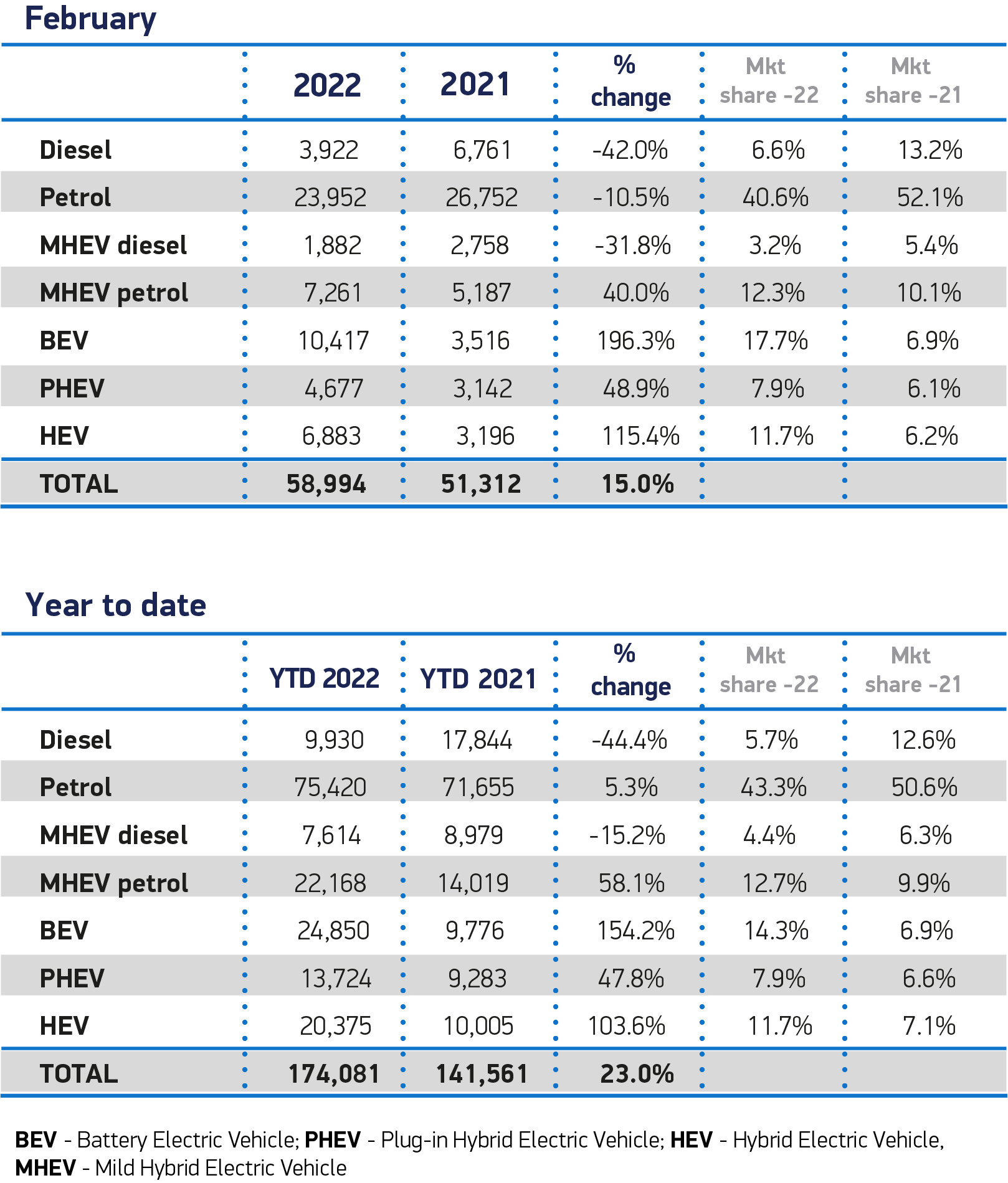

It was another bumper month for battery electric vehicles (BEVs), however, which took a 17.7% market share to reach 10,417 units, while registrations of plug-in hybrids (PHEVs) rose to 4,677 units and a 7.9% share of the market. When combined with hybrid (HEV) registrations (6,883), electrified vehicles accounted for more than a third of all new cars leaving dealerships. While this demonstrates the growing demand for electric cars, February is typically the lowest volume month, as many buyers delay purchases until the ‘new plate’ month of March, and fluctuations in supply for some key models can have a more pronounced effect in terms of market share.

Of greater concern to the long term delivery of net zero road transport, however, is the need for accelerated public chargepoint provision. Investments are being made, but at a pace that continues to lag behind plug-in vehicle uptake. Last month, the industry published its seven-point plan to increase the number of public on-street chargers ahead of need.2

Meanwhile, April will see the effective end of the Electric Vehicle Homecharge Scheme (EVHS), which has provided vital funding for homeowners to install their own chargepoint. Ahead of the government’s Spring Statement, SMMT is calling for an extension to both the EVHS and its business counterpart, the Workplace Charging Scheme, beyond 2025 to ensure EV uptake remains on track to meet Government’s net zero deadlines. It also recommends that VAT on electricity used for public charging points be cut to match that for home use, so that EV drivers are treated equally regardless of where they charge their vehicle.

Mike Hawes, SMMT Chief Executive, said,

Despite February’s traditional low registration numbers, consumers are switching to EVs in ever-increasing numbers. More than ever, infrastructure investment needs to accelerate

to match this growth. Government must use its upcoming Spring Statement to enable this transition, continuing support for home and workplace charging, boosting public chargepoint rollout to tackle charging anxiety and, given the massive increase in energy prices, reducing VAT on public charging points. This will energise both consumer and business confidence and accelerate our switch to zero emission mobility.

Notes to editors

1. February 2020 registrations: 79,594

2. https://www.smmt.co.uk/2022/02/uk-automotive-calls-for-ev-chargepoint-mandate-governed-by-independent-regulator-to-level-up-network-for-consumers/

File Downloads

- February 2022

February 2022

| Title | Description | Version | Size | Download |

|---|---|---|---|---|

| SMMT NEW CAR REGISTRATIONS FEBRUARY | 95.11 KB | Download | ||

| February registrations 2006 to 2022 | 1.56 MB | DownloadPreview | ||

| February registrations 2006 to 2022 | 91.09 KB | DownloadPreview | ||

| February Sales 2022 and YTD cars | 465.02 KB | DownloadPreview | ||

| February Sales 2022 and YTD cars | 82.95 KB | DownloadPreview | ||

| February Fuel 2022 and YTD cars | 143.17 KB | DownloadPreview | ||

| February Fuel 2022 and YTD cars | 780.21 KB | DownloadPreview | ||

| February 2022 best sellers_cars | 188.09 KB | DownloadPreview | ||

| February 2022 best sellers_cars | 729.40 KB | DownloadPreview | ||

| Cars_02_2022 | 147.50 KB | DownloadPreview | ||

| Car regs summary graphic February 2022 | 338.79 KB | DownloadPreview | ||

| Car registrations 3 | 7.21 MB | DownloadPreview | ||

| Car registrations 2 | 7.03 MB | DownloadPreview |

Comments are closed.