January 2021 UK Car Manufacturing

January 2021 UK Car Manufacturing

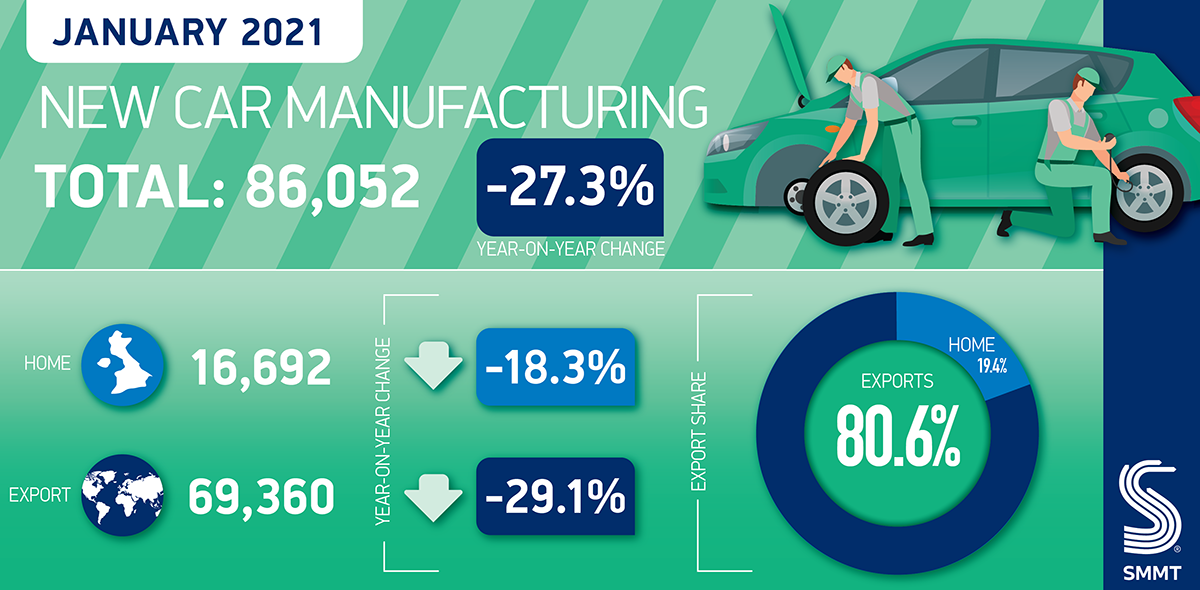

January UK car production falls -27.3% as industry calls for measures to support competitiveness

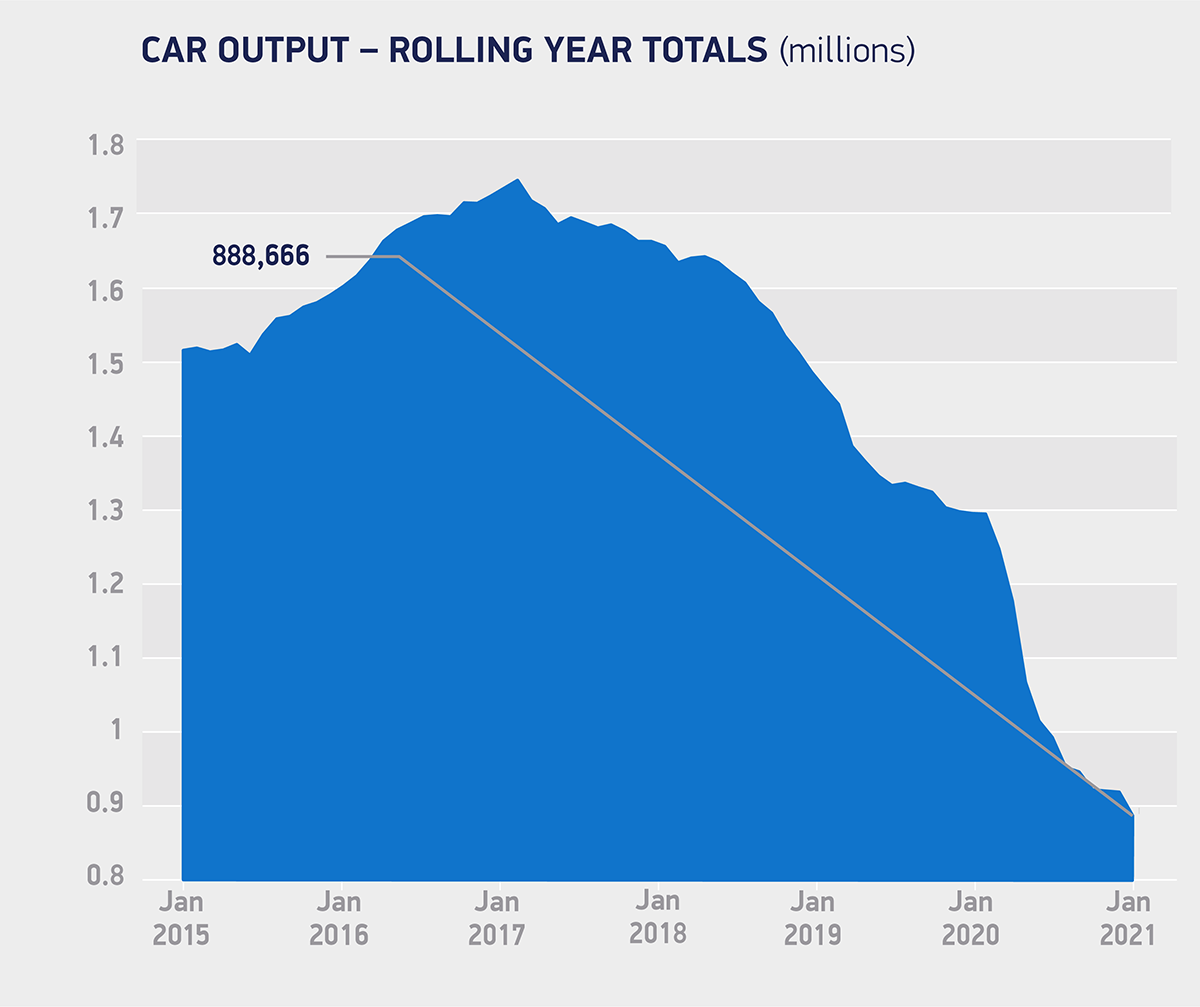

- Weakest January since 2009 as UK car manufacturing output declines -27.3% to 86,052 units – the 17th consecutive monthly decline.

- Better news for alternatively fuelled vehicles with 21,792 cars made, up 18.9%.

- Having lost car production worth £11.3bn to pandemic, sector urges Chancellor to introduce measures to enhance auto manufacturing competitiveness.

Friday 26 February, 2020

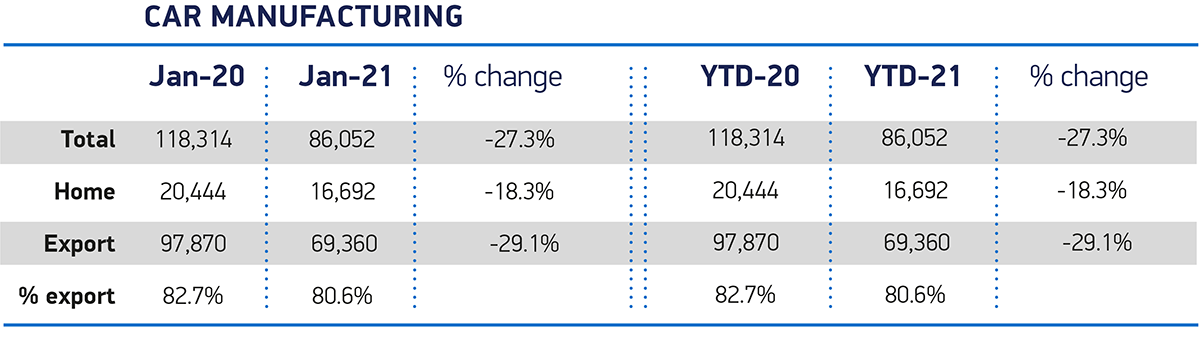

UK car production fell -27.3% in January to 86,052 units, according to the latest figures issued today by the Society of Motor Manufacturers and Traders (SMMT). With a fall of 32,262, this was the worst January performance since 2009, and a 17th consecutive month of decline.1 Multiple factors, including the ongoing effects of the pandemic, global supply chain issues, extended shutdowns and friction in the new trading arrangements following the end of the Brexit transition period, affected output.

Car manufacturing for both home and overseas markets was down, to 16,692 and 69,360 units respectively, representing falls of -18.3% and -29.1%. While exports still accounted for more than eight in 10 of all cars made in the month, shipments to major markets the EU, US and Asia all fell by double digits, down -26.2%, 34.5% and -36.1%.

In better news, the growth in UK production of battery electric (BEV), plug-in hybrid (PHEV) and hybrid vehicles (HEV) seen in 2020 continued, with combined output of these vehicles rising 18.9% in January to 21,792 units. This means more than one in four (25.3%) of all cars leaving factory gates was alternatively fuelled, further evidence of the UK’s growing capability in ultra-low and zero emission vehicle manufacturing.

The news comes as the sector counts the £11.3 billion cost of lost car production since March 2020.2 Whilst manufacturing businesses remain open, weak demand hindered by the ongoing closure of new car showrooms is affecting production volumes. SMMT is, therefore, urging the Chancellor to use next week’s Budget to announce measures that enhance UK automotive manufacturing competitiveness, with an extension of Covid-19 business support schemes including the CJRS furlough, amendments to business rates reform to incentivise manufacturing investment and more support for skills and training.

Mike Hawes, SMMT Chief Executive, said,

Yet another month of decline for UK car production is a grave concern and next week’s Budget is the Chancellor’s opportunity to boost the industry by introducing measures that will support competitiveness, jobs and livelihoods. Whilst there have been some very welcome recent announcements, we need to secure our medium to long-term future by creating the conditions that will attract battery gigafactory investment and transform the supply chain. Most immediately, however, we must get our Covid-secure car showrooms back open, ideally before 12 April. This will be the fastest way to UK automotive manufacturing recovery.

Notes to editors

1: January 2009 UK car production 61,404

2: SMMT calculations

File Downloads

- January 2021

January 2021

| Title | Description | Version | Size | Download |

|---|---|---|---|---|

| UK new car production Jan 2021 | 138.55 KB | DownloadPreview | ||

| UK new car production Jan 2021 | 101.82 KB | DownloadPreview | ||

| UK car manufacturing | 242.42 KB | DownloadPreview | ||

| UK Manufacturing | 4.92 MB | DownloadPreview | ||

| SMMT_UK car manufacturing data for January 2021 | 265.50 KB | Download | ||

| MH car production quote Jan 2021 | 390.49 KB | DownloadPreview | ||

| Car output_rolling year totals January 2021 | 235.01 KB | DownloadPreview | ||

| Car output_rolling year totals January 2021 | 121.91 KB | DownloadPreview | ||

| Car manufacturing summary graphic Jan 2021 | 313.43 KB | DownloadPreview |

Comments are closed.