January 2023 New Car Registrations

January 2023 New Car Registrations

New car market defies national trend to deliver green growth

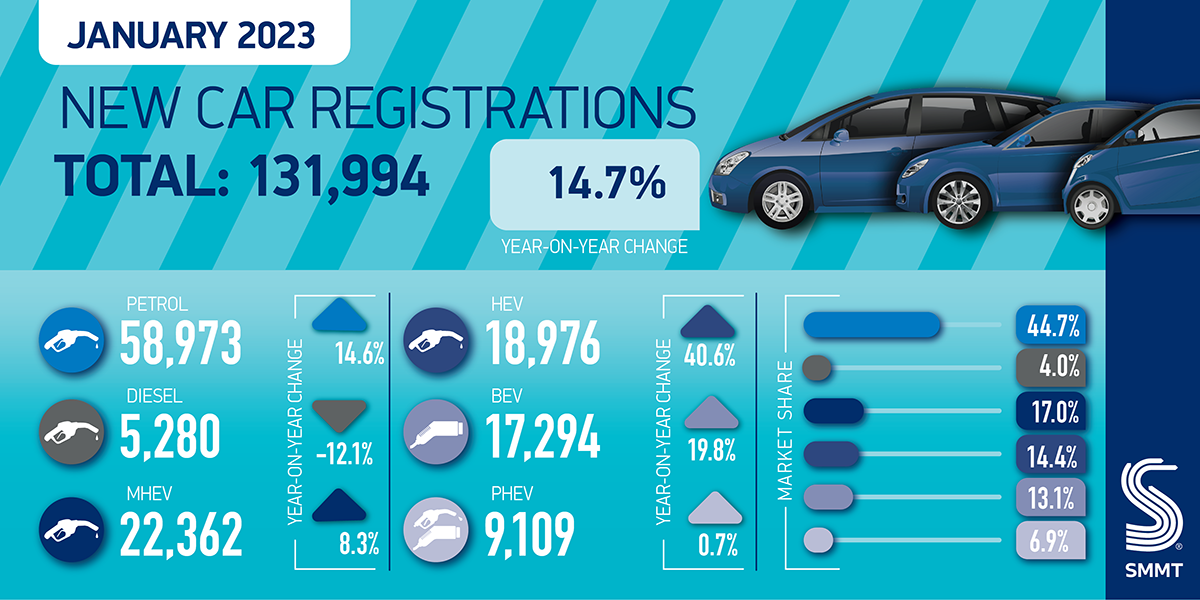

- New car market records sixth consecutive month of growth with January registrations rising 14.7% as 131,994 new cars reach the road.

- Plug-in vehicles continue growth but chargepoint rollout fails to keep pace, challenging consumer confidence.

- Latest outlook anticipates 11.1% market uplift in 2023 to reach 1.79m units despite straitened economy and strained supply chains.

- Delivery of green goals in danger of delay without chargepoint mandates and action on VAT and VED.

Monday 6 February, 2023

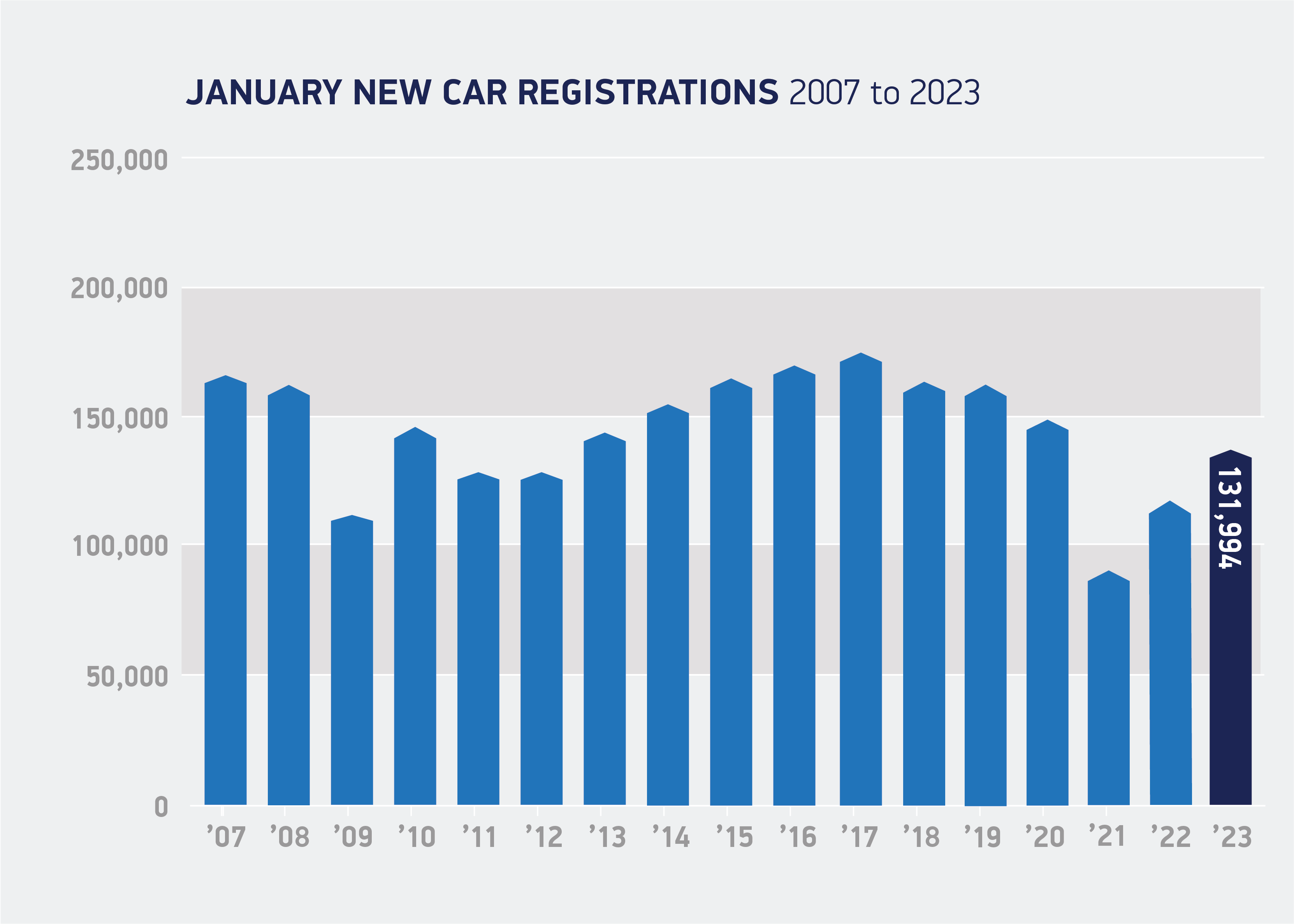

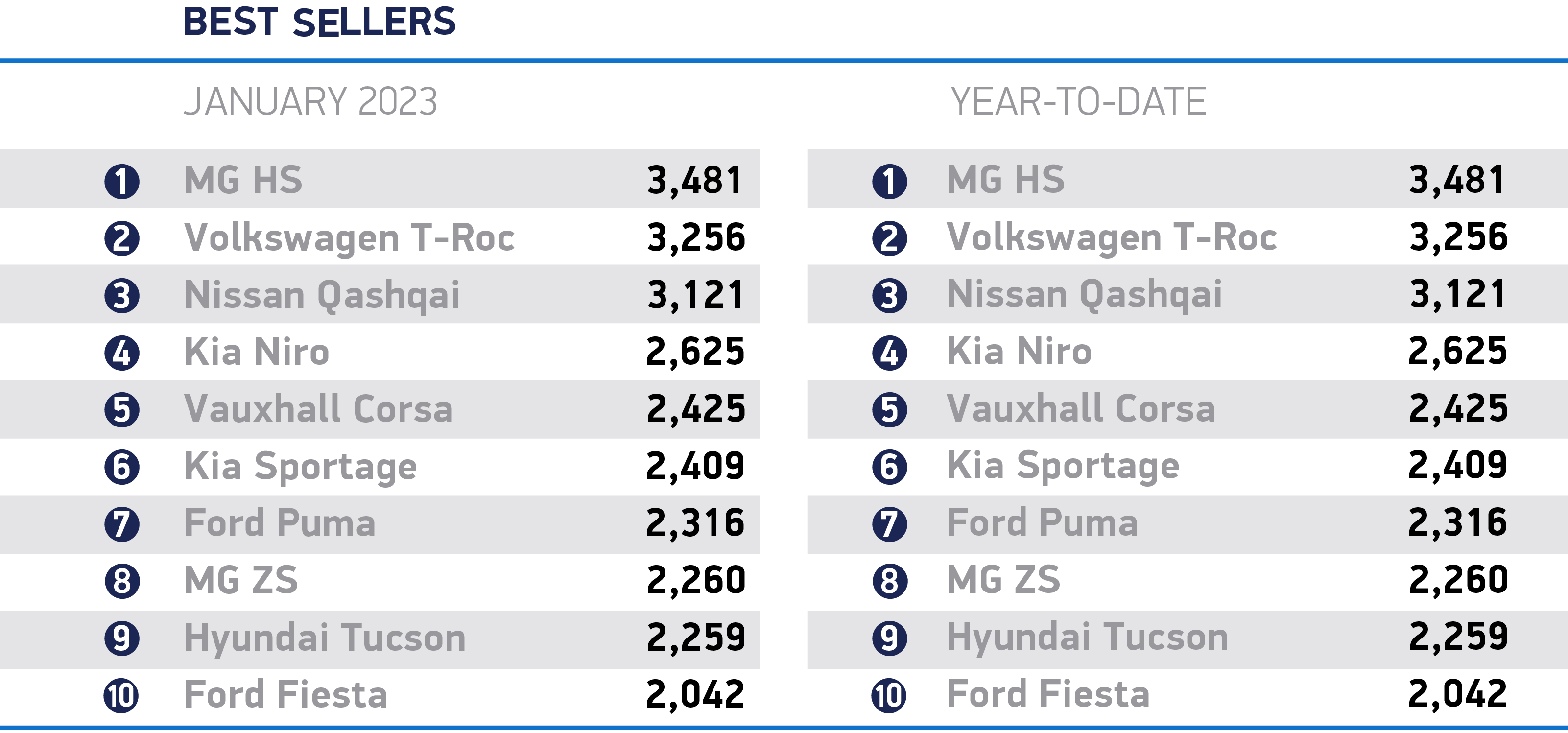

The UK new car market grew 14.7% in January to reach 131,994 units, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT), setting the tone for an anticipated countercyclical year of growth. This was the best start to the year since January 2020’s pre-Covid 149,279 units and marks the sixth successive month of expansion.

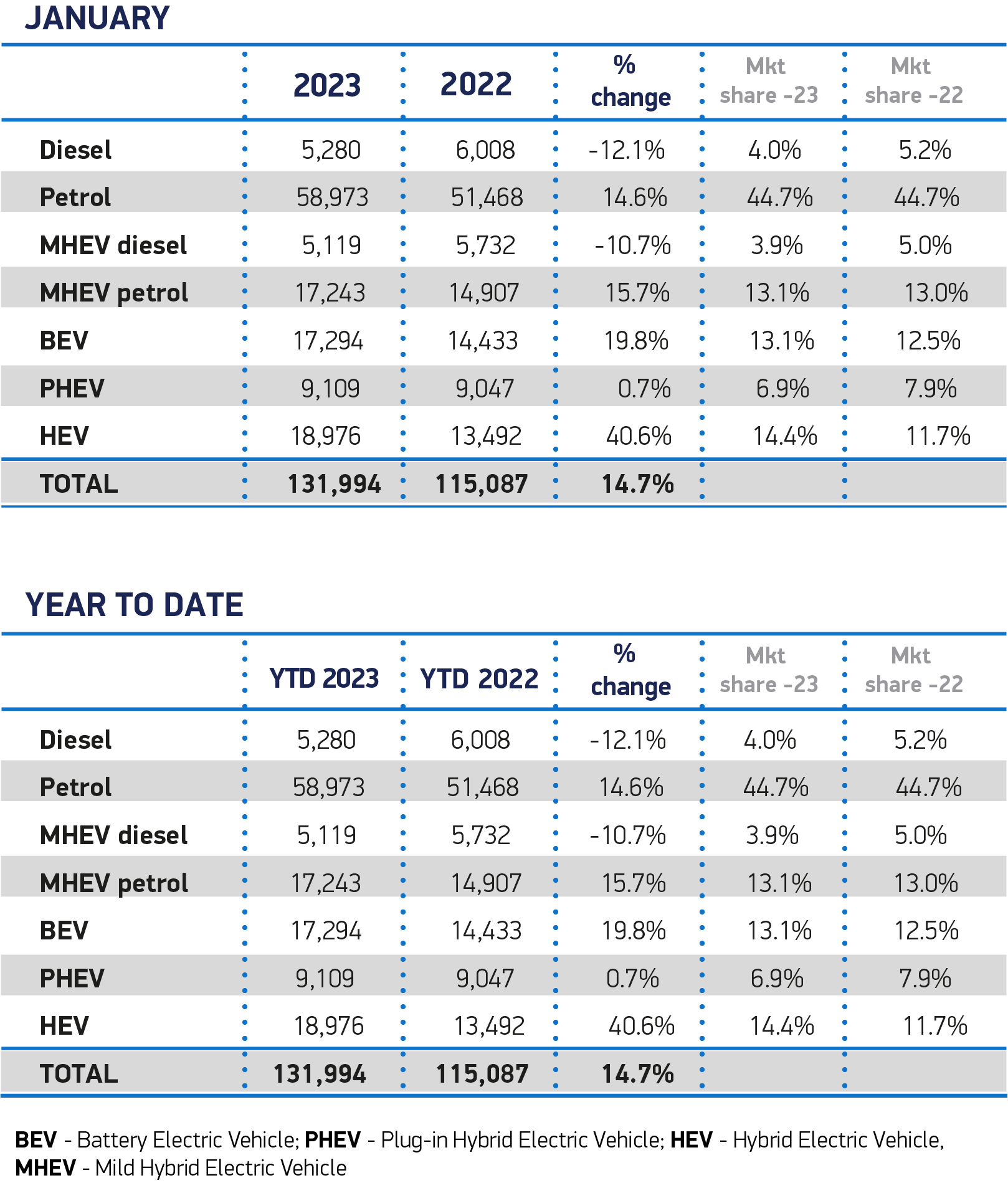

Electrified vehicles notably drove the increase, as manufacturers continue to bring ever more choice to the market despite ongoing strains on the supply chains. Hybrid electric vehicles (HEVs) comprised 14.4% of new car registrations, increasing volumes by 40.6%. Meanwhile, battery electric vehicle (BEV) registrations rose 19.8% to reach 17,294 units, or 13.1% of new registrations – slightly below the average recorded for 2022.1 Plug-in hybrid vehicles (PHEVs) recorded a 0.7% rise, although their share fell to 6.9% of new cars reaching the road.2 As a result, one in five new cars registered in the month came with a plug.

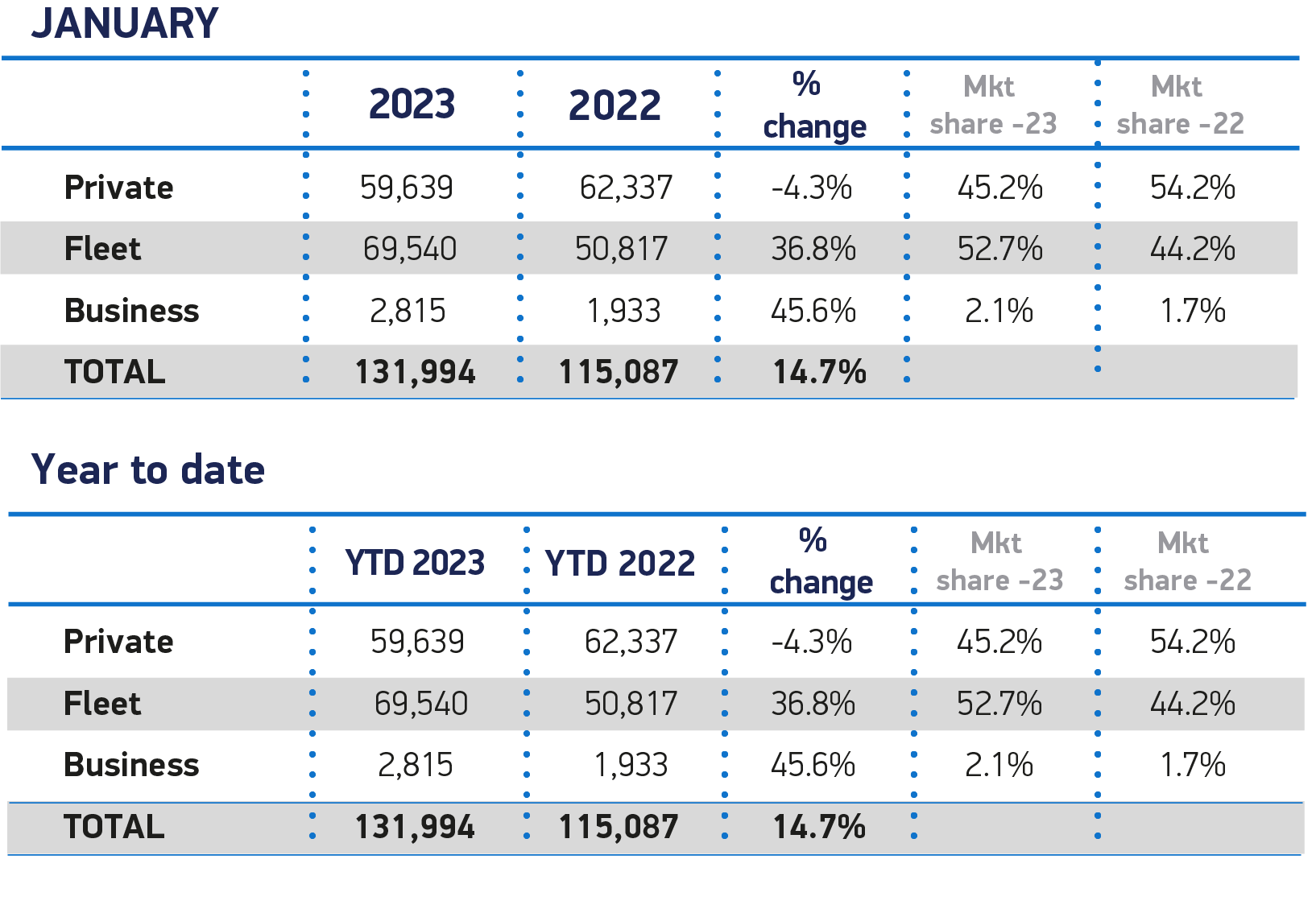

It was also a strong month for large fleet registrations, which increased by 36.8% to 69,540 units, while registrations by private buyers fell by -4.3% to 59,639 units – reflecting some easing of supply and evidence of how shortages last year distorted market performance. Registrations by businesses, the smallest segment at 2,815 units, rose by 45.6%.

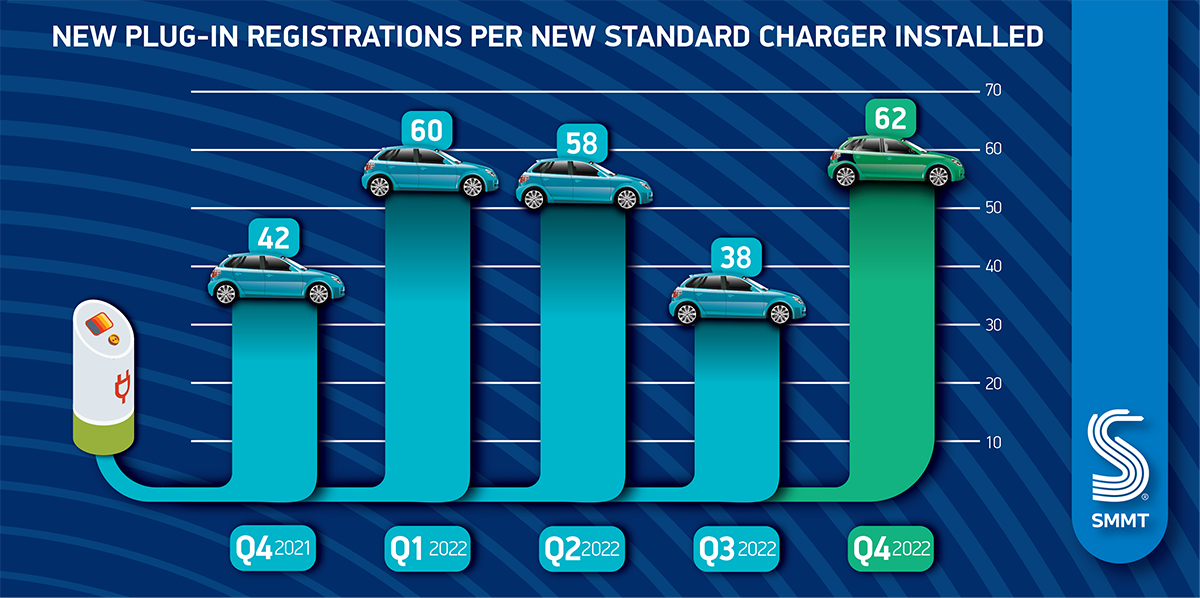

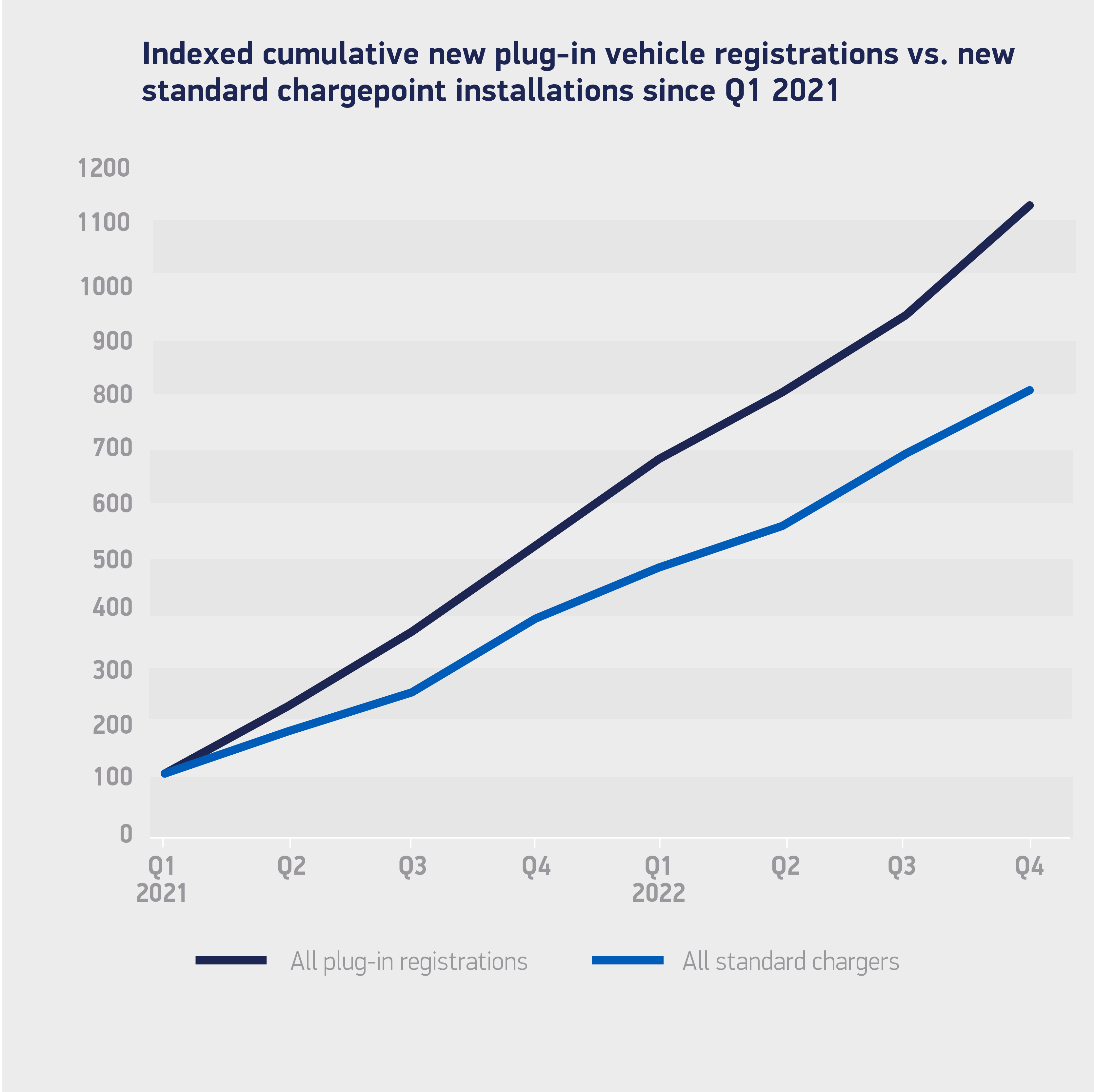

Plug-ins are anticipated to comprise of more than one in four new registrations this year, representing growth of 32.1% or approximately 487,140 units, and almost a third (31.0%) of the market in 2024 at 607,150 units3. However, the rollout of infrastructure needed to charge them is failing to keep pace.

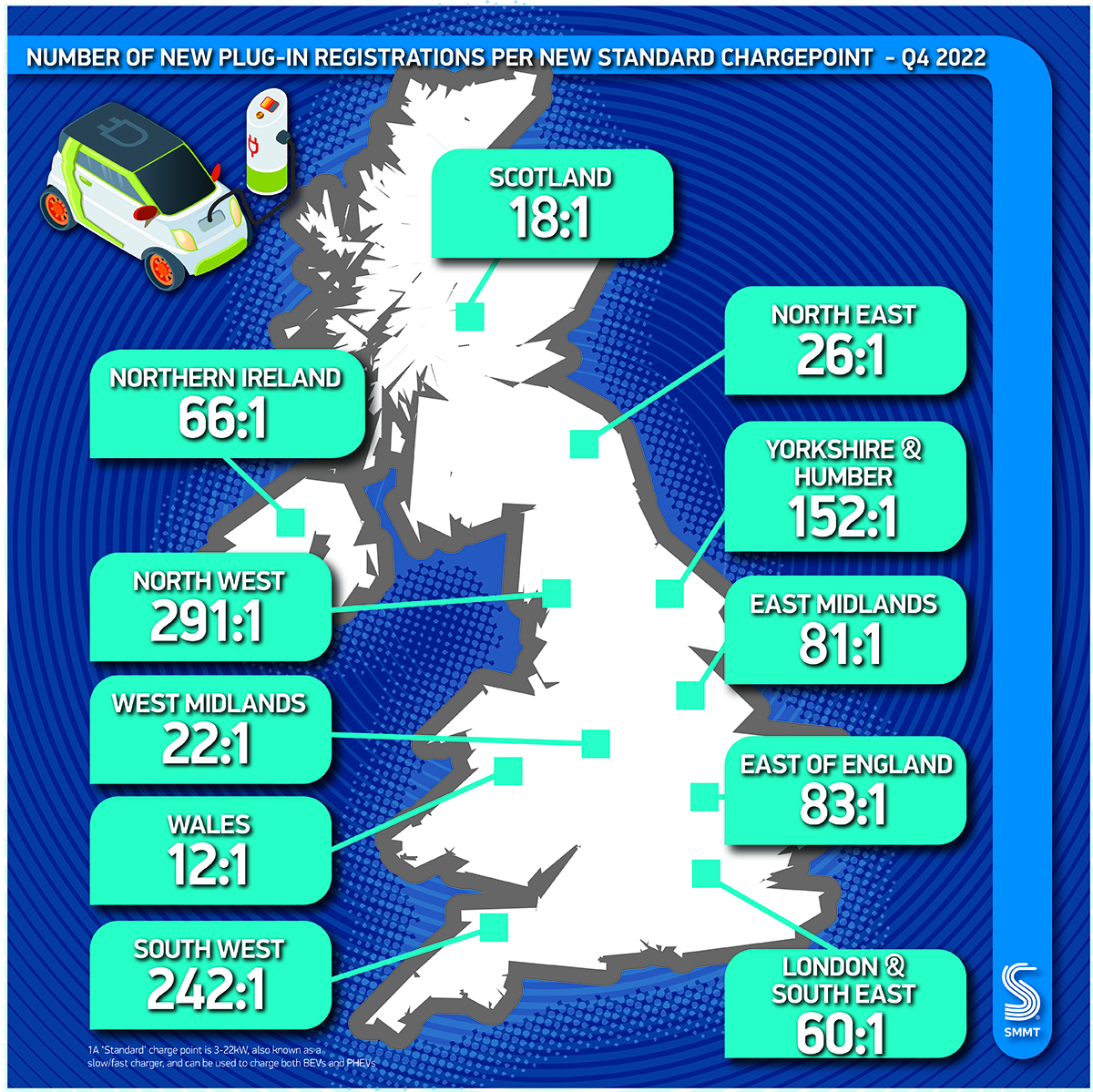

During Q4 2022, the ratio of new chargepoint installations to new plug-in car registrations dropped to one for every 62 – a significant fall compared with the same quarter last year, when the ratio was 1:42.4 As a result, in 2022, one standard public charger was installed for every 53 new plug-in cars registered, the weakest ratio since 2020.5 Mandating rollout targets for infrastructure and regulating service standards would give drivers certainty they can always find a working, available charger. Infrastructure must be built ahead of demand else poor provision risks delaying the electric transition.

More immediately, the upcoming Budget is an opportunity to implement measures that support the transition. Reducing VAT on public chargepoint use from 20% to 5% in line with home charging would ensure more affordable access for all and underpin a fair net zero transition. Government should also review proposals to graft a Vehicle Excise Duty regime designed for fossil fuel cars onto zero emission vehicles (ZEVs). The higher production costs associated with electric vehicles means that currently more than half of all available BEVs would be subject to the expensive car supplement due to apply to ZEVs from 2025.6 While it is right that all drivers pay their fair share, existing plans would unfairly penalise those making the switch, and risk disincentivising the market at the time when EV uptake should be encouraged. Government should also tackle other fiscal blocks to uptake by raising recommended business mileage rates.

Mike Hawes, SMMT Chief Executive, said,

The automotive industry is already delivering growth that bucks the national trend and is poised, with the right framework, to accelerate the decarbonisation of the UK economy. The industry and market are in transition, but fragile due to a challenging economic outlook, rising living costs and consumer anxiety over new technology. We look to a Budget that will reaffirm the commitment to net zero and provide measures that drive green growth for the sector and the nation.

The strong start to the year is mirrored in the latest market outlook, which anticipates 1.79 million new car registrations in 2023, an 11.1% increase on the past year but still well below 2019 levels. This also represents a -0.8% reduction on October’s outlook, against a weak economic backdrop. However, a further 9.3% increase is expected next year, with 1.96 million new cars expected to join the road in 2024.

Notes to editors

1 BEV market share in 2022: 16.6%

2 PHEV market share in January 2022: 7.9%

3 SMMT market outlook, published January 2023

4 Based on SMMT analysis of plug-in car registrations and DfT EV chargepoint figures

5 2020 ratio – 1:54

6 Based on SMMT analysis of available BEV models and base vehicle prices

File Downloads

- January 2023

January 2023

Comments are closed.