June 2023 UK Car Manufacturing

June 2023 UK Car Manufacturing

Double digit growth for UK car production since January

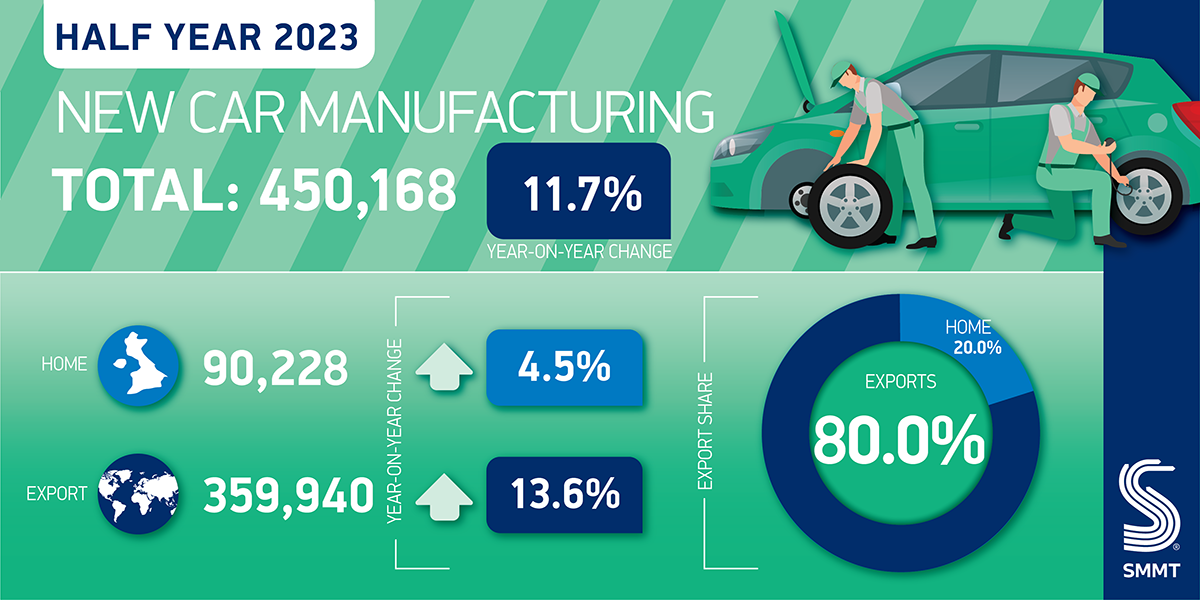

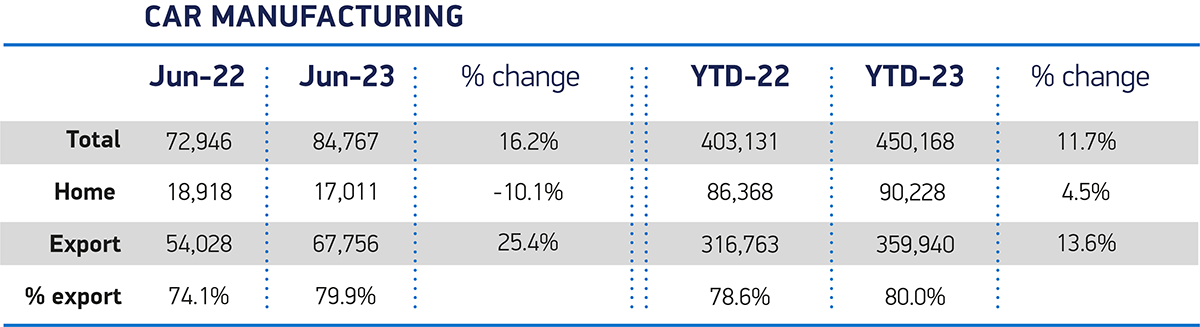

- British car production rebounds 11.7% in first six months with 450,168 units made as June completes fifth consecutive month of growth.

- Electrified vehicle production YTD surges 71.6% to new first half record, with 170,231 units rolling off factory lines.

- Latest independent production outlook anticipates UK factories turning out around 860,000 cars this year, up 10.9% on 2022.

- Recent EV investment announcements, as well as new commitment to build one of Europe’s largest gigafactories in the UK, indicate a sector looking to the future.

Thursday 27 July, 2023

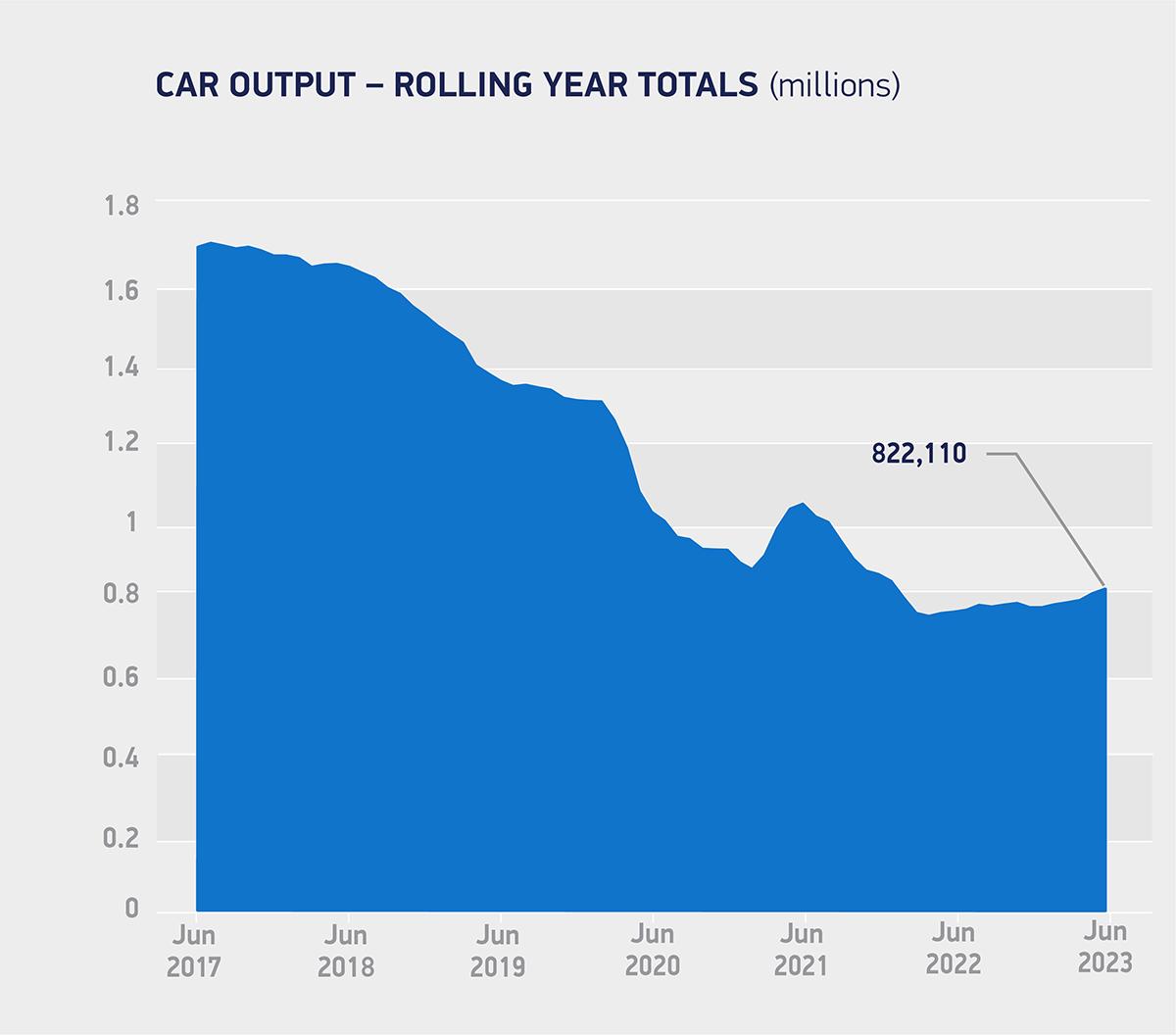

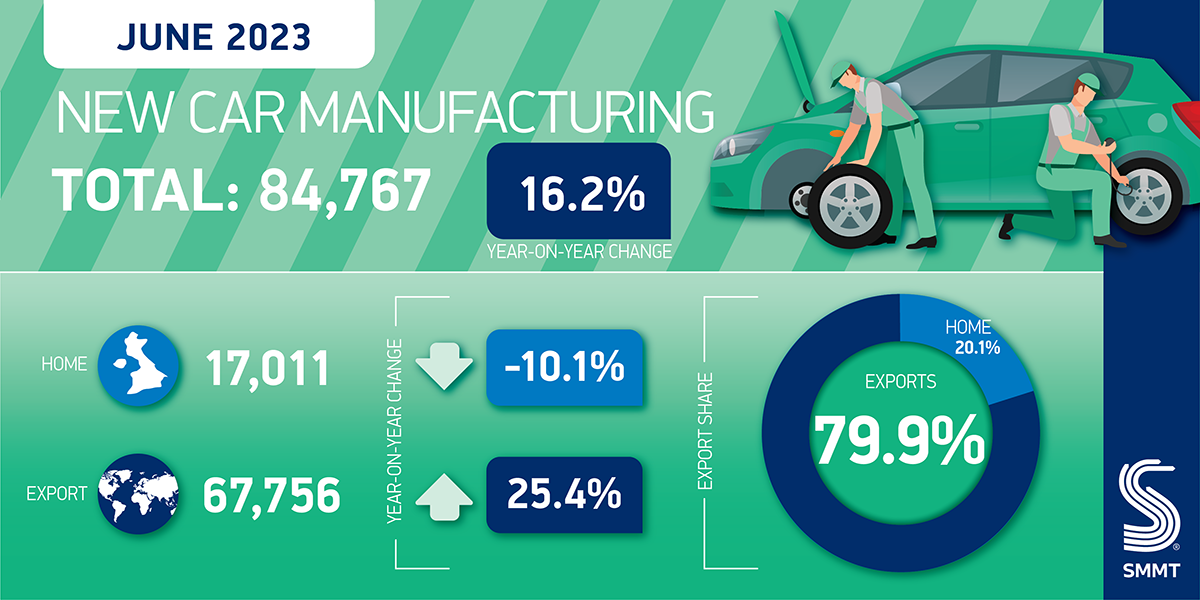

UK car production rose 11.7% in the first half of the year to 450,168 units with June – up 16.2% – the fifth consecutive month of growth, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). The performance represented the best first half since 2021 as manufacturers were increasingly able to manage global supply chain challenges – notably the shortage of semiconductors – that had constrained production since the pandemic. The news comes a week after the announcement of the development of a massive new gigafactory for the UK, helping anchor EV production for one of Britain’s biggest car makers.

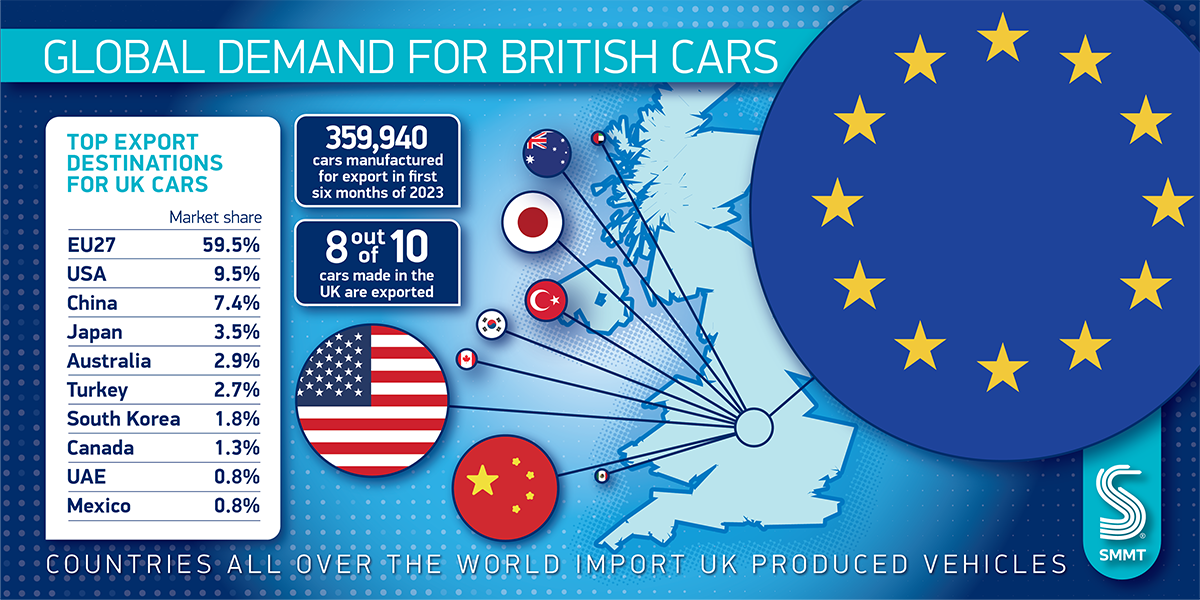

Since January, factories have produced an additional 47,037 units, the uplift having been driven by exports which have surged 13.6% to 359,940 units, representing eight-in-ten cars made. Volumes for the UK are up too, rising 4.5% to 90,228 units. However, year-to-date output remains -32.5% below 2019 levels, a reflection of structural changes in the sector but also pointing to the opportunity for UK car makers to recover if a globally competitive business investment environment can be assured.1

The capacity of UK car makers to turn out the latest, greenest models has also increased, with production of hybrid electric (HEV), plug-in hybrid (PHEV) and battery electric vehicles (BEVs) up 71.6% from January to June to a record total of 170,231 units. This represents more than a third (37.8%) of all cars produced so far this year, good news given the importance of these products to the future of the industry and wider society in driving down emissions.

With eight-in-ten UK built cars heading to overseas markets, free and fair global trade – especially of the latest, zero emission electric vehicles – is essential. The European Union (EU) remains the UK’s largest export market accounting for 59.5% of all British car shipments, up 11.2% to 214,017 units year to date. The EU is also the largest source of imported vehicles, so safeguarding this important bilateral trading relationship is essential for both sides, hence the need for a quick and positive outcome to discussions on forthcoming changes to the rules of origin requirements for electrified vehicles and components.

Looking further afield, the US, China, Japan and Australia make up the top five global export destinations for UK cars, with Turkey, South Korea, Canada, the UAE and Mexico completing the top ten, shipments to most rose, apart from those to the US, down just -0.1% and China, which fell -6.4%. Some of these key overseas markets are members of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) to which the UK is now a party, and who have taken a cumulative 9.6% of UK car exports so far this year.

Mike Hawes, SMMT Chief Executive, said,

UK car manufacturing is growing again, with production – especially of electrified models – increasing and major investment announcements making headlines. This is testament to the resilience of the sector and its undoubted strengths – a skilled and productive workforce, world-class R&D, and efficient, productive plants. But we must build on this momentum, sustain growth and attract further investments with a strategy that focuses on competitiveness and which strengthens the UK’s unique automotive offering.

Today the UK automotive sector supports some 800,000 jobs in total, including manufacturing, retail and aftermarket, with 208,000 workers in manufacturing achieving annual turnover of £78 billion, adding £16 billion to the UK economy and investing around £3 billion in R&D every year. Recent investment announcements augur well for the future of the sector, but sustained growth requires more and continued investment. Creating the conditions for such investments was the subject of SMMT’s ‘Manifesto 2030: Automotive growth for a zero emission future’. Launched last month, it sets out five key pledges and policy actions, as part of an industrial strategy, to drive growth and deliver net zero.

The plan calls for all political parties to commit to attract more global investment; to support upskilling workers as they transition from making engines to batteries; to boost global trade; to provide affordable, sustainable energy; and to drive a vibrant electric vehicle market with world-class charging infrastructure, incentives and choice.

The latest independent production outlook shows the potential for UK vehicle manufacturing output. Total UK car production is expected to reach around 860,000 units this year, an uplift of 10.9% on 2022, as the sector recovers from three tough Covid years, with the possibility to get back to near a million cars in 2028.2 Significantly, that volume will be electrified, with a 10-fold rise in annual BEV production anticipated, to more than 750,000 units per year by 2030, a potential £106 billion prize from now until the end of the next parliament.3

Notes to editors

1: H1 2019 UK car production 666,521 units.

2: Independent production outlook snapshot June 2023 from AutoAnalysis – 2028 expectation based on optimistic scenario, 986k cars.

3: Value based on analysis of new AutoAnalysis outlook ‘optimistic scenario’ for UK production by powertrain and estimates of battery electric vehicle factory gate prices.

File Downloads

- June 2023

June 2023

Comments are closed.