May 2022 UK Car Manufacturing

May 2022 UK Car Manufacturing

First rise in 11 months for UK car production

- UK car production up 13.3% in May, the first growth after 10 consecutive months of decline.

- Battery electric car production more than doubles, increasing by 108.3%, with 4,525 built.

- Sector calls for urgent action to mitigate £90 million uplift in energy costs and protect UK Automotive’s competitiveness as it transitions to a zero emissions future.

Thursday 30 June, 2022

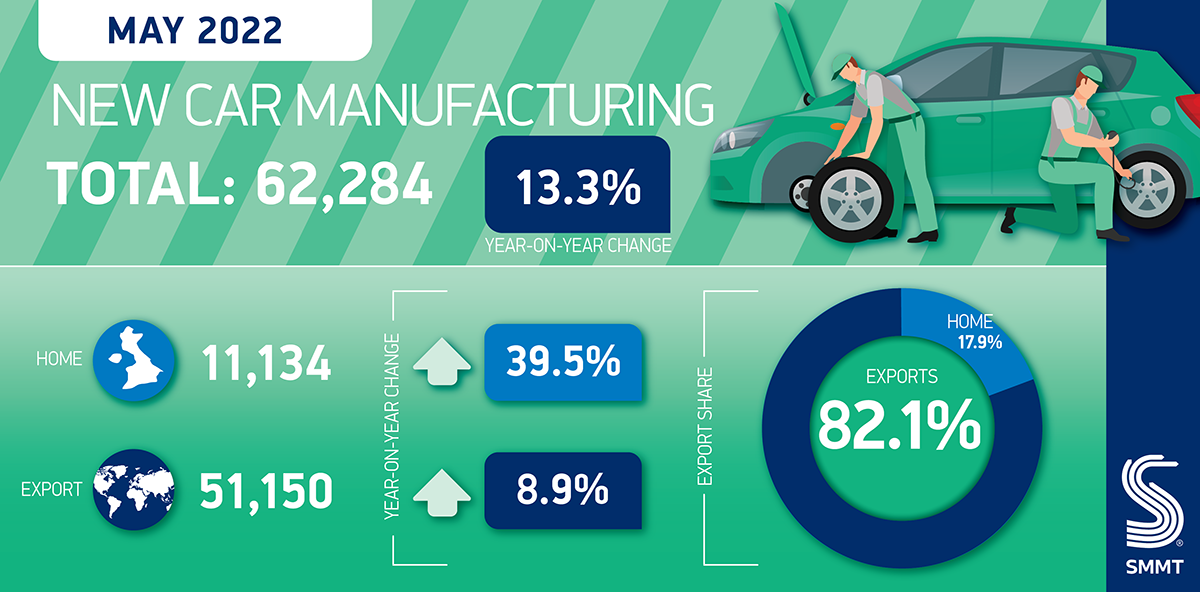

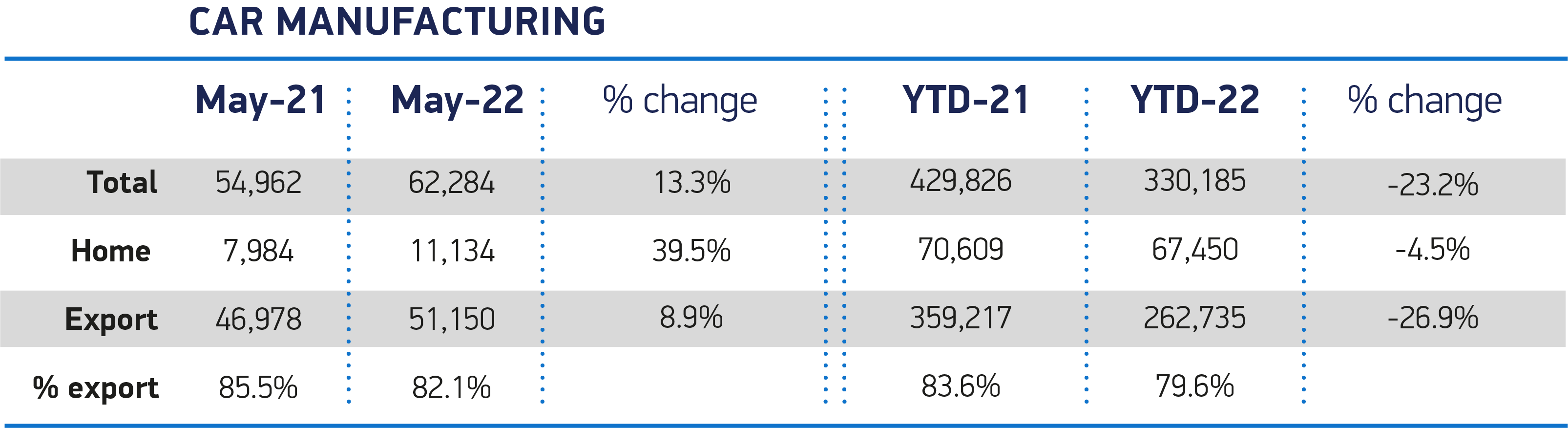

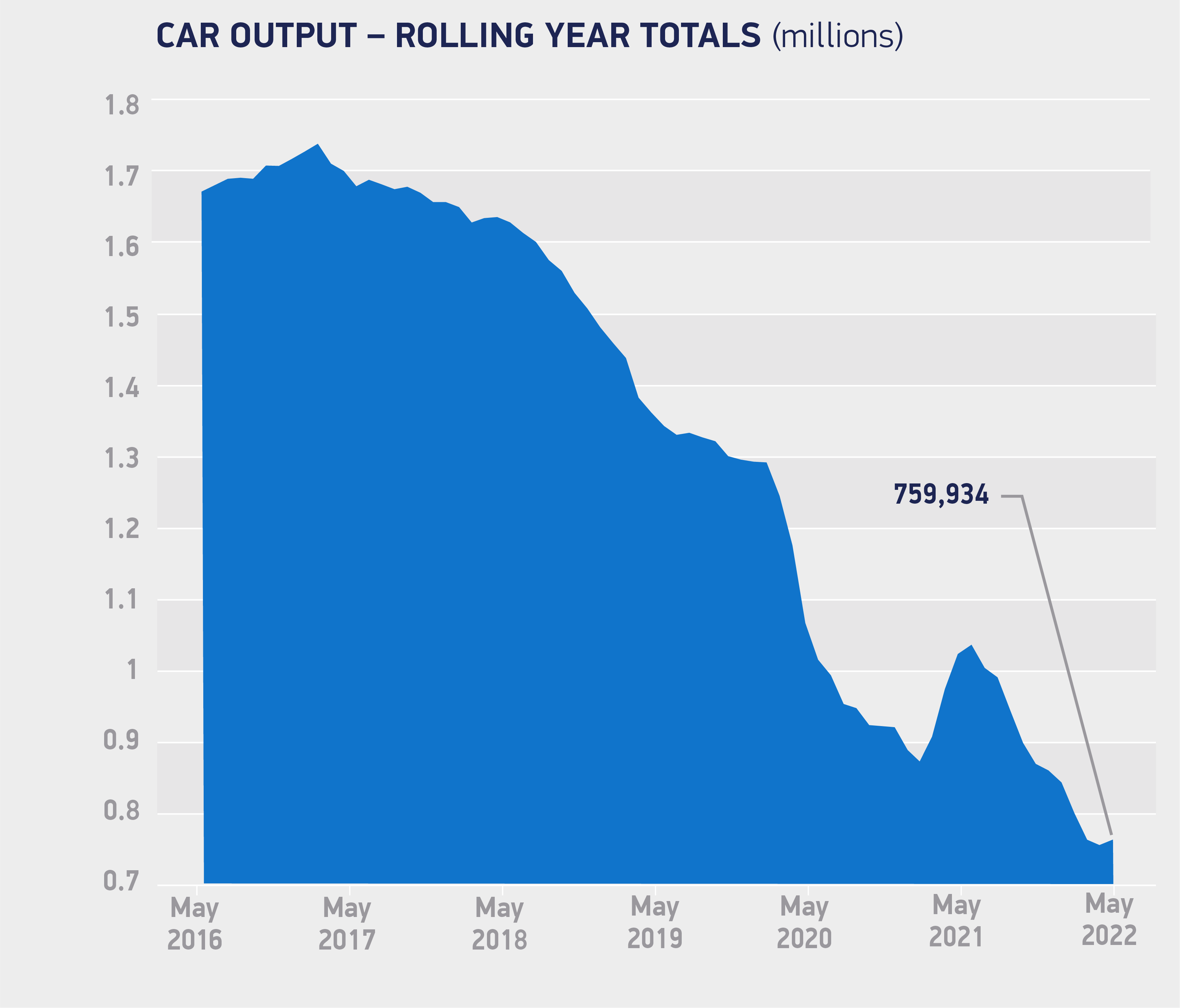

UK car production grew for the first time since June 2021 in May, up 13.3%, with 62,284 units leaving factory gates, according to figures released today by the Society of Motor Manufacturers and Traders (SMMT). This rise, which comes despite the closure of a major car plant last year, along with key model changeover at another, must, however, be viewed in context against May 2021, which was still suffering significantly from pandemic related headwinds. Indeed, output remains -46.3% below the pre-pandemic month in 2019, with ongoing supply chain issues, increasing economic uncertainty, rising business costs and disruption caused by the war in Ukraine.1

Production for both overseas and domestic markets increased in May, by 8.9% and 39.5% respectively. Exports accounted for 82.1% of all new cars built, with almost six-in-ten of these destined for the EU. Shipments to the US decreased by -35.4%, with the closure of a major UK plant in 2021 continuing to affect export levels across the Atlantic.

Positively, UK car makers continued to build the latest and greenest zero and low emission models at pace with an increase in output of battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs) and hybrid electric vehicles (HEVs). BEVs increased by 108.3%, while more than one-in-five (22.6%) of all cars built last month was alternatively fuelled, up from 19.3% last year.

In the year to date, overall output has decreased by more than a fifth (-23.2%), with supply chain constraints, most notable the shortage of semiconductors, constricting volumes, with just 330,185 units built – a shortfall of some 99,641. This has largely been driven by a -26.9% decline in exports and a further -4.5% fall in production for the domestic market.

This news comes in the same week as new analysis from SMMT revealed manufacturers are facing a £90 million increase on their energy bills, which are already 59% higher than the EU average. In its new report, From Full Throttle to Full Charge, SMMT is calling on the government for urgent action to enhance UK Automotive’s competitiveness and safeguard manufacturing as the sector transitions towards zero emission motoring.2

Mike Hawes, SMMT Chief Executive, said,

May’s return to growth for UK car output is hugely welcome after 10 months of decline, indicating the sector’s fundamental resilience. Any recovery, however, will be gradual as supply chain deliveries remain erratic, business costs volatile and geopolitical instability still very real. With the industry racing to decarbonise, we need to safeguard manufacturing competitiveness, drive investment and develop the skill base. Government and industry have a role to play in this transformation and collaboration will be essential if the UK is to remain at the forefront of automotive innovation.

Notes to editors

1: May 2019: 116,035

2: From Full Throttle to Full Charge – https://www.smmt.co.uk/wp-content/uploads/sites/2/SMMT-Full-Throttle-To-Full-Charge-report.pdf

File Downloads

- May 2022

May 2022

| Title | Description | Version | Size | Download |

|---|---|---|---|---|

| car exporting | 349.62 KB | DownloadPreview | ||

| UK new car production May 2022 | 488.73 KB | DownloadPreview | ||

| UK new car production May 2022 | 87.07 KB | DownloadPreview | ||

| UK car manufacturing | 242.42 KB | DownloadPreview | ||

| SMMT_UK car manufacturing data for May 2022 | 206.58 KB | Download | ||

| MH car production quote | 492.67 KB | DownloadPreview | ||

| Car output_rolling year totals May 2022 | 126.63 KB | DownloadPreview | ||

| Car output_rolling year totals May 2022 | 525.67 KB | DownloadPreview | ||

| Car Manufacturing twitter graphic May 2022 | 302.70 KB | DownloadPreview |

Comments are closed.