November 2020 UK Car Manufacturing

November 2020 UK Car Manufacturing

UK car manufacturing declines -1.4% in November as sector urges Brexit negotiators to ‘seal the deal’

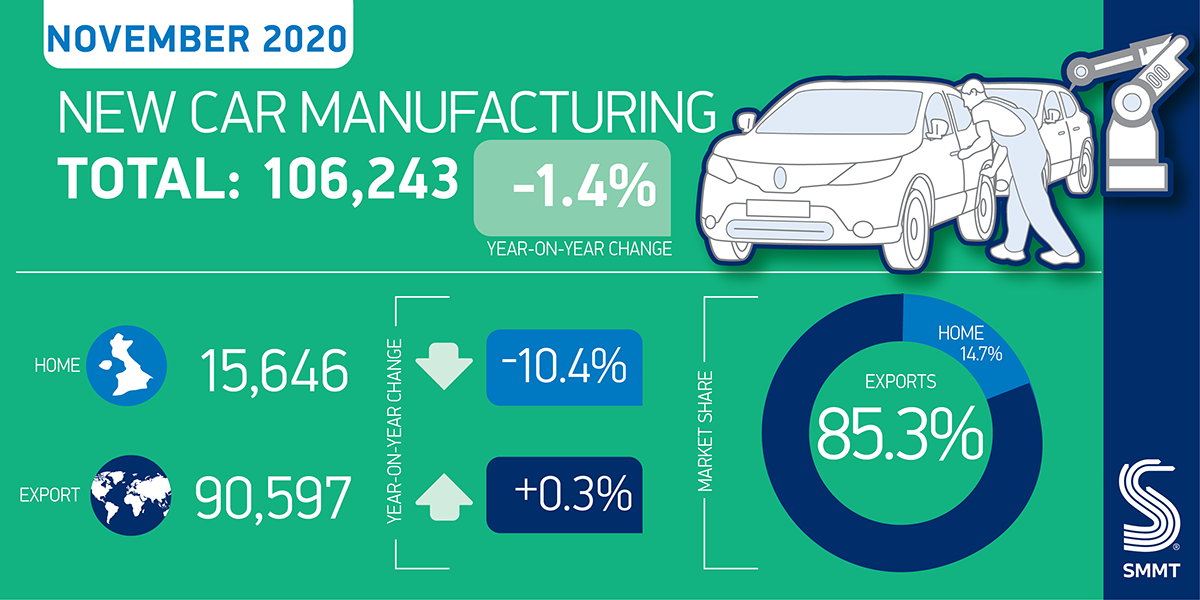

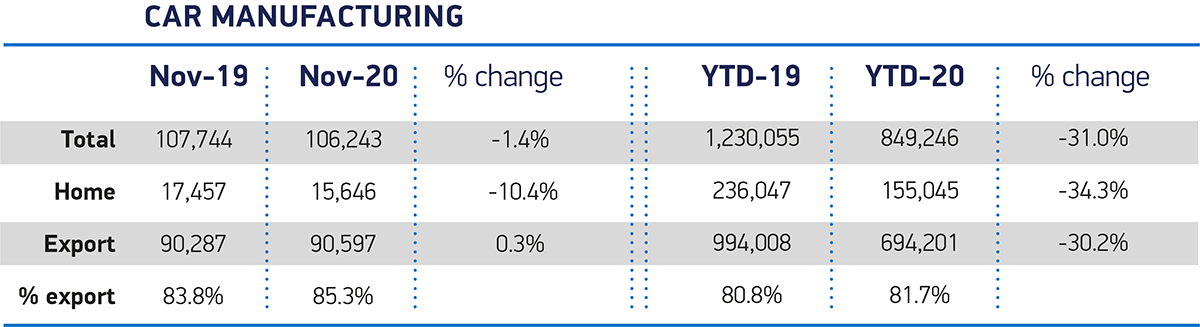

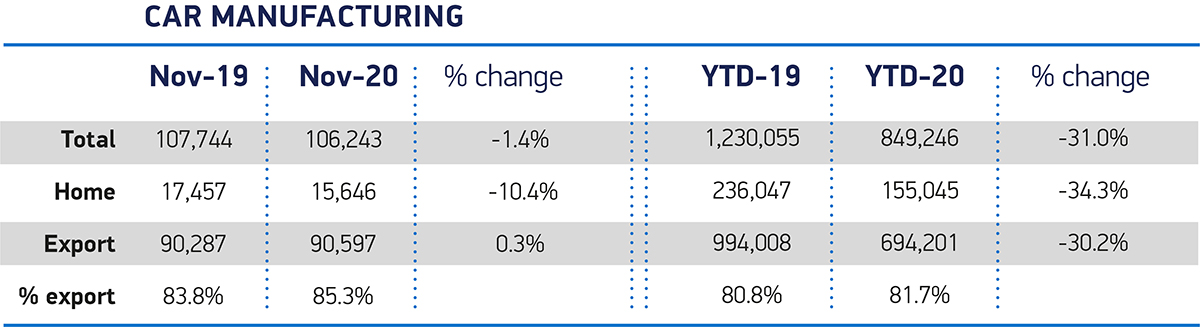

- UK car manufacturing falls -1.4% in November with 106,243 vehicles leaving production lines.

- Output for domestic market declines -10.4% with exports flat, up just 0.3% to 90,597 units.

- Year-to-date production now down -31.0% with 380,809 fewer cars manufactured in 2020.

- Industry calls on Brexit negotiators to ‘seal the deal’ before Christmas to avoid irrevocable damage of tariffs to critical automotive sector and jobs.

Wednesday 23 December, 2020

UK car production declined -1.4% in November to 106,243 units, according to the latest figures issued today by the Society of Motor Manufacturers and Traders (SMMT). Although a better year on year performance than many other months in a challenging 2020, the fall in output masks a particularly weak November 2019 when precautionary factory shutdowns in anticipation of a potential ‘no deal’ Brexit on 31 October depressed output.

November saw 1,501 fewer cars made than in the same month last year, as many of the factors present throughout much of 2020 conspired to dampen domestic orders, not least a second national lockdown in England and subsequent economic and political turbulence. Export volumes were flat, up just 0.3% and equivalent to a rise of 310 units, boosted by shipments to key markets in the EU, Asia and the US.

More than eight in 10 (85.3%) cars built in November were built for export, highlighting the critical importance of free and fair trade with global markets to UK car makers.

In the 11 months to November, total UK car production is now down -31.0% compared with the same period in 2019, representing a loss of 380,809 models at a cost of some £10.5 billion to the sector.1 This puts the industry on course to produce fewer than a million cars this year for only the second time since the early eighties and facing a tough future with potential further production losses amounting to £55.4 billion over the next five years if the sector is forced to trade on WTO conditions in a ‘no deal’ Brexit.2

Mike Hawes, SMMT Chief Executive, said,

Yet another decline for UK car production is of course concerning, but not nearly as concerning as the New Year nightmare facing the automotive industry if we do not get a Brexit deal that works for the sector. With just nine days to go, the threat of ‘no deal’ is palpable and the sector, now also reeling from the latest coronavirus resurgence, Tier 4 showroom lockdowns and disruption at critical UK ports, needs more than ever the tariff-free trading arrangements on which our competitiveness is founded.

It is finally make or break time, as being forced to trade on WTO terms would be a hammer blow for many automotive businesses, workers and their families, so we must get a deal – and one that avoids the devastation of punitive tariffs for all automotive products, from day one. For the long-term survival of UK Automotive, there is quite simply no other option.

While any deal at any time before 31 December is better than no deal at all, it is now all but impossible for automotive businesses to be ready and many critical questions remain unanswered. Should an agreement be reached, it will need swift ratification by Parliaments, flexible rules of origin thresholds for hybrid vehicles and batteries and a suitable phase in period to allow supply chains to adapt. Urgent clarity, in the event of a deal, would also be needed on proof of origin requirements to ensure qualification for tariff-free trade from 1 January, as well as a 12-month grace period on supplier declarations, with reciprocal facilitation measures by our European counterparts.

These measures are essential to help guarantee the future health of the British automotive sector, which is a vital part of the UK economy, turning over an annual £78.9 billion and representing the country’s biggest exporter of goods, accounting for 13% of total exports. It also invests more than £3 billion each year, as standard, in automotive R&D and employs 180,000 people directly in manufacturing – often in high skilled, high value jobs, with the average wage 21% higher than the UK average.3

Notes to editors

1 SMMT calculations

2 2009 – 999,460 cars made; Auto Analysis calculations – https://www.smmt.co.uk/2020/11/drive-home-brexit-deal-for-christmas-or-risk-55bn-manufacturing-hit-warns-uk-auto-sector/

3 https://www.smmt.co.uk/2020/10/no-deal-tariffs-would-undermine-britains-green-recovery-with-2800-drain-on-electric-car-affordability-warns-smmt/

File Downloads

- November 2020

November 2020

| Title | Description | Version | Size | Download |

|---|---|---|---|---|

| car exporting | 349.62 KB | DownloadPreview | ||

| UK new car production Nov 2020 | 158.22 KB | DownloadPreview | ||

| UK new car production Nov 2020 | 103.69 KB | DownloadPreview | ||

| UK car manufacturing | 242.42 KB | DownloadPreview | ||

| SMMT_UK car manufacturing data for November 2020 | 366.57 KB | Download | ||

| MH car manufacturing Nov quote | 422.24 KB | DownloadPreview | ||

| Car output_rolling year totals Nov 2020 | 168.51 KB | DownloadPreview | ||

| Car output_rolling year totals Nov 2020 | 123.14 KB | DownloadPreview | ||

| Car manufacturing summary graphic-03 | 259.32 KB | DownloadPreview |

Comments are closed.