October 2022 New Car Registrations

October 2022 New Car Registrations

EVs energise new car market but chargepoint rollout must accelerate

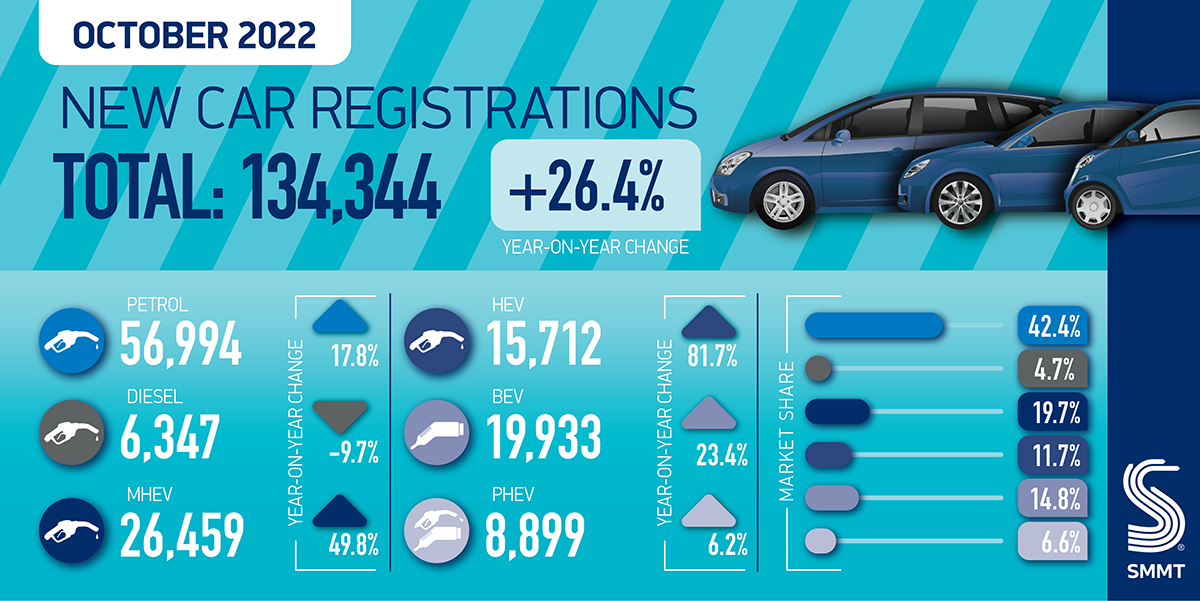

- October new car registrations rise 26.4% in third month of growth, with hybrid and battery electric vehicles driving uplift.

- Despite bumper month, market on course for weakest year since 1982 but recovery expected to continue in 2023.

- Plug-ins account for 21.5% of new registrations but infrastructure rollout risks hampering government zero emission ambition.

Friday 4 November, 2022

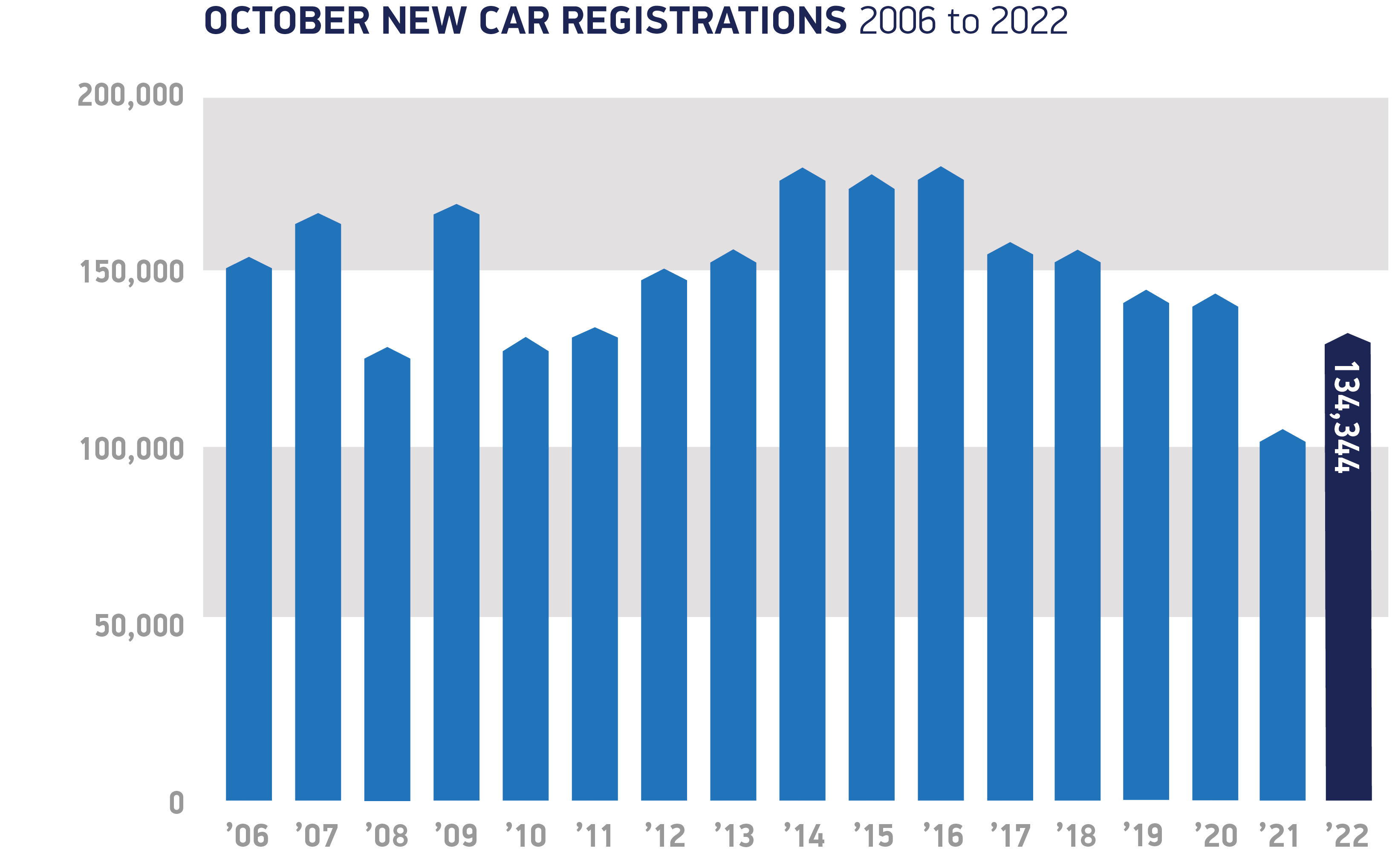

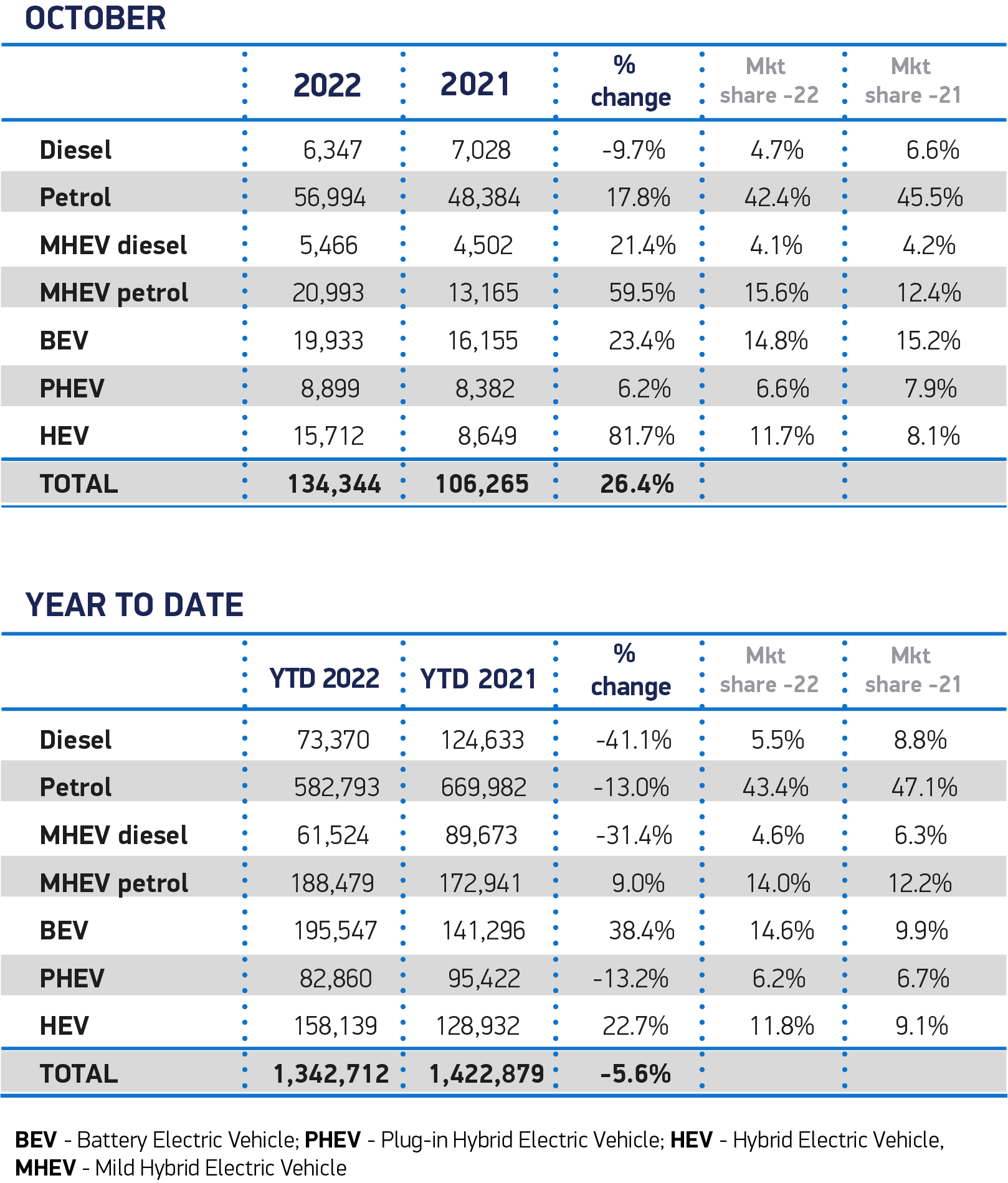

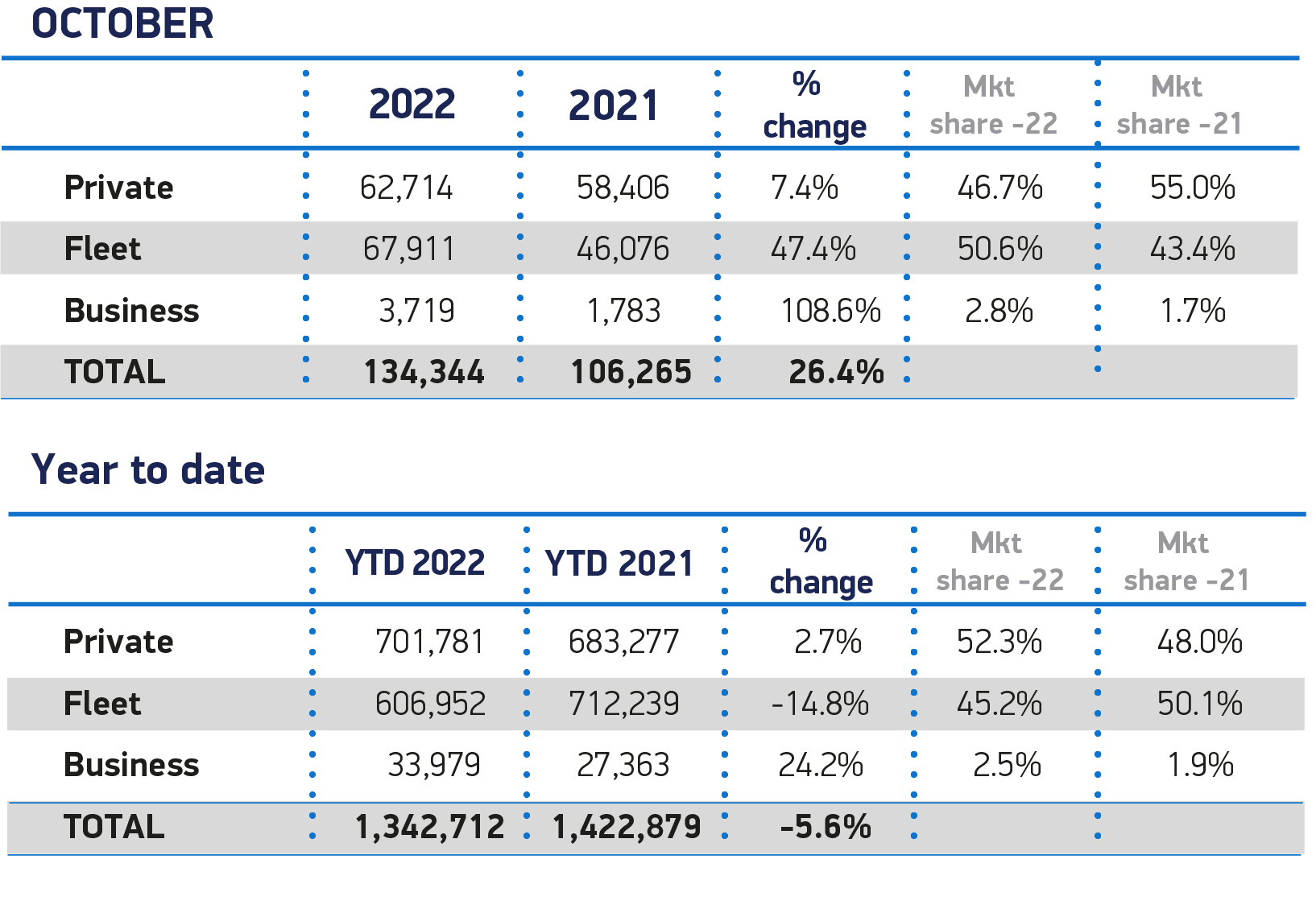

The UK new car market recorded a third month of growth in October, with registrations rising by more than a quarter (26.4%) to 134,344 units, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT). Fulfilment of strong order books helped deliver the bounce-back, although the increase follows a particularly disappointing October 2021 when deliveries fell by -24.6%.1 In the year to date, the market is down -5.6% on the same period in 2021, but still a third below pre-Covid levels.2

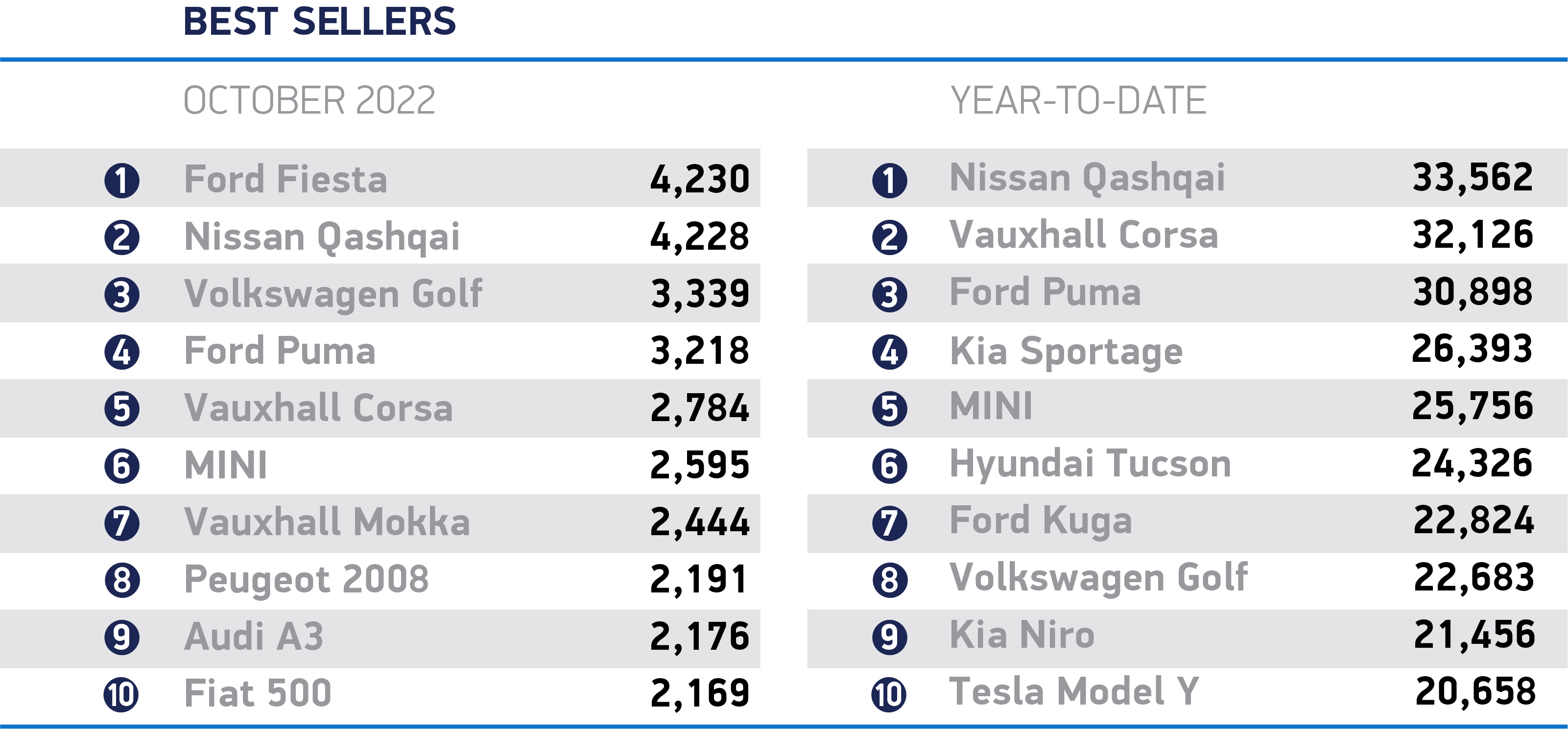

Growth in October was driven primarily by large fleet registrations, which grew 47.4% to 67,911 units, while those by private buyers rose 7.4% to 62,714. Smaller businesses recorded a 108.6% increase although, at 3,719 units, this is a small segment of the market.

Zero emission capable car deliveries continued to grow in volume, with battery electric vehicle (BEV) registrations increasing by 23.4% to 19,933 and plug-in hybrids (PHEVs) by 6.2% to 8,899. However, BEV uptake grew by less than the overall market for the first time since the pandemic, meaning October is the first month to see BEV market share fall year on year since May 2021, primarily attributable to supply challenges.

Deliveries of hybrid electric vehicles (HEVs), meanwhile, rocketed 81.7% to account for more than one in 10 new cars, as supply was prioritised for a raft of popular new models. Overall, electrified vehicles accounted for one in three registrations, while more than a fifth (21.5%) came with a plug.

Ongoing supply chain shortages, surging inflation and a growing cost of living crisis have led to a -2.2% downward revision of the market outlook for the year, with 1.566 million registrations now anticipated. This puts 2022 on course to be the market’s toughest year since 1982.3 More positively, demand for electric vehicles is anticipated to result in a plug-in market share of 21.9%. Overall market recovery is anticipated to continue through 2023, with an outlook of 1.808 million units and plug-ins accounting for 26.7% of registrations next year.

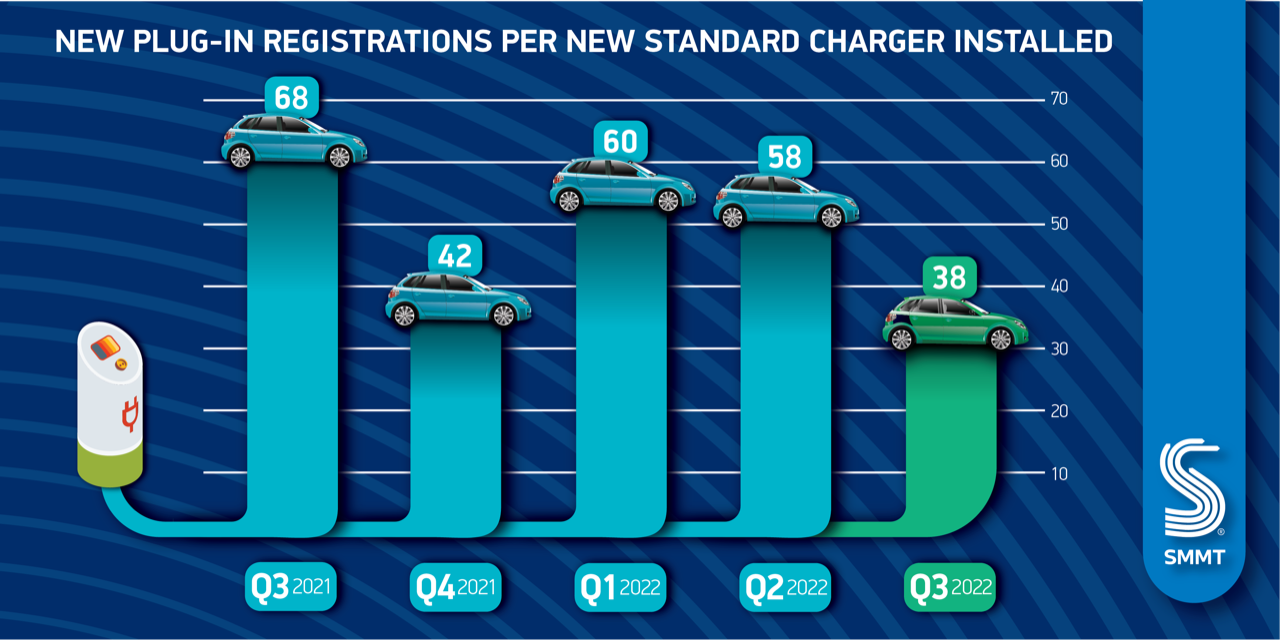

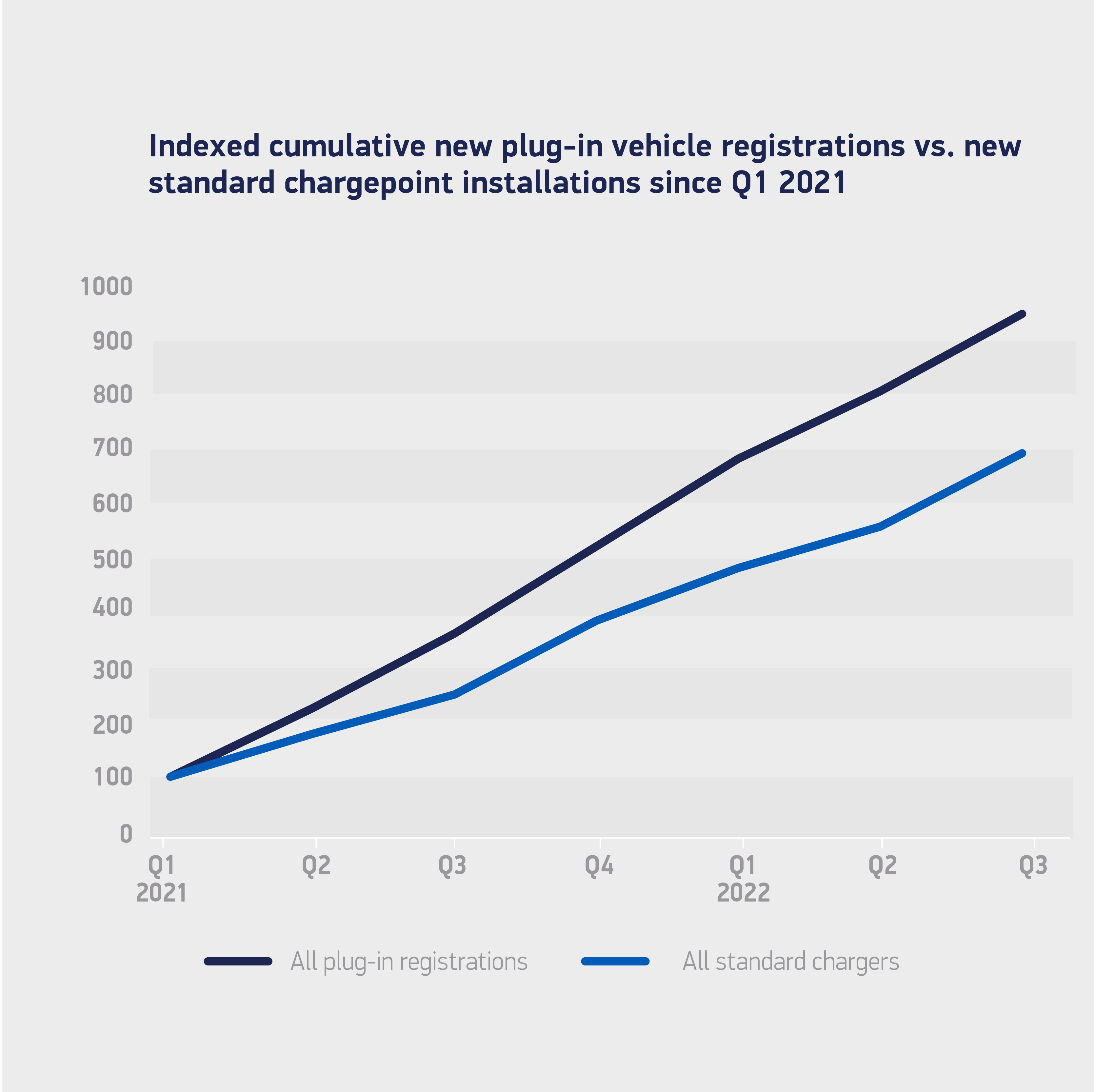

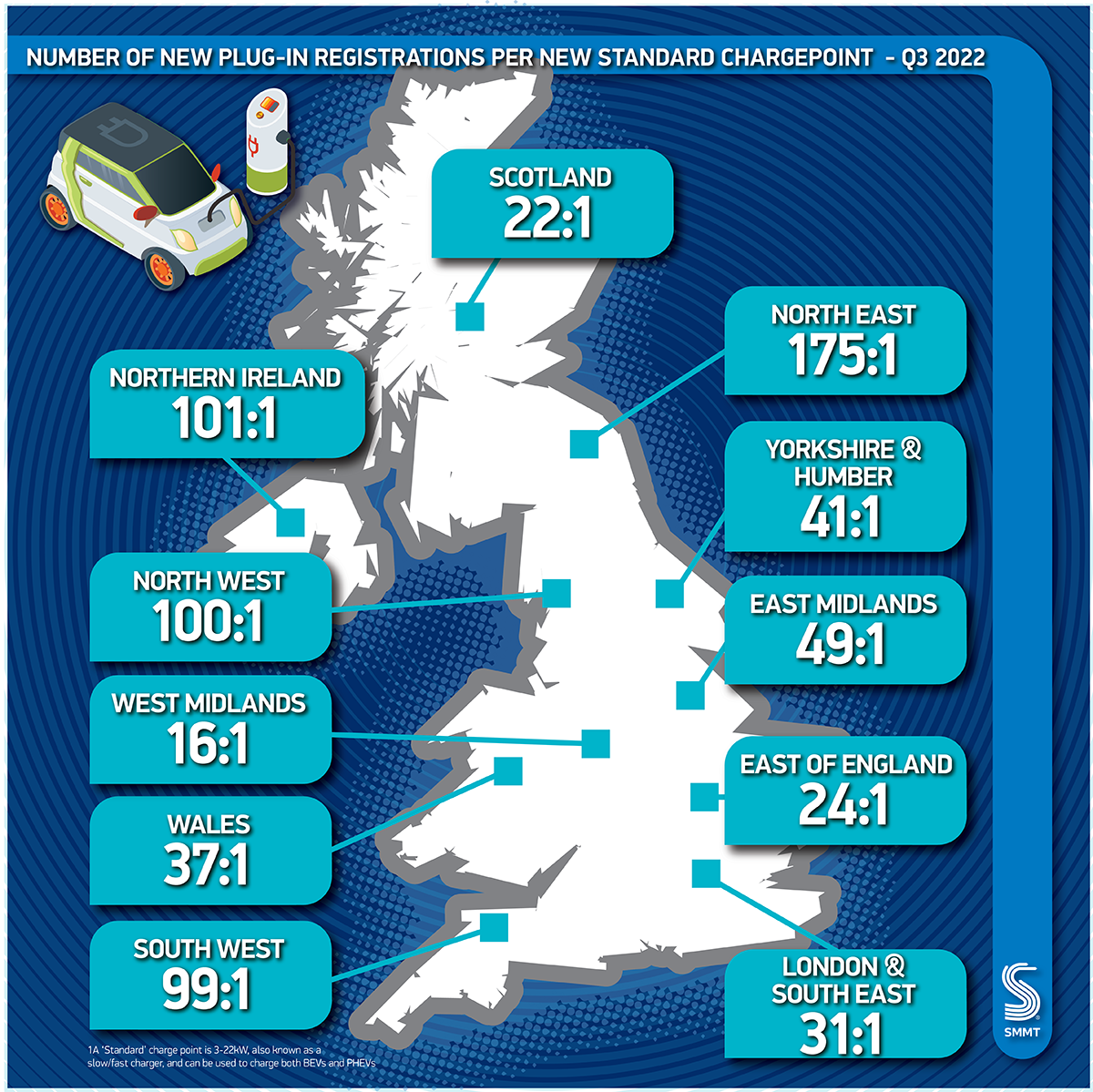

Such growth underlines the importance of increasing public chargepoint provision. At the start of October 2022 the UK had 34,637 public standard, rapid and ultra-rapid electric vehicle charging devices, with 1,239 new rapid chargers and 5,023 new standard chargers installed during the first nine months of the year. With 249,575 new plug-in registrations during the same period, just one new standard public charger has been installed for every 50 new plug-in EV registrations. At this rate, it is unlikely that government’s ambition for 300,000 public chargers by 2030 will be met.4

Mike Hawes, SMMT Chief Executive, said,

A strong October is hugely welcome, albeit in comparison with a weak 2021, but it is still not enough to offset the damage done by the pandemic and subsequent supply shortages. Next year’s outlook shows recovery is possible and EV growth looks set to continue but, to achieve our shared net zero goals, that growth must accelerate and consumers given every reason to invest. This means giving them the economic stability and confidence to make the switch, safe in the knowledge they will be able to charge – and charge affordably – when needed. The models are there, with more still to come; so must the public chargepoints.

With stretched infrastructure and the cost of living crisis both having the potential to undermine future uptake, government’s Autumn Statement, set for 17 November, provides an opportunity to stimulate demand and deliver both economic growth and net zero progress. Further measures to mitigate energy costs in the longer term for consumers and businesses would give greater confidence. Now is not the time to raise motorists’ costs, which would likely stoke inflation and damage broader government revenues from new car sales. A long-term fiscal commitment to zero emission motoring would do much to stimulate investment and demand. EV drivers’ top complaints are, invariably, cost and charging anxiety so reducing VAT on public charging to bring it into line with home charging would level the playing field for drivers unable to install a home chargepoint.

Notes to editors

1. October 2019 registrations: 143,251

2. YTD 2021 registrations: 1,422,879; YTD 2019 registrations: 2,055,522

3. 1982 registrations: 1,555,027

4. Analysis of SMMT data and DfT, Electric vehicle charging device statistics: October 2022. Standard chargers defined as 3-22kW, also known in the UK as a slow/fast charger, and can be used to charge both BEVs and PHEVs. These are normally found on streets, public car parks and destinations such as supermarkets, retail parks and places of interest.

File Downloads

- October 2022

October 2022

Comments are closed.