Q1 2022 Bus & Coach Registrations

Q1 2022 Bus & Coach Registrations

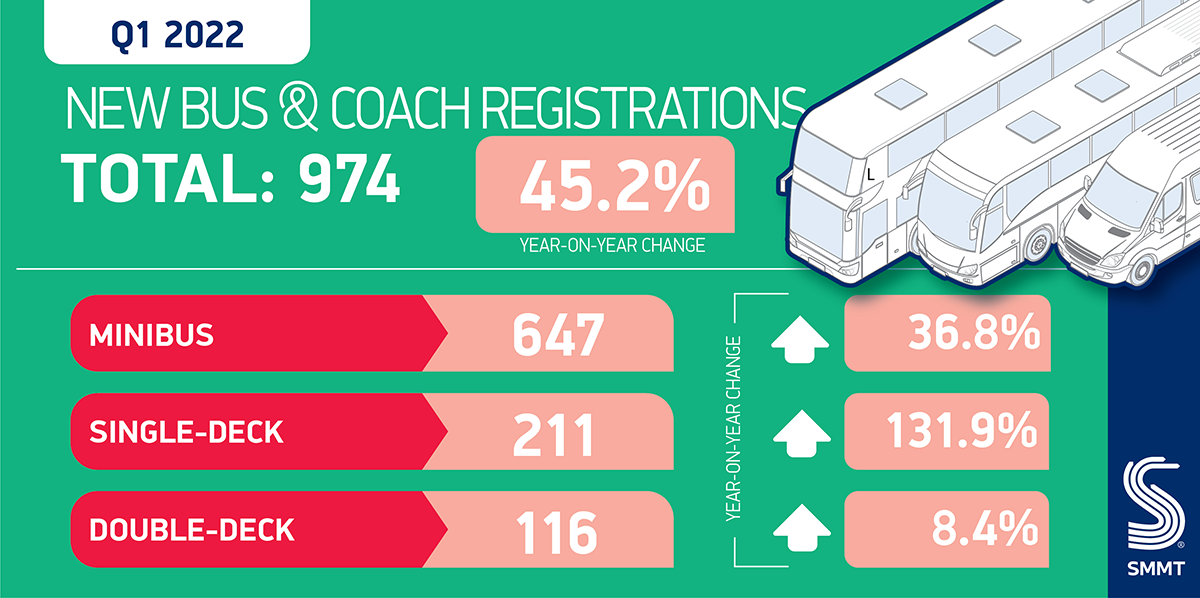

Bus and coach registrations grow 45.2% in Q1 2022 but remain well below pre-pandemic levels

- Demand for new buses and coaches grows 45.2% in Q1 2022, but remains -44.4% below pre-pandemic five year average.

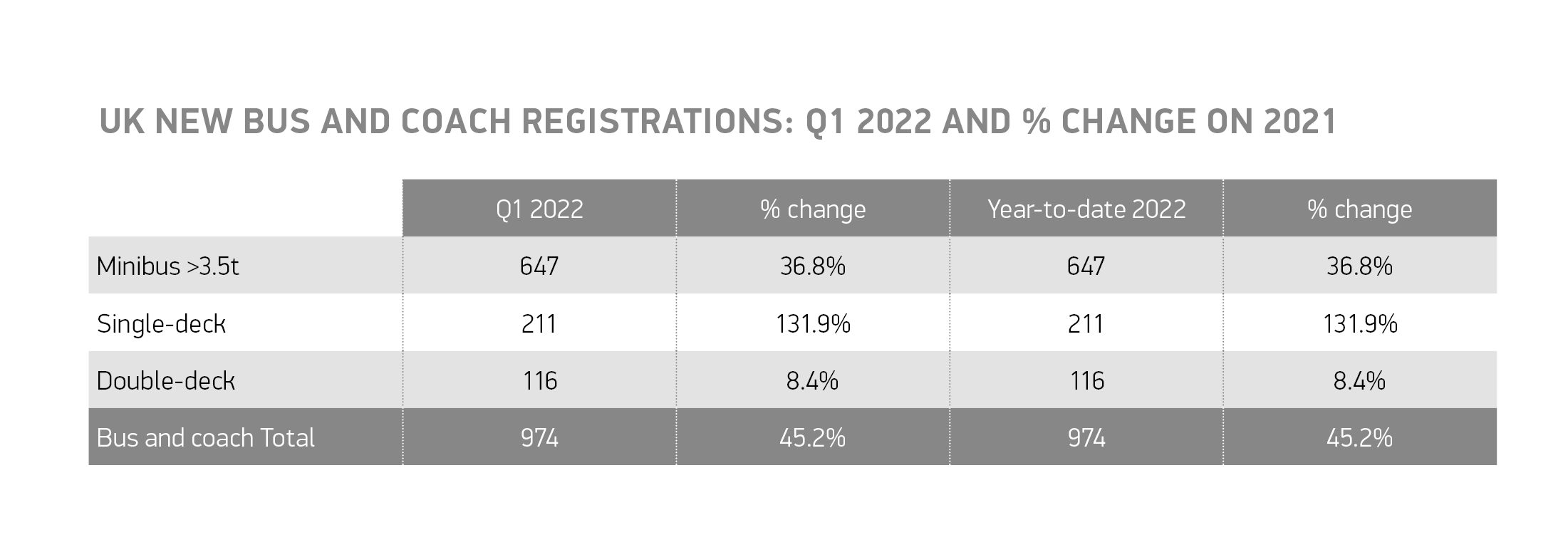

- Single deck bus registrations increase sharply, rising by 131.9%, with minibuses up 36.8% and double-deckers up 8.4%.

- Industry looks to government for crucial infrastructure support and release of Bus Back Better funding to drive fleet renewal.

Tuesday 17 May, 2022

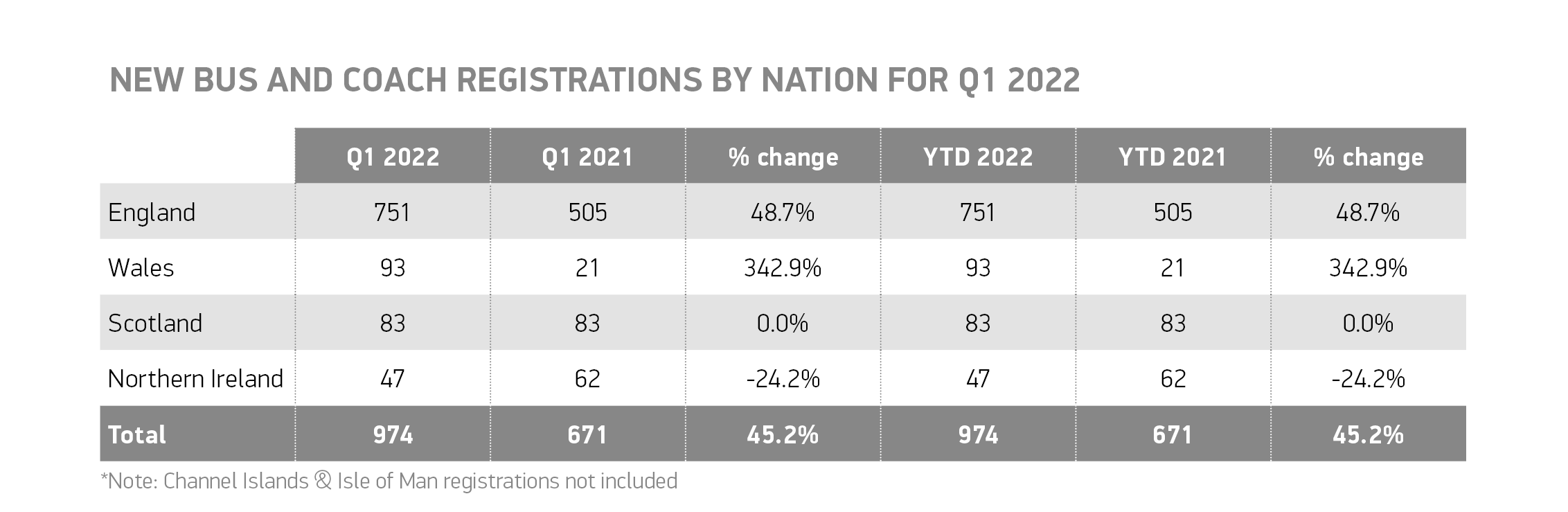

The UK new bus and coach market grew by 45.2% in the first quarter of 2022, with registrations increasing to 974, according to figures released today by the Society of Motor Manufacturers and Traders (SMMT). The year-on-year increase compares with the weakest start to a year on record in 2021, when orders collapsed as a result of plummeting passenger numbers given pandemic-related restrictions.1

With restrictions easing over the first three months of the year and bus journeys increasing, all vehicle types saw registrations rise, with single-deck buses experiencing the largest growth, up 131.9% year-on-year with some 211 units sold.2 Registrations of minibuses, which continue to dominate the market, rose 36.8%, with 647 joining UK roads, accounting for two thirds of all new registrations (66.4%). Double-deck bus demand also grew, by some 8.4% to 116 units.

Despite the significant year-on-year increase, the sector is still struggling with low demand given long-term declines in ridership levels, with -44.4% fewer buses and coaches registered in Q1 than the pre-pandemic five-year average.3

With bus fleet renewal essential for the UK to meet the government’s ambitious Net Zero goals, operators need confidence and support to switch to the latest and greenest buses. Bus manufacturers are already deploying zero emission buses in the UK and this may be accelerated with the provision of charging and refuelling infrastructure.

The consultation for ending the sale of new, non-zero-emission buses is currently ongoing and sets an ambitious target for this sector which can only be achieved with immediate investment in charging and refuelling infrastructure and the allocation of funding from policies in the Bus Back Better Strategy. This would support operators to invest in new vehicles, protecting jobs and livelihoods, while keeping the UK moving and reducing emissions. The transition to zero emission coaches remains a challenge and will require a holistic approach that considers passenger needs, public realm requirements in addition to incentives and infrastructure.

Mike Hawes, SMMT Chief Executive, said,

The return to growth of the bus and coach sector, which is critical for the UK’s Net Zero goals and levelling up agenda, is very welcome. It is, however, still some way short of a recovery. As declining passenger numbers continue to hamper the confidence of operators to renew their fleets, incentives are essential. Funding has slowly started to be released but government must act faster, using cash from the Bus Back Better Fund to support investment in vehicles and using its other funding streams to encourage infrastructural expansion, both of which are needed to deliver the rapid transition to net zero transport everyone demands.

Notes to Editors

1. Q1 2021 was the weakest performing first quarter since records began in 1996 with just 582 registrations

2. https://www.gov.uk/government/statistics/quarterly-bus-statistics-october-to-december-2021

3 2015-2019 Q1 average: 1,751 units.

File Downloads

- Q1 2022

Q1 2022

| Title | Description | Version | Size | Download |

|---|---|---|---|---|

| UK new bus and coach registrations – Q1 2022 and % change on 2021 | 54.43 KB | DownloadPreview | ||

| SMMT quarterly Bus and Coach Q1 2022 | 243.12 KB | DownloadPreview | ||

| SMMT Bus and coach registrations_Q1 FINAL | 64.48 KB | Download | ||

| Q1 2022 UK B&C registrations quarterly totals – Q2 2020 to date chart | 32.49 KB | DownloadPreview | ||

| New bus and coach registrations by nation for Q1 2022 | 156.98 KB | DownloadPreview | ||

| B&C Q1 2022 top 5 regions by volume | 71.42 KB | DownloadPreview | ||

| 8_BUS_AND_COACH_PRESS_RELEASE MINIBUS UPDATE Q1 2022 | 13.58 KB | Download |

Comments are closed.