Q2 2021 Heavy Goods Vehicle Registrations

Q2 2021 Heavy Goods Vehicle Registrations

HGV market in Q2 post-Covid boost, but full recovery still awaited

- UK HGV market shows signs of recovery after Covid-impacted Q2 2020, with 9,493 vehicles registered.

- New truck registrations up significantly on lockdown-affected Q2 2020 and remain down by -20.1% on pre-pandemic five-year average.1

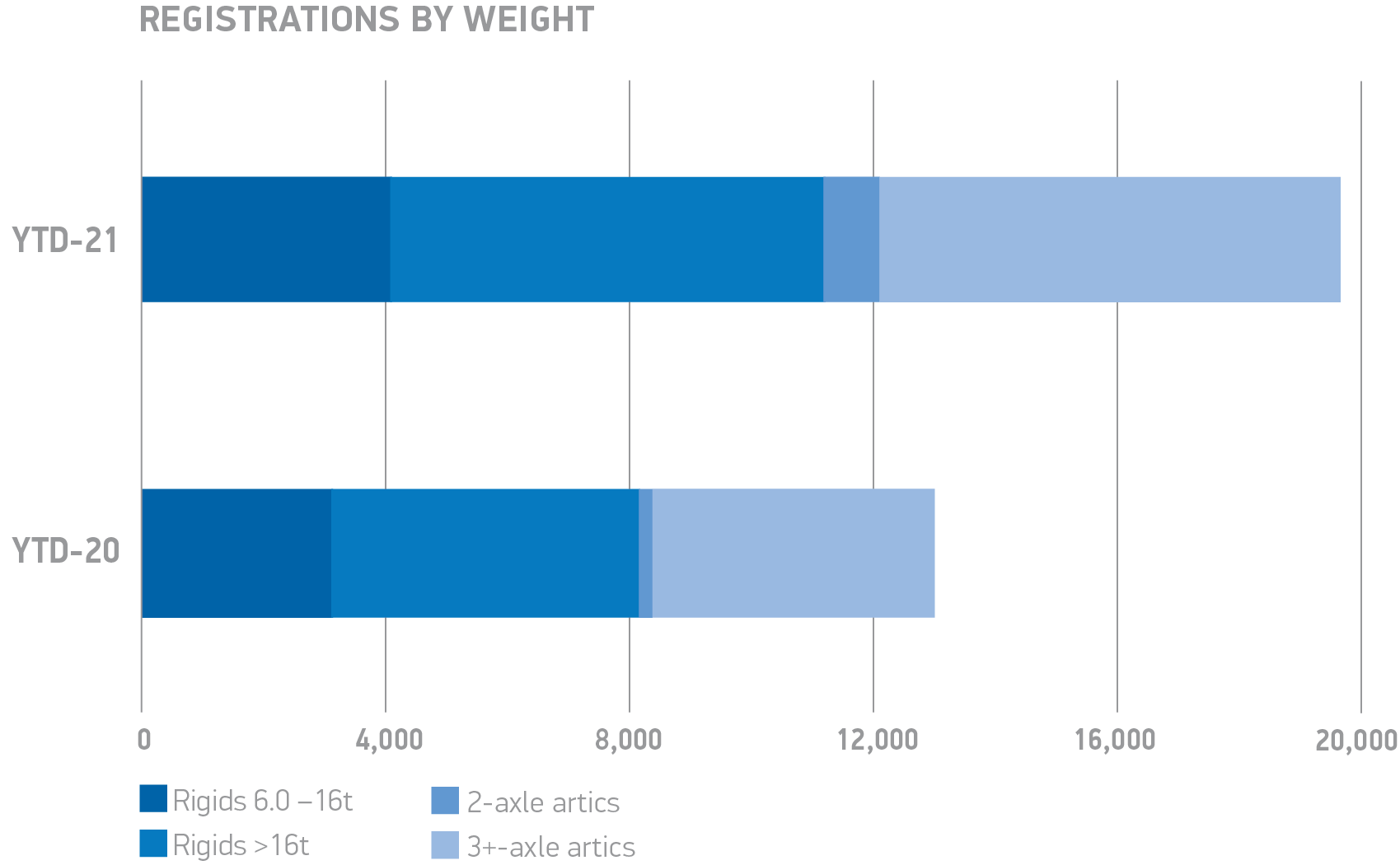

- Almost 20,000 trucks registered in the first six months of the year, down -28.8% on 2019.

Monday 16 August, 2021

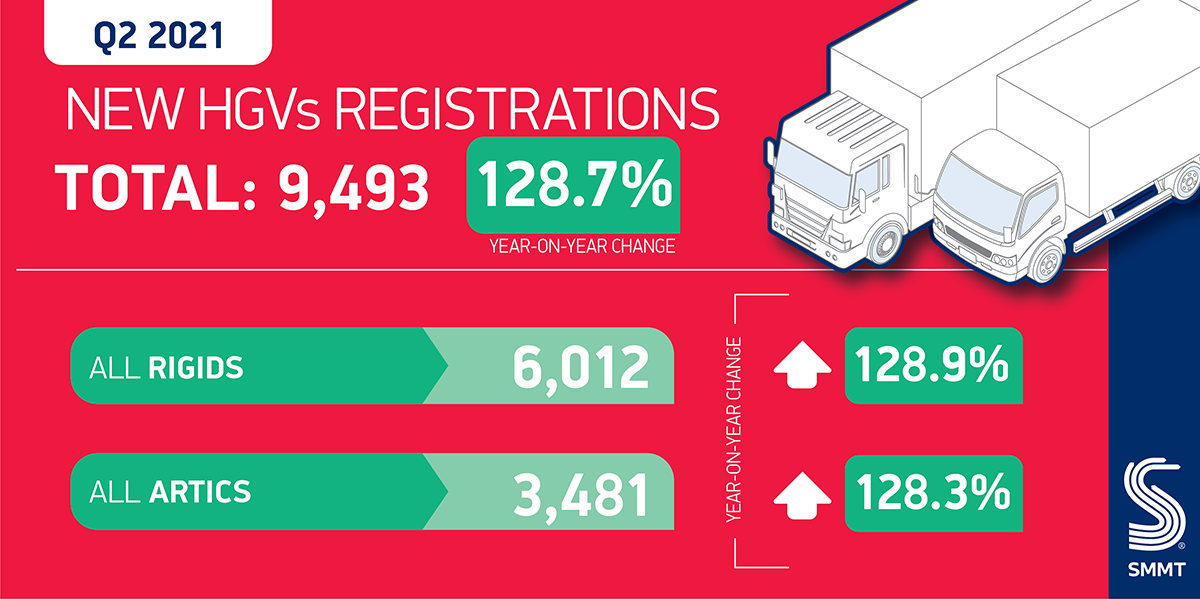

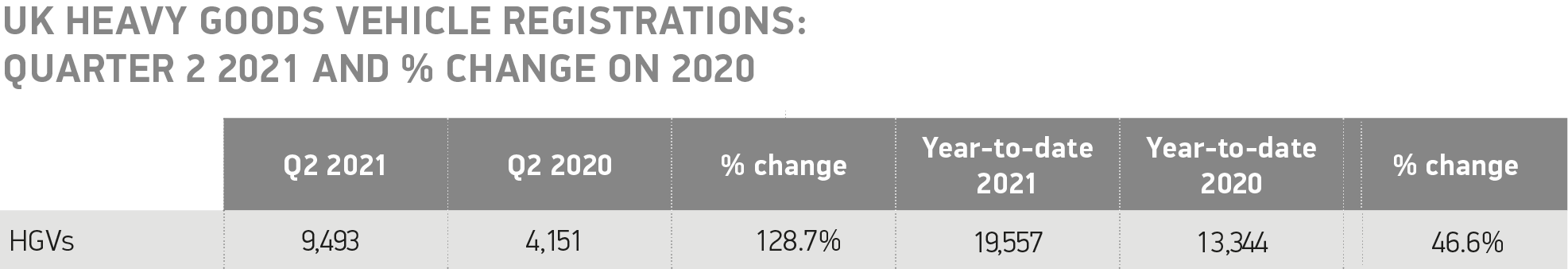

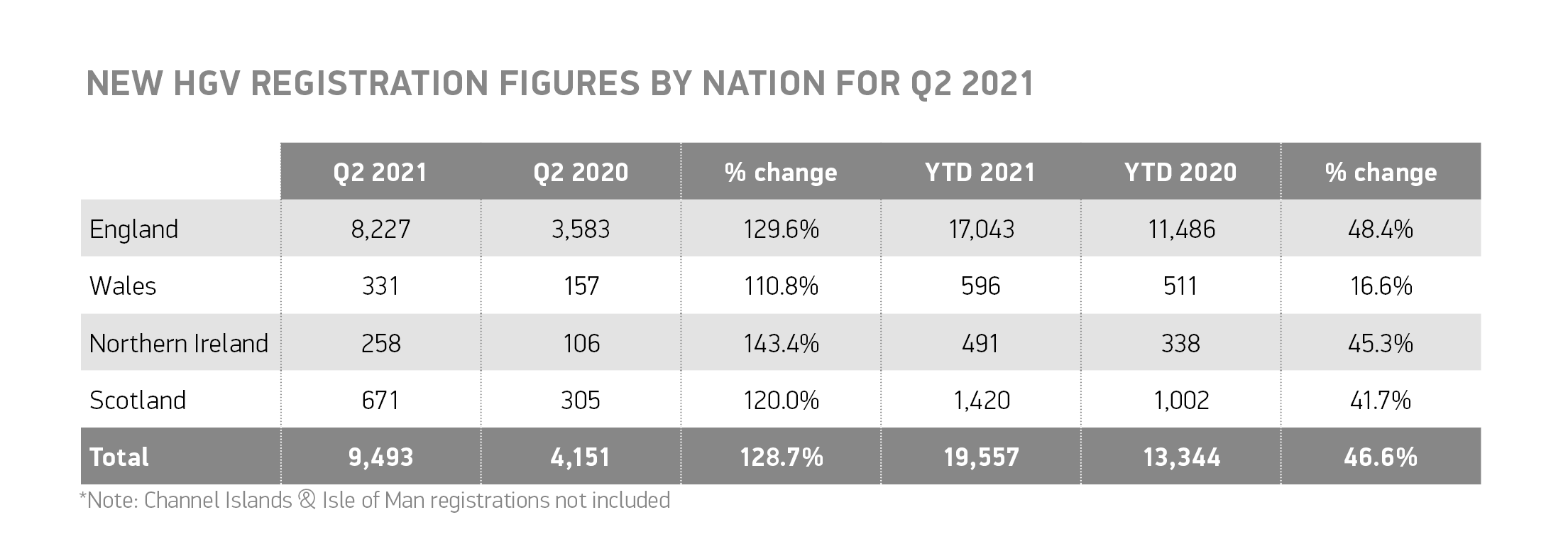

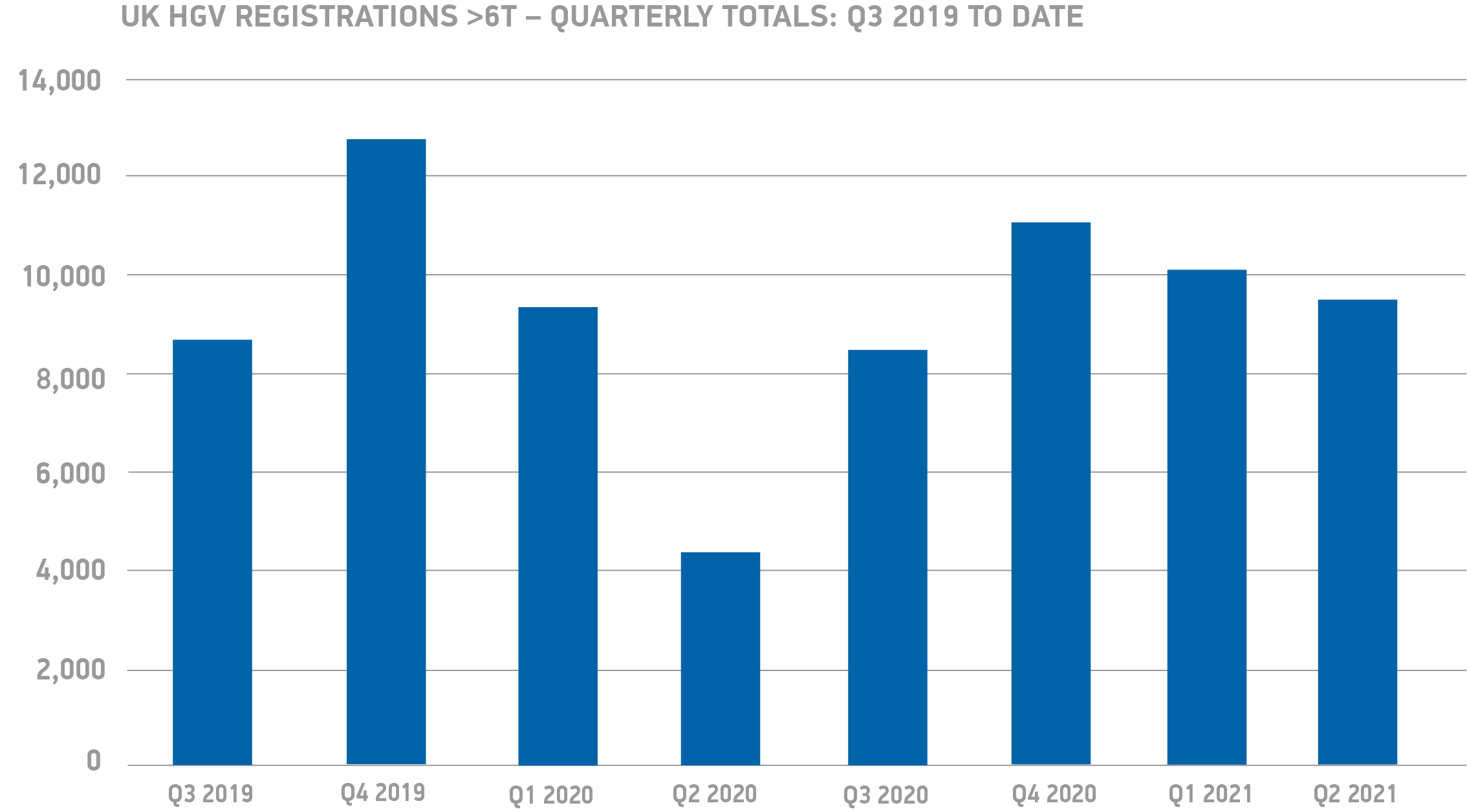

New heavy goods vehicle (HGV) registrations increased by 128.7% in the second quarter of 2021, according to figures released today by the Society of Motor Manufacturers and Traders (SMMT). The increase saw some 9,493 units registered, up from 5,342 in Covid-impacted 2020. Compared to the pre-pandemic five-year average, however, truck registrations fell -20.1%, as nationwide lockdown and business uncertainty continued to discourage greater investment in new equipment.

Performance for the year to date followed a similar pattern, with 19,557 vehicles registered in 2021 – a 46.6% increase on 2020, but falling short by some 7,907 trucks when compared to 2019, a -28.8% reduction.

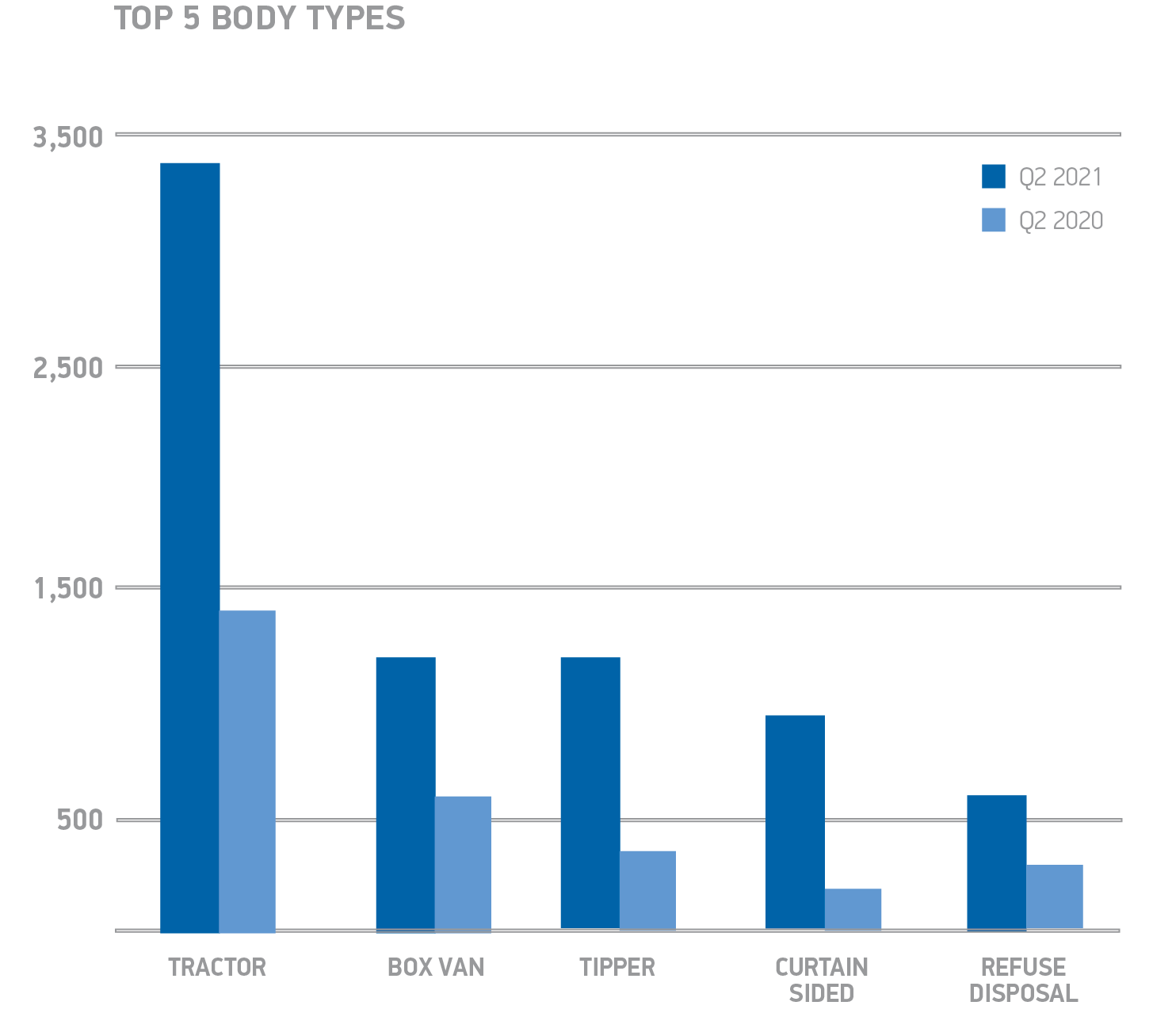

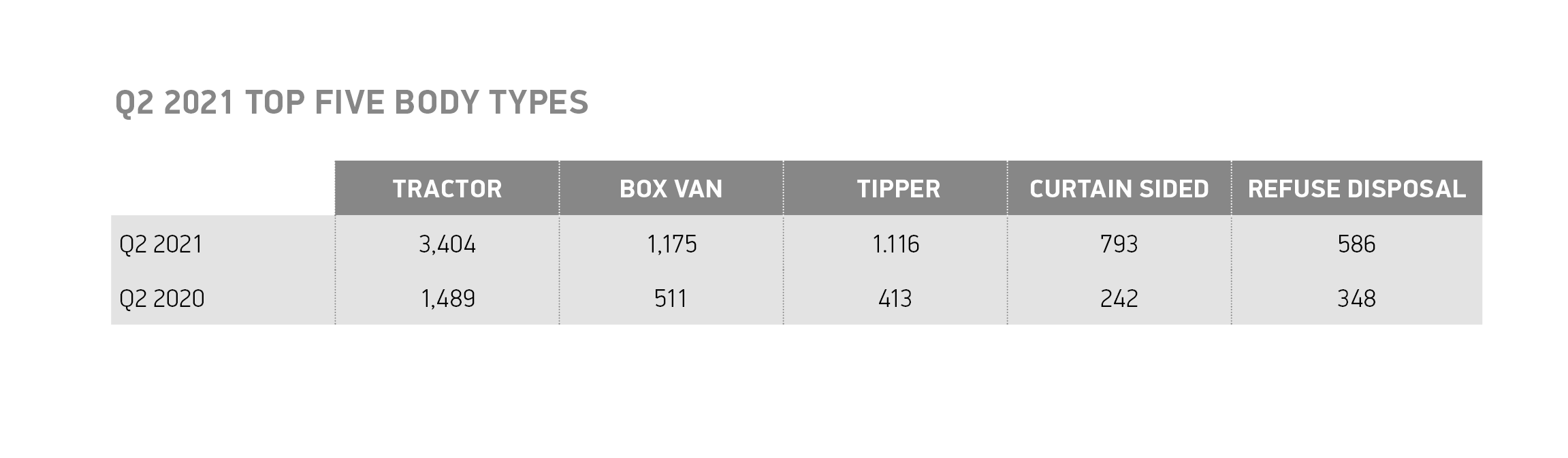

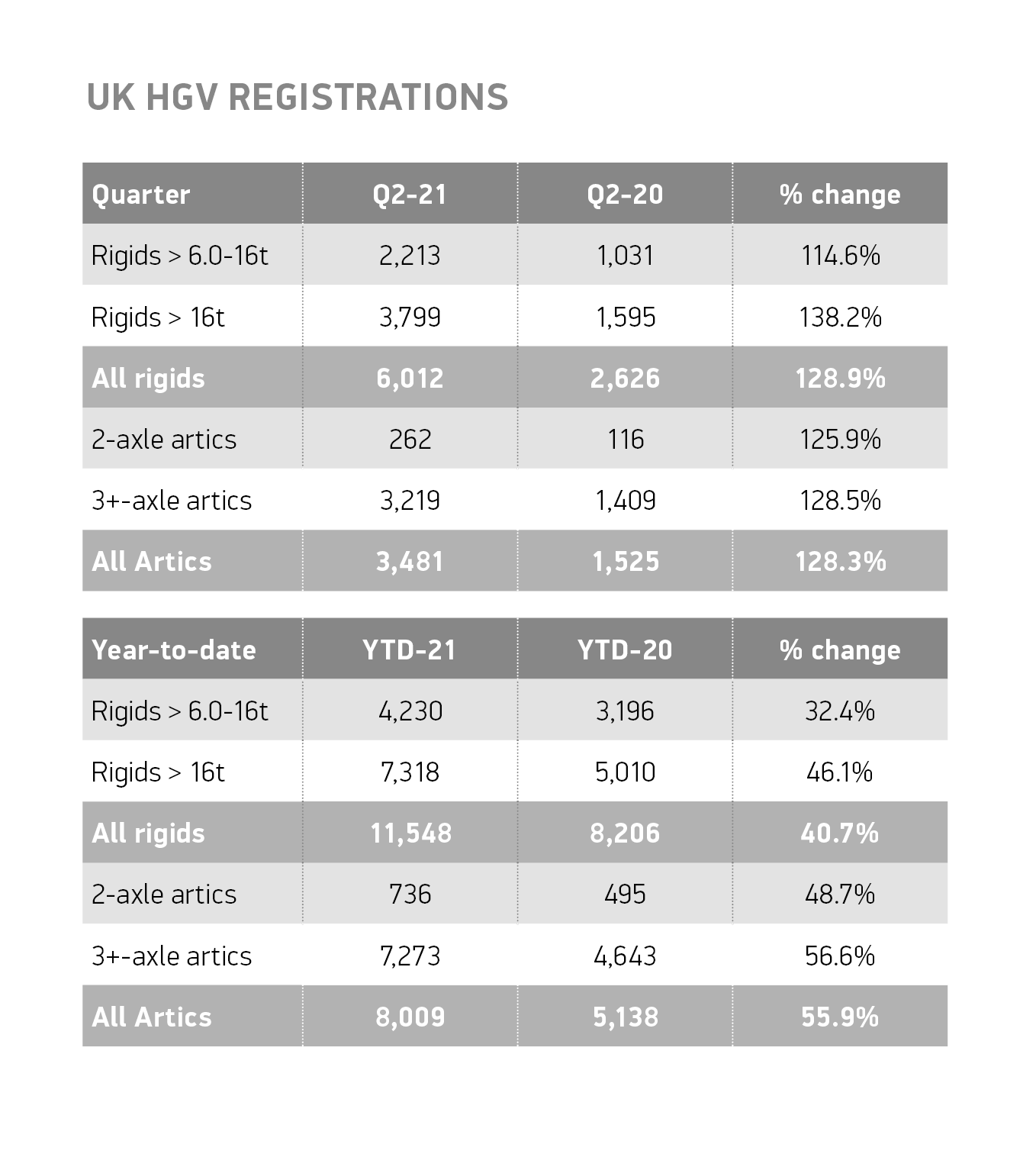

All segments saw volume increases compared to 2020, with articulated trucks up 128.3% and rigids up 128.9% respectively, while tractors continue to be the most popular vehicle body type, making up more than a third of all registrations in the quarter (35.9%). The refuse disposal sector saw one of the smallest gains, up 68.4% to 586 waste collection vehicles, as local authority funding continued to be impacted by Covid, thereby delaying new orders.

Mike Hawes, SMMT Chief Executive, said,

While it’s good – if unsurprising – to see an increase in HGV registrations, these are still relatively low numbers compared to the rapid growth the sector enjoyed before the start of the pandemic. As operators continue to battle against acute driver shortages, the sector faces a longer term and more significant challenge as the Government proposes the complete decarbonisation of this sector by 2040. This would be an incredibly tough timeline when the technological solutions are unclear, with nearly all of the sector diesel-powered. The sector needs stability, certainty and support if it is to develop the technologies and make them commercially viable for our heaviest mobility challenges.

Notes to Editors

1: Q2 2015-2019 average – 11,881

File Downloads

- Q2 2021

Q2 2021

Comments are closed.