Q3 2020 Heavy Goods Vehicle Registrations

Q3 2020 Heavy Goods Vehicle Registrations

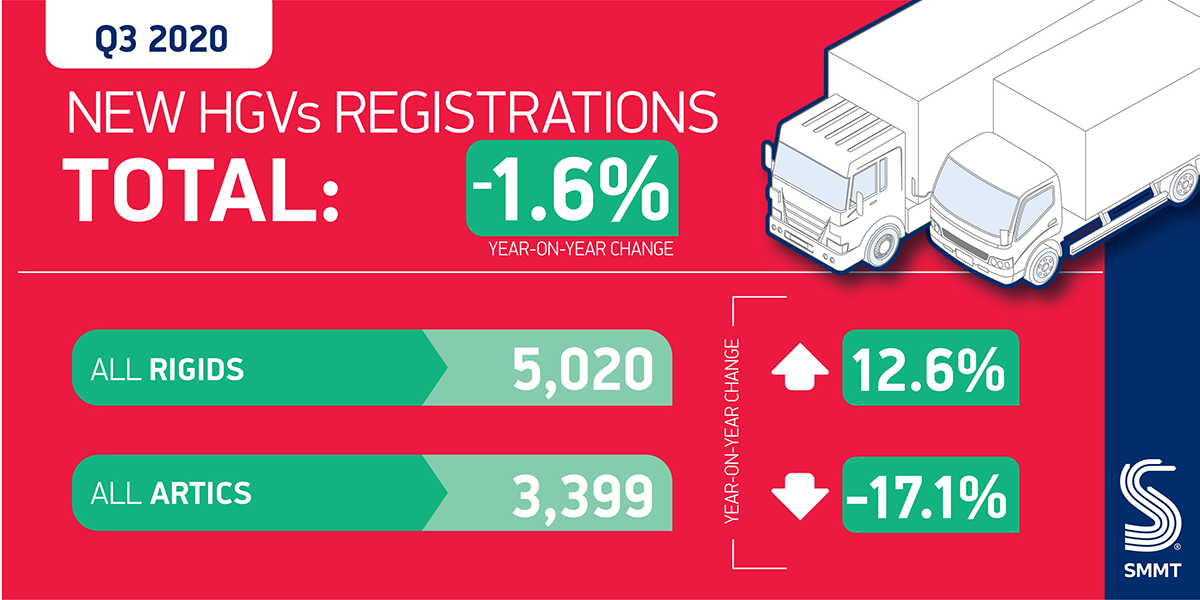

New HGV registrations decline -1.6% in Q3 2020

- UK HGV market dips by 138 units to 8,419 in Q3 after turbulent first half of the year.

- Demand for rigids up by 12.6% mirroring demand for essential delivery services and construction as lockdown measures eased over the summer.

- Market currently down -39.6% year to date, representing a drop of more than 14,000 units.

Monday 16 November, 2020

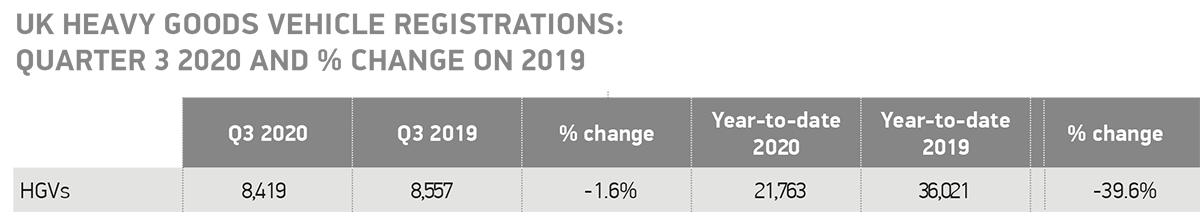

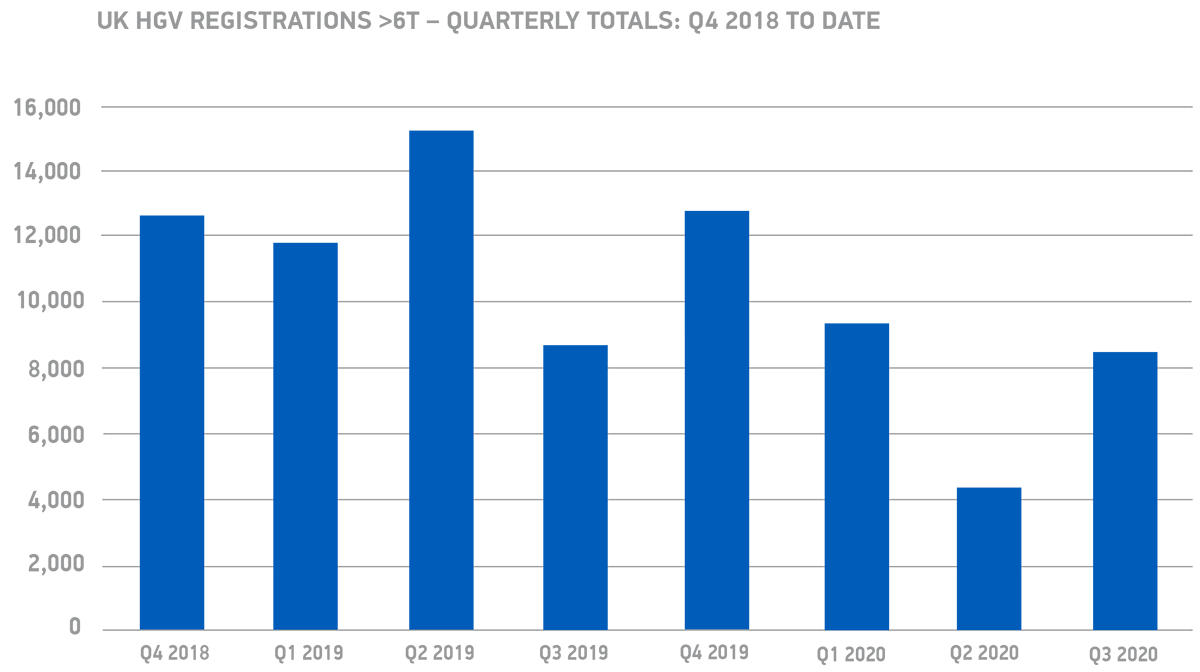

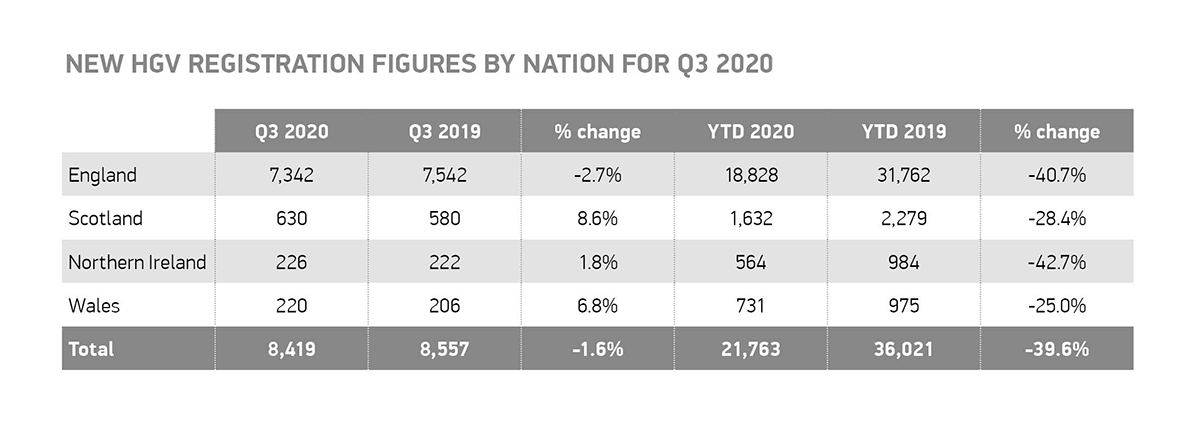

The UK’s new heavy goods vehicle (HGV) market declined slightly in the third quarter of 2020, down -1.6% with 8,419 units registered, according to figures published today by the Society of Motor Manufacturers and Traders (SMMT). The decline was far smaller than that seen in the first half thanks to the easing of the UK’s first Covid-19-enforced lockdown, balanced by an increase in demand for rigids as key sectors, including deliveries and construction, continued working throughout the pandemic. This also follows a particularly weak third quarter in 2019, which saw orders pulled forward into Q2 ahead of new smart tachograph regulations.1

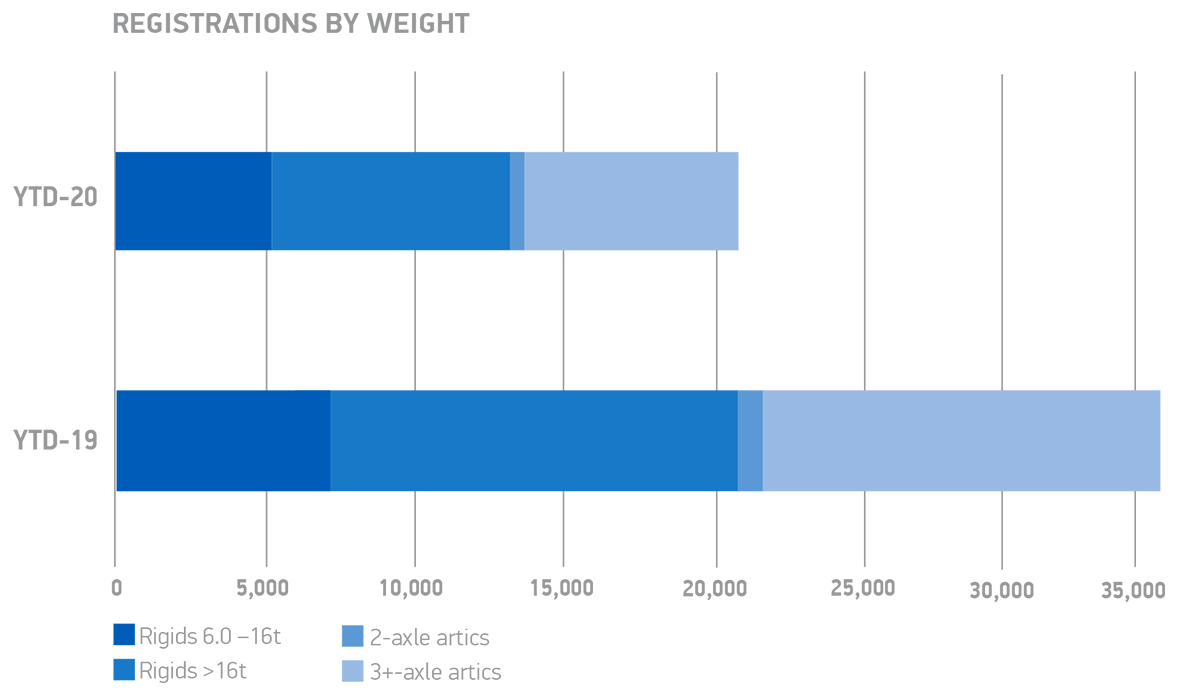

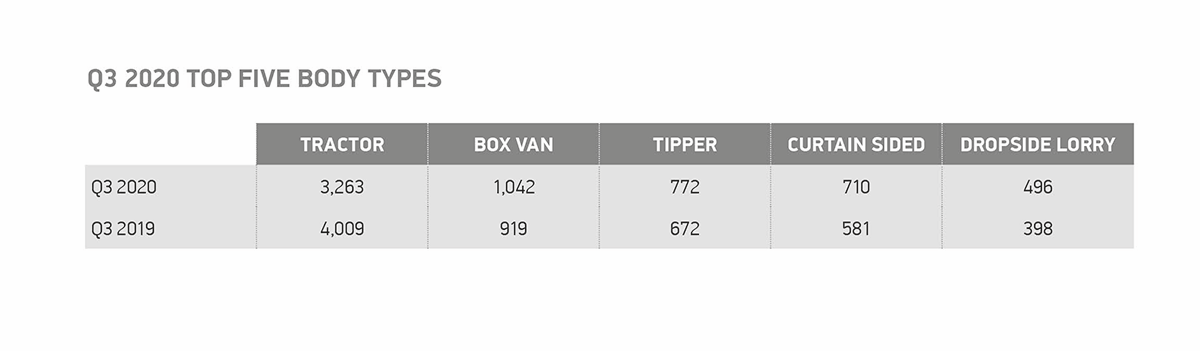

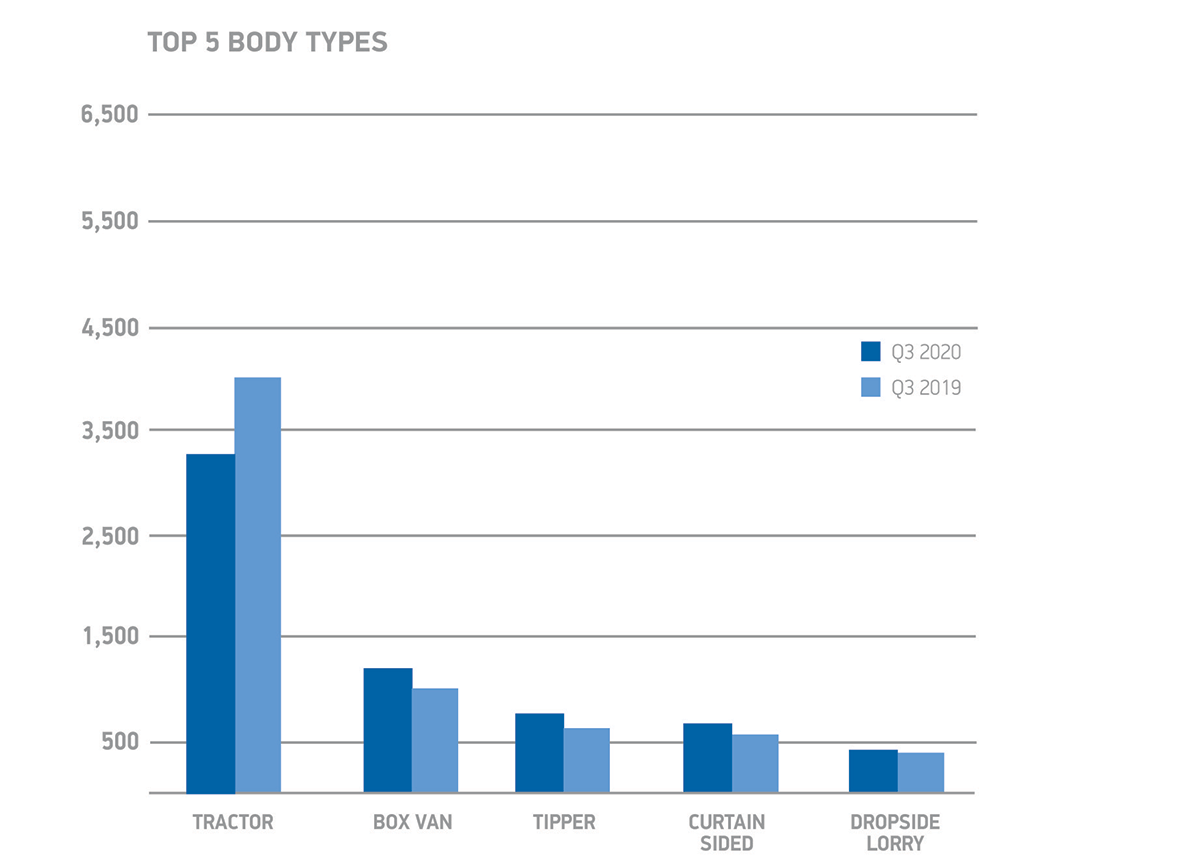

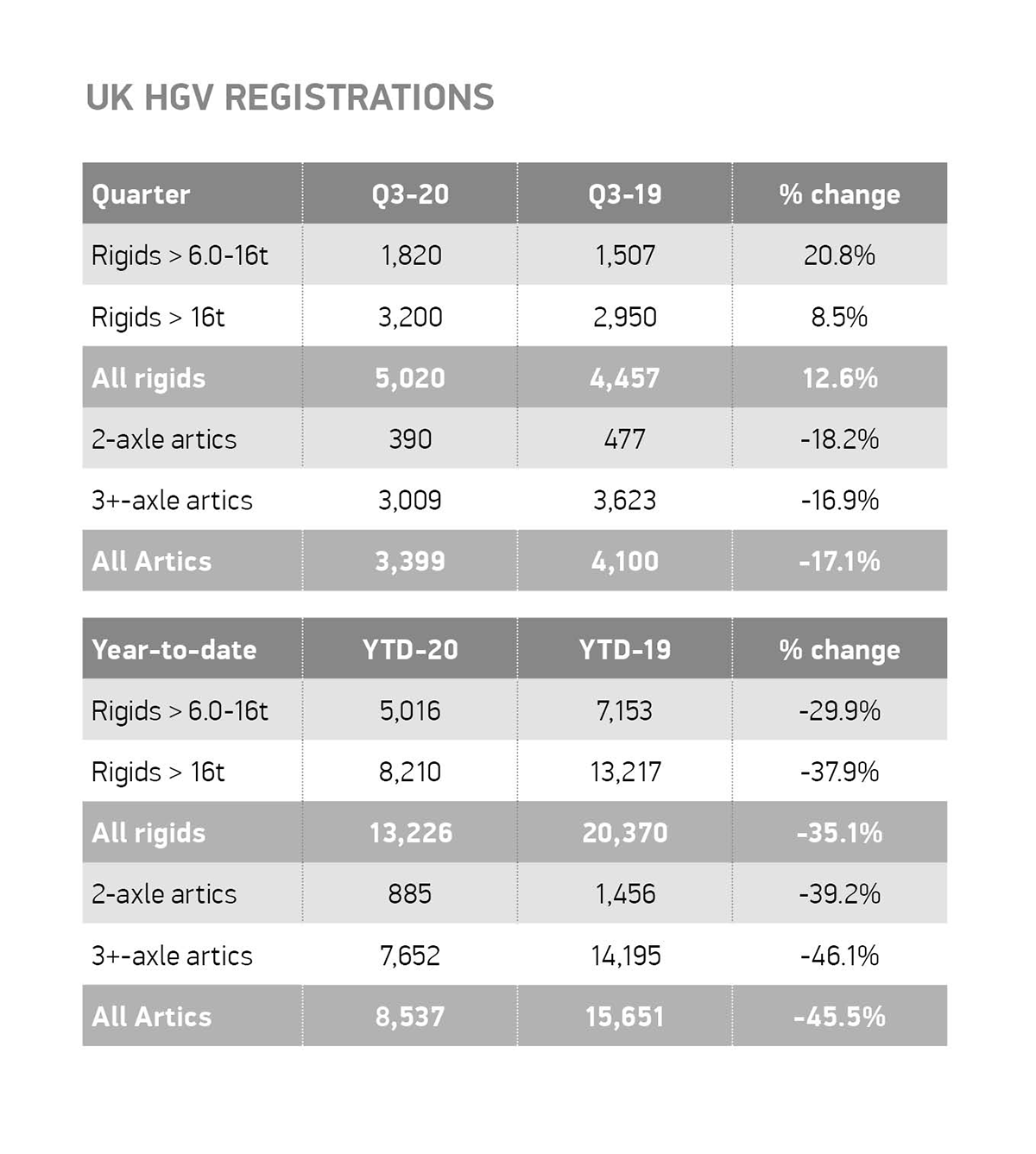

Articulated heavy truck demand fell by -17.1% in the quarter, although this decline was entirely attributable to an -18.6% drop in tractor registrations, which accounted for more than a third (38.8%) of the HGV market. Meanwhile, it was a brighter three months for rigid trucks, with the >6-16T and >16T segments growing by 20.8% and 8.5% respectively, leading to a 12.6% overall increase for the segment.

In the year to date, however, the overall market remains -39.6% down on the same period in 2019, equivalent to a loss of 14,258 units year on year.

Mike Hawes, SMMT Chief Executive, said,

“While Q3 saw some stability return to the HGV market, this may well be short-lived amid fresh autumn lockdowns across Wales and England. These lockdowns should serve as a reminder of the critical role the industry plays in keeping the country’s shelves stocked with vital supplies, and the need to provide operators with business certainty and confidence. As the end of 2020 approaches, this will mean a redoubling of efforts to secure a zero-tariff trade deal with EU, as well as promoting fleet renewal to help drive a green recovery for the sector, and the UK.”

Notes to Editors

- Q3 2019 – 8,557, down -13.1% on 2018

File Downloads

- Q3 2020

Q3 2020

| Title | Description | Version | Size | Download |

|---|---|---|---|---|

| UK HGV registrations Q3 2020 and % change | 55.62 KB | DownloadPreview | ||

| Top 5 HGV body types chart | 77.75 KB | DownloadPreview | ||

| SMMT quarterly HGVs Q3 2020-01 | 274.46 KB | DownloadPreview | ||

| SMMT HGV registrations_Q3 2020 | 899.25 KB | Download | ||

| Q3HGV 2020 MH quote | 448.07 KB | DownloadPreview | ||

| Q3 2020 YTD BY WEIGHT chart | 76.48 KB | DownloadPreview | ||

| Q3 2020 UK HGV registrations table | 297.07 KB | DownloadPreview | ||

| Q3 2020 UK HGV registrations 6T quarterly totals – Q4 2018 to date chart | 120.71 KB | DownloadPreview | ||

| New HGV registration figures by nation for Q3 2020 table | 102.79 KB | DownloadPreview | ||

| 2020 Top 5 HGV body types table | 65.34 KB | DownloadPreview | ||

| 7_HCV_PRESS_RELEASE Q3 2020 | 18.71 KB | Download |

Comments are closed.