Q3 2024 New HGV Registrations

Q3 2024 New HGV Registrations

HGV market slows down as demand normalises following bumper year

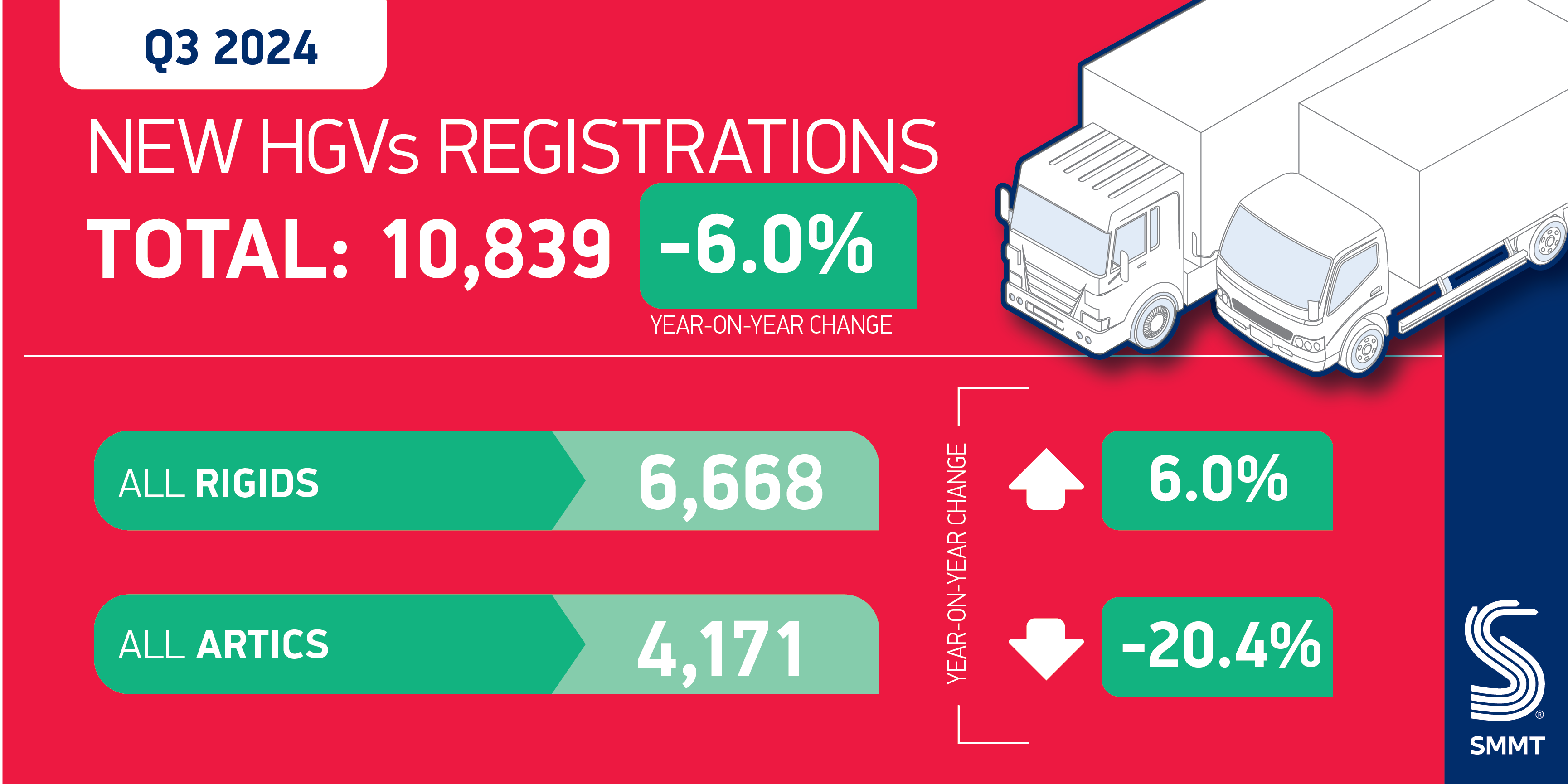

- Heavy goods vehicle market falls by -6.0% in quarter compared with last year’s significant uptake.

- Decline driven by fall in demand for largest trucks, but overall uptake still above pre-pandemic levels.

- Zero emission truck market shrinks for first quarter this year, but share of overall market holds steady for year to date.

Thursday 14 November, 2024

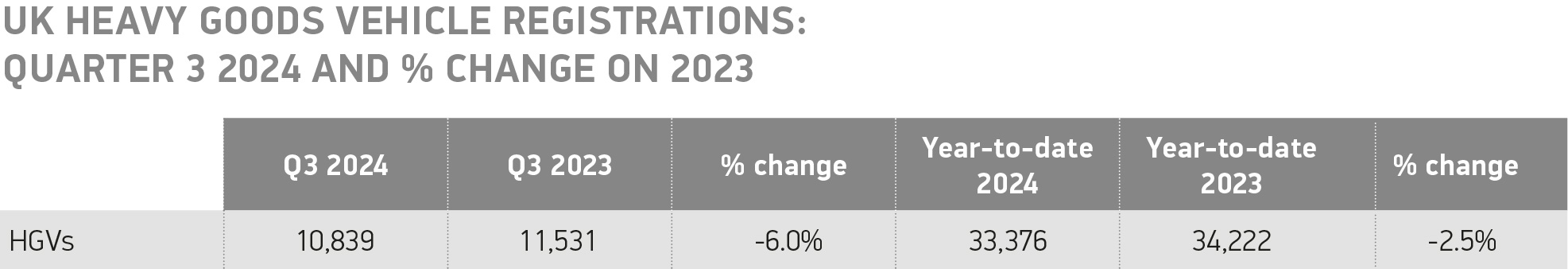

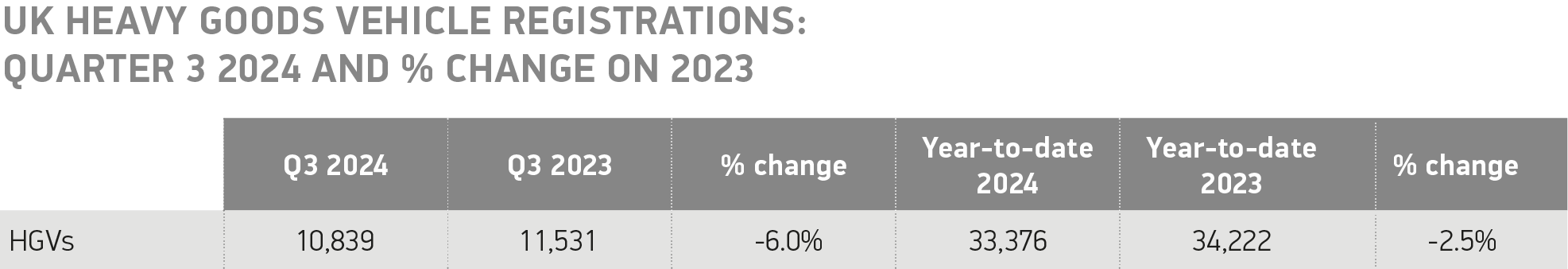

New heavy goods vehicle (HGV) registrations fell by -6.0% in the third quarter, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). The decline was in comparison with Q3 last year, when uptake surged above pre-pandemic levels to fulfil pent-up demand. Demand in Q3 2024 remained robust, at 26.7% above the same quarter in 2019.1

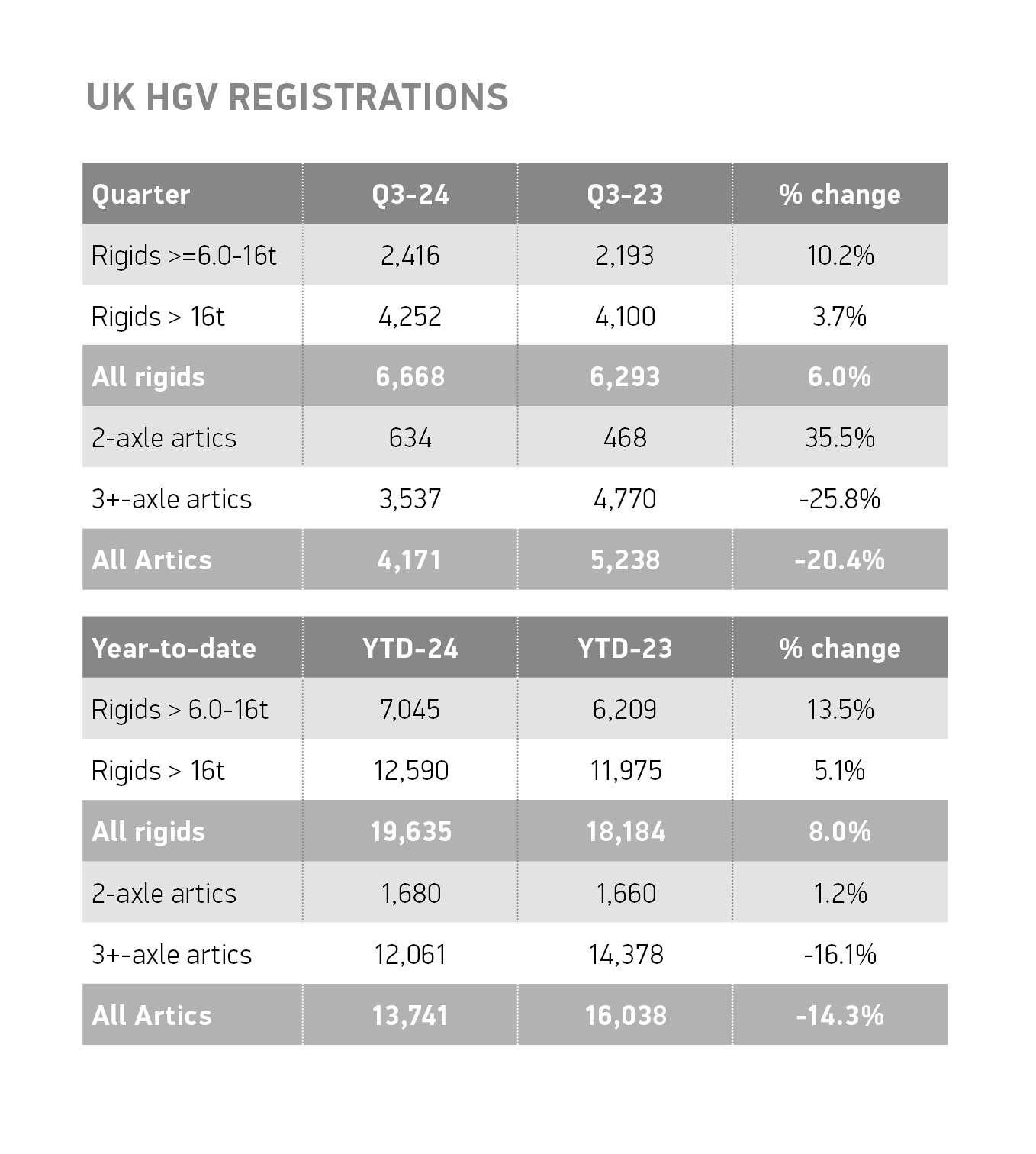

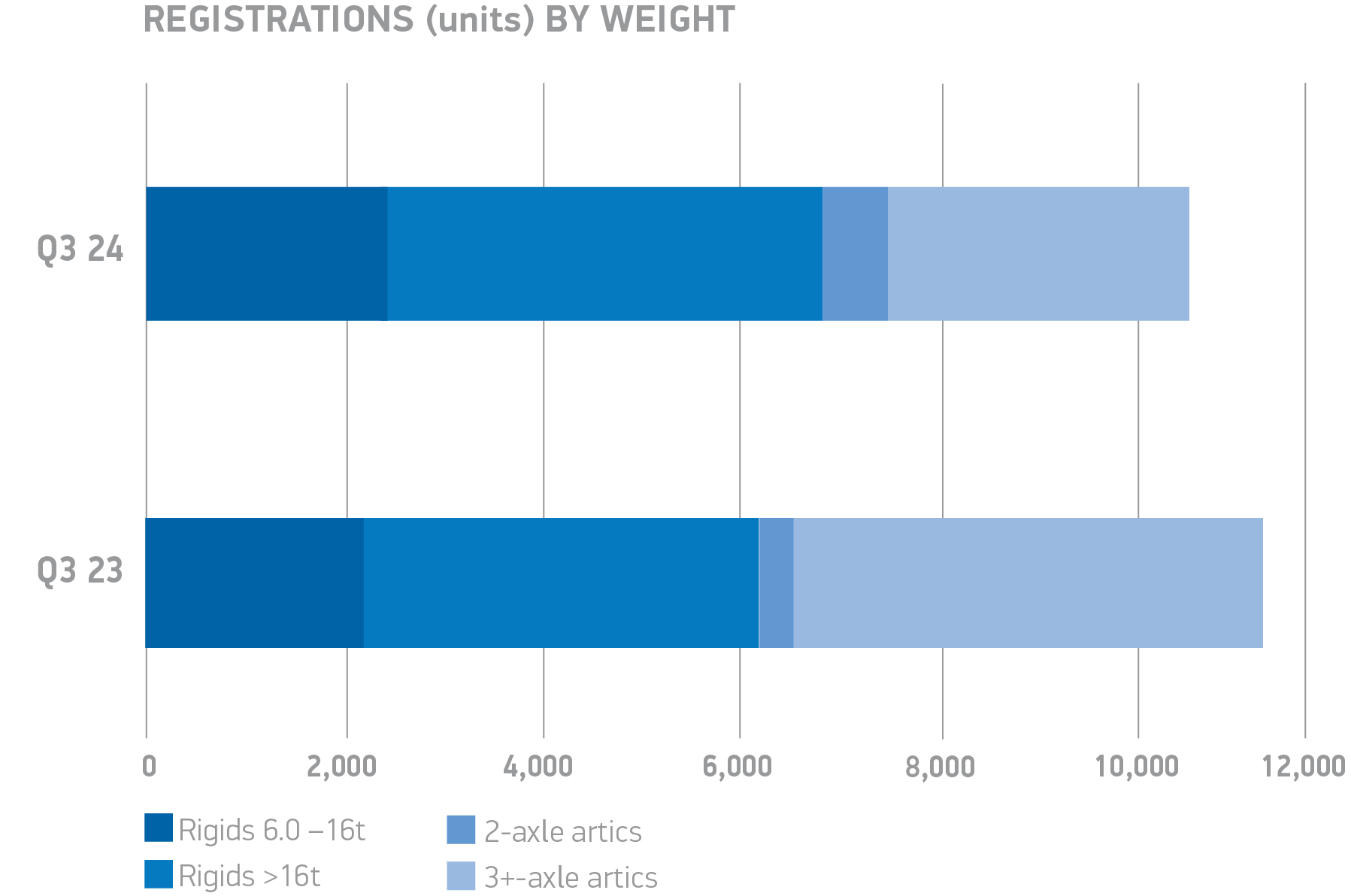

Between July and September, 10,839 new HGVs joined fleets across the country, with growth recorded in rigids, rising 6.0% to reach 6,668 units to achieve a 61.5% market share. Conversely, artic volumes continued to decline, down -20.4% to 4,171 units.

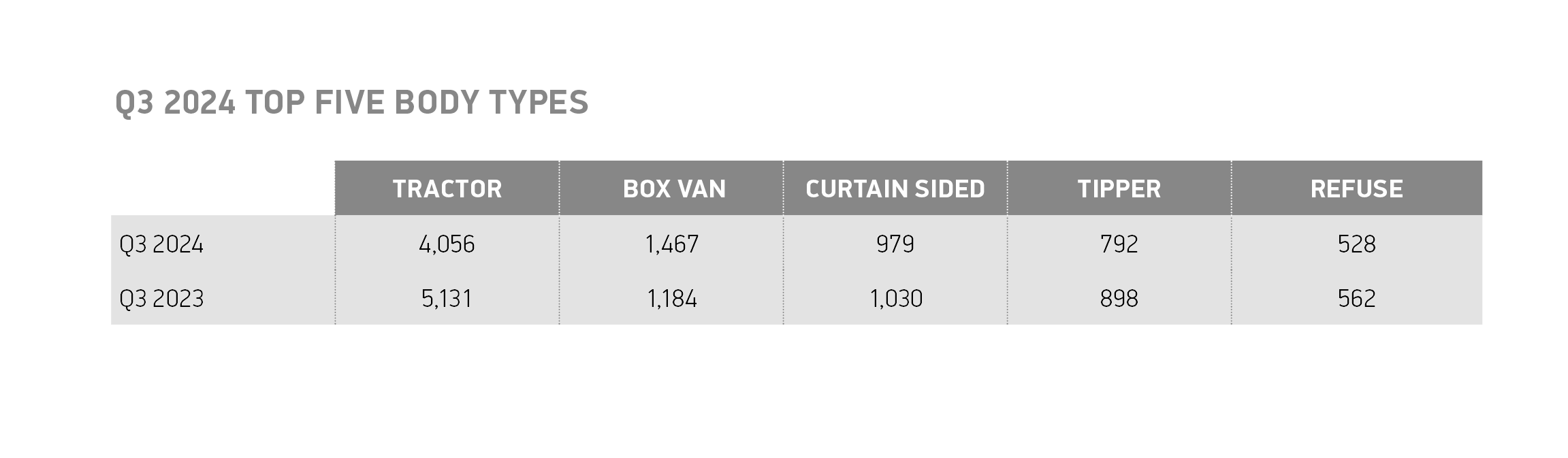

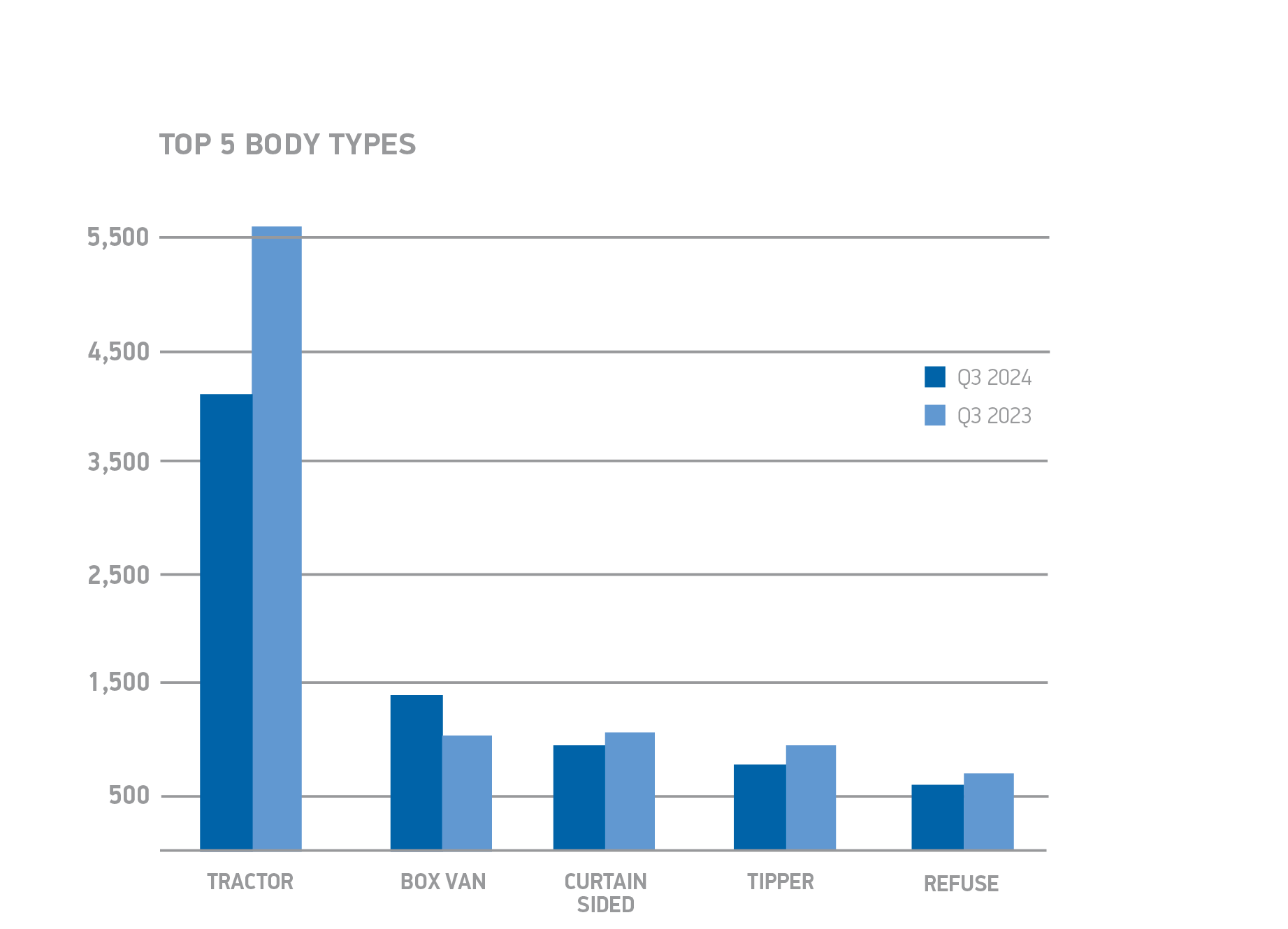

Of the top five body types, box vans were the only one to see volumes increase, up by 23.9%. Tractor units, curtainsiders, tippers and refuse vehicles all recorded declines, down -21.0%, -5.0%, -11.8% and -6.0% respectively. As a result, the overall market year-to-date is down slightly, by -2.5%, but this is compared with last year’s flourishing market that grew 16.4% in the first nine months.

While the UK remains Europe’s second largest zero-emission truck market by volume2, uptake almost halved during Q3, down -47.5% to achieve a market share of 0.5%, down from 0.8% in Q3 last year. Operators continue to face significant barriers which prevent them from having the confidence to invest in ZEVs at a larger scale. Dedicated HGV public chargepoint provision remains severely limited, while uptake from an ever-increasing choice of ZEV trucks is also stymied by a grant system that involves a lengthy application process and covers less than half of all available models.

Year-to-date, the ZEV share of the HGV market remains unchanged from last year at 0.5% of the market – yet the end of sale date for non-ZEVs under 26 tonnes is the same as that currently for cars, where market share is almost 40 times higher (18.1%). A national infrastructure plan and reform to the grant, would help boost operator confidence and stimulate greater uptake – vital for fleet renewal and reducing road transport emissions today.

Mike Hawes, SMMT Chief Executive, said:

After last year’s surge in truck demand, one quarter of decline is not a cause for serious concern. Falling zero emission truck uptake, however, is another matter, showing the market is struggling to keep up with ambition. Reforming the Plug-in Truck Grant and more rapidly rolling out infrastructure would help encourage more operators to switch to zero emission vehicles sooner, instead of delaying their transition and decarbonisation.

Notes to editors

1 Q3 2019: 8,557 units

2 ACEA New commercial vehicle registrations Q1-Q3 2024. Germany is Europe’s largest market for vehicles >16t that are electrically chargeable, at 2,377 units

File Downloads

- Q3 2024

Q3 2024

Comments are closed.