September 2020 New Car Registrations

September 2020 New Car Registrations

- 5th October 2020

- 10:26 am

- Cars, Registrations

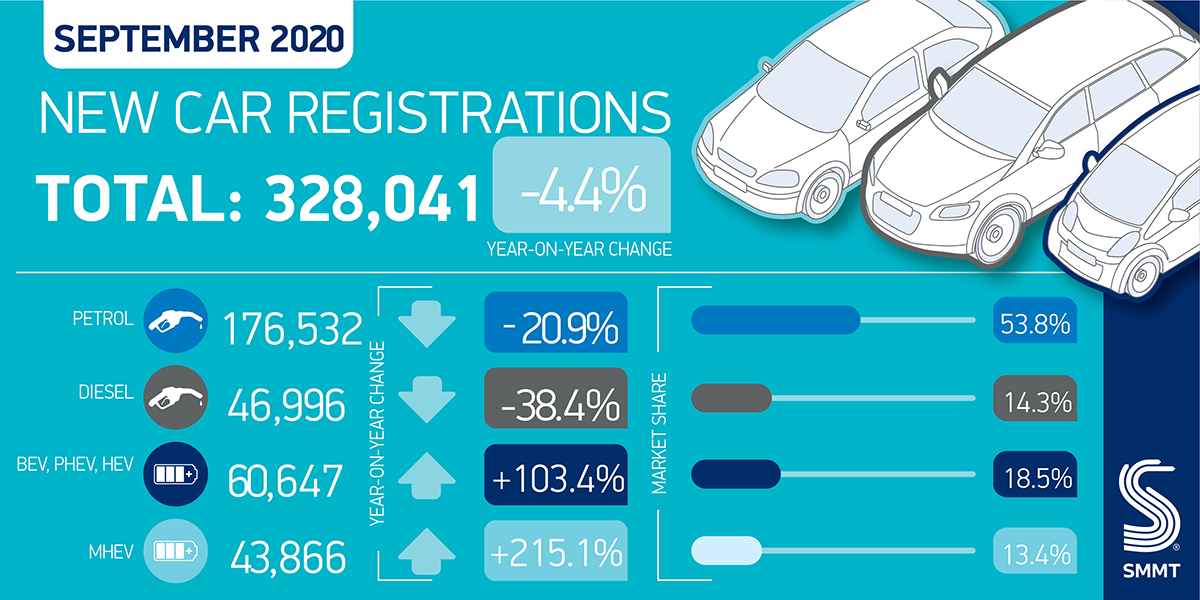

New car registrations drop -4.4% in weakest ever ‘new plate’ September

- Just 328,041 cars registered – the lowest September volume recorded since 1999.

- Decline represents -15.8% drop on 10-year September average.1

- New 70-plate, model upgrades and attractive offers help but industry still counting cost of lockdown with more than 615,000-unit year to date shortfall.

Monday 5 October, 2020

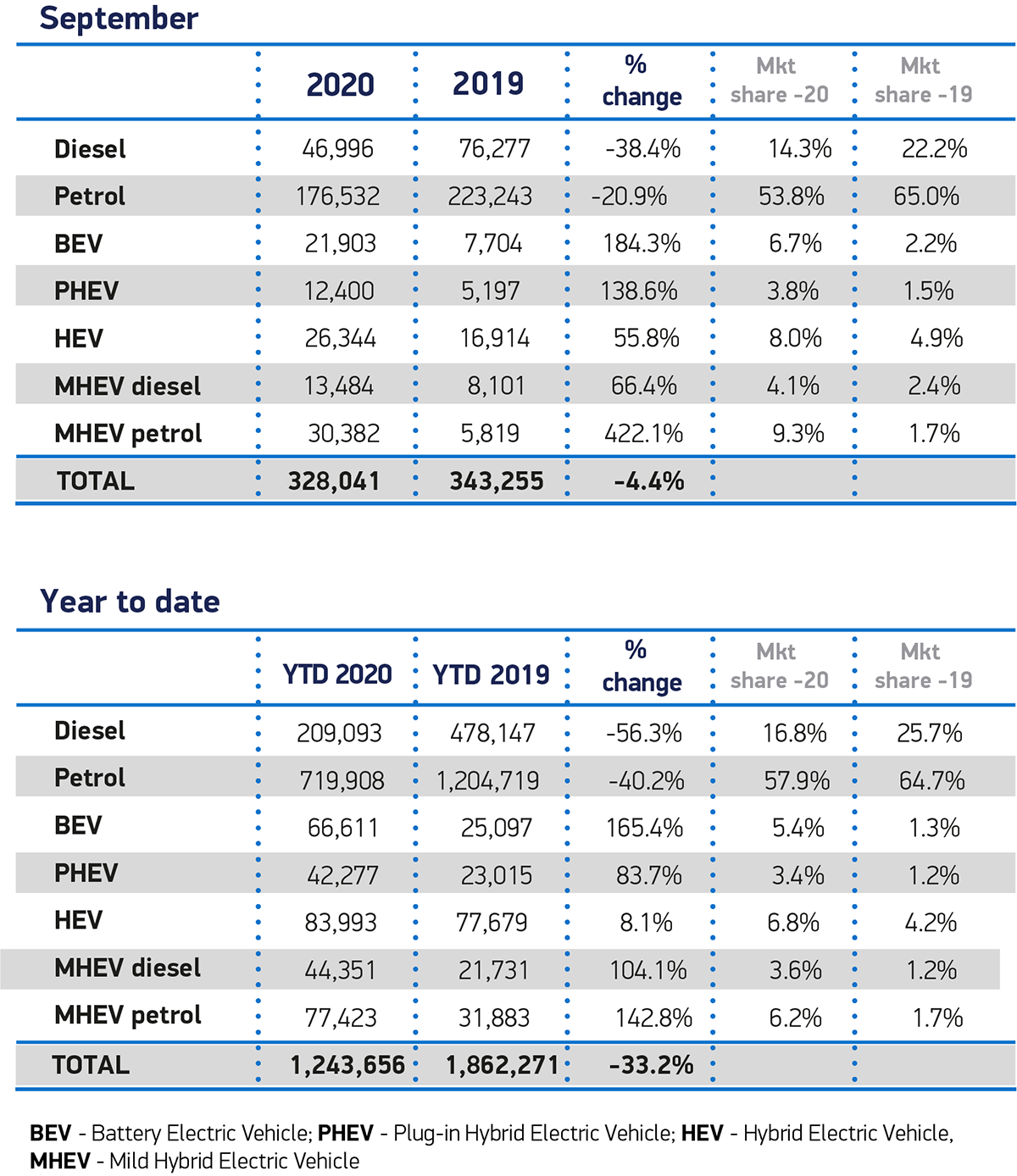

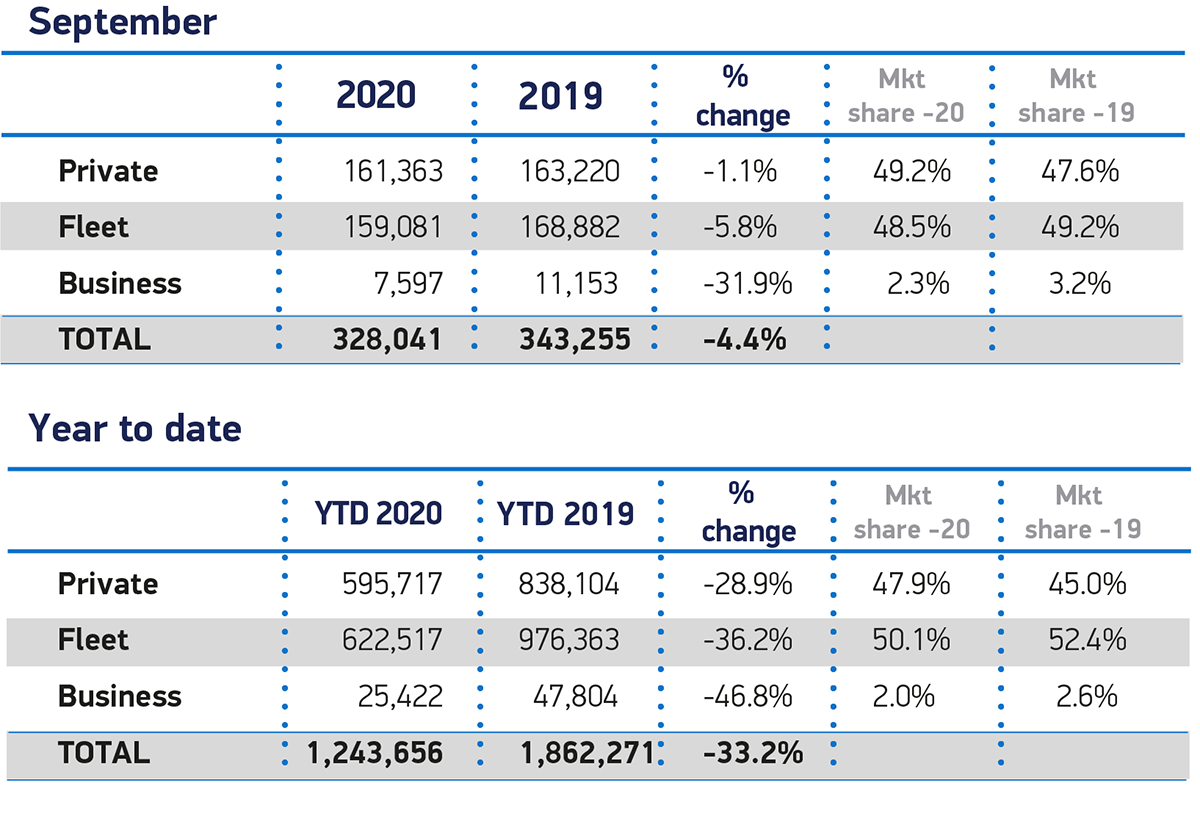

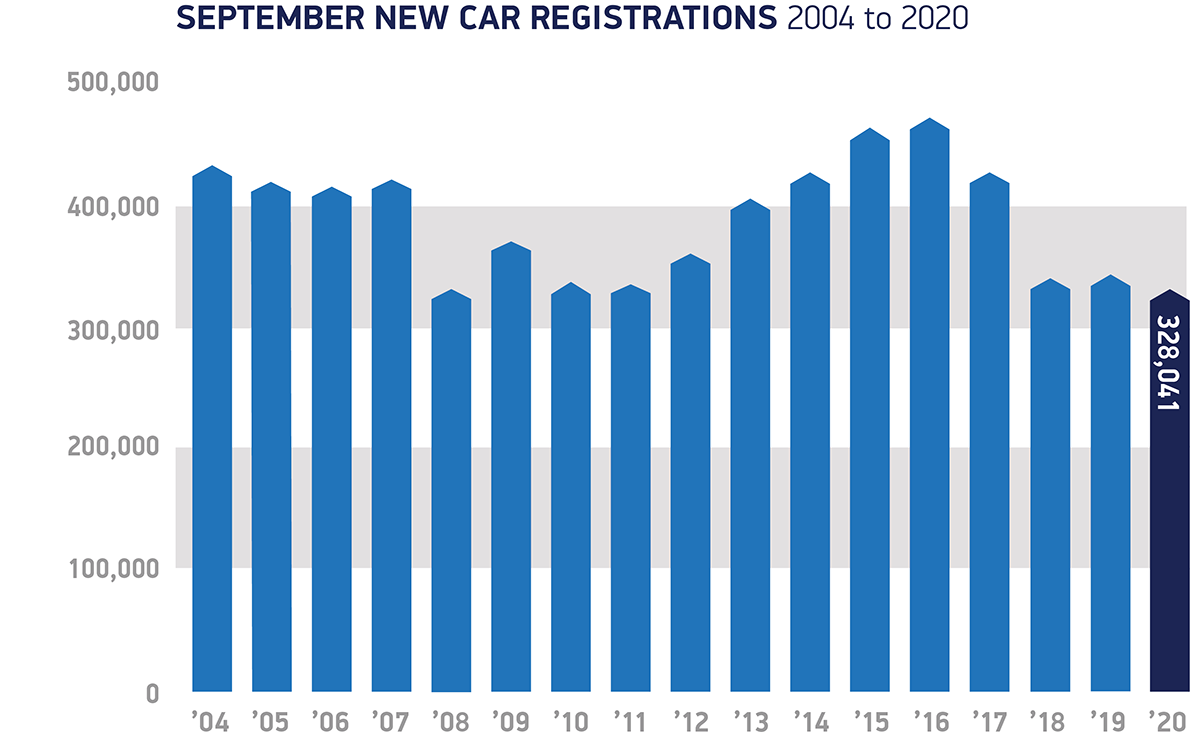

The UK new car market declined -4.4% in September, according to figures published today by the Society of Motor Manufacturers and Traders (SMMT). The sector recorded 328,041 new registrations in the month – the weakest September since the introduction of the dual number plate system in 1999 and some -15.8% lower than the 10-year average of around 390,000 units for the month.

The poor monthly performance follows very low volumes recorded in September 2018 and 2019, when regulatory changes surrounding the new WLTP emissions testing regime delayed vehicle certification and caused supply problems across Europe. Some brands hit by these factors previously saw substantial growth in September 2020, but total registrations still fell well short of previous years and follow an erratic period of market performance since emerging from lockdown.

Private registrations fell by -1.1% over the month. Demand from business was also muted, with around 10,000 fewer cars joining larger fleets, representing a -5.8% decline.

More encouragingly, battery electric and plug-in hybrid car uptake grew substantially to account for more than one in 10 registrations as new models continue to increase consumer choice. Demand for battery electric vehicles (BEVs) increased by 184.3% compared with September last year, with the month accounting for a third of all 2020’s BEV registrations. Even with this growth, however, meeting accelerated ambitions for uptake of these vehicles will require government to get behind a truly world-class package of incentives – alongside binding targets on infrastructure to reassure consumers that recharging will be as easy as re-filling.

The relaxation of COVID lockdown restrictions from June saw consumers return to showrooms and factories restart production lines, after one of the bleakest periods in the sector’s history. The market still faces continued pressure, however, with myriad challenges over the next quarter. Brexit uncertainty and the threat of tariffs still concerns the industry, while the shift towards zero emission-capable vehicles is demanding huge investment from the sector, and stalling fleet renewal across all technologies is hampering efforts to meet climate change and air quality targets now.

Additionally, consumer and business confidence is threatened by the forthcoming end of the Government’s furlough scheme, an expected rise in unemployment and continuing restrictions on society as a result of the pandemic. With little realistic prospect of recovering the 615,000 registrations lost so far in 2020, the sector now expects an overall -30.6% market decline by the end of the year, equivalent to some £21.2 billion2 in lost sales.

Mike Hawes, SMMT Chief Executive, said,

During a torrid year, the automotive industry has demonstrated incredible resilience, but this is not a recovery. Despite the boost of a new registration plate, new model introductions and attractive offers, this is still the poorest September since the two-plate system was introduced in 1999. Unless the pandemic is controlled and economy-wide consumer and business confidence rebuilt, the short-term future looks very challenging indeed.

Notes to editors

1Based on average September registrations 2010-2019 of 389,680

2Based on an expected shortfall of c708,000 units at an average cost from JATO of c£30,000 per vehicle

File Downloads

- September 2020

September 2020

| Title | Description | Version | Size | Hits | Date added | Download |

|---|---|---|---|---|---|---|

| SMMT August 2020 new car registrations | 813.11 KB | 428 | 07-10-2020 | Download | ||

| Cars_08_2020 | 141.00 KB | 406 | 07-10-2020 | DownloadPreview | ||

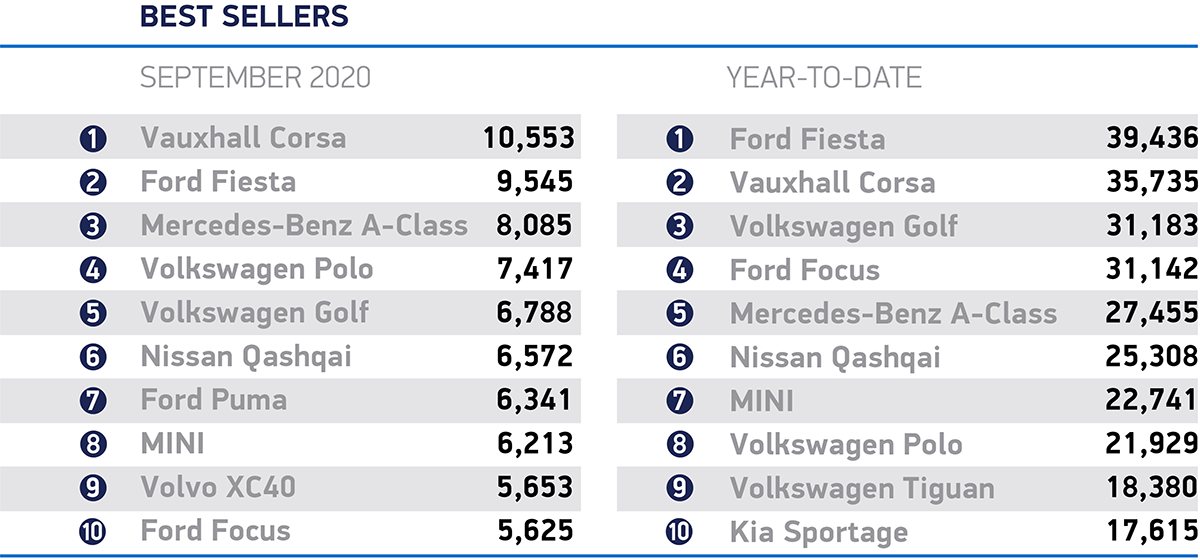

| Car regs best sellers Sept 2020 | 291.49 KB | 450 | 09-10-2020 | DownloadPreview | ||

| Car regs YTD by sales Sept 2020 | 407.60 KB | 448 | 09-10-2020 | DownloadPreview | ||

| Car regs YTD by fuel Sept 2020 | 677.81 KB | 521 | 09-10-2020 | DownloadPreview | ||

| Car regs 2004 to 2020 Sept 2020 | 888.15 KB | 423 | 09-10-2020 | DownloadPreview | ||

| August registrations 2004 to 2020 | 97.70 KB | 411 | 07-10-2020 | DownloadPreview | ||

| August Car Registrations Sales 2020 and YTD cars | 219.18 KB | 447 | 07-10-2020 | DownloadPreview | ||

| August 2020 best sellers_cars | 212.32 KB | 409 | 07-10-2020 | DownloadPreview | ||

| August 2020 Car registrations summary | 286.46 KB | 416 | 07-10-2020 | DownloadPreview | ||

| August 2020 Car registrations Mike Hawes quote | 309.76 KB | 445 | 07-10-2020 | DownloadPreview | ||

| August 2020 Car registrations Fuel and YTD cars | 398.14 KB | 407 | 07-10-2020 | DownloadPreview |

Notes to Editors

About SMMT and the UK automotive industry

The Society of Motor Manufacturers and Traders (SMMT) is one of the largest and most influential trade associations in the UK. It supports the interests of the UK automotive industry at home and abroad, promoting a united position to government, stakeholders and the media.

The automotive industry is a vital part of the UK economy accounting for £82 billion turnover and £18.6 billion value added. With some 168,000 people employed directly in manufacturing and 823,000 across the wider automotive industry, it accounts for 13% of total UK export of goods and invests £3.75 billion each year in automotive R&D. More than 30 manufacturers build some 70 models of vehicle in the UK supported by 2,400 component providers and some of the world’s most skilled engineers.

More detail on UK automotive available in SMMT’s Motor Industry Facts 2019 publication at smmt.co.uk/facts20

Broadcasters

SMMT has an ISDN studio and access to expert spokespeople, case studies and regional representatives.

SMMT media contacts

- Paul Mauerhoff, 020 7344 9233, pmauerhoff@smmt.co.uk

- Daniel Zealander, 020 7344 1667, dzealander@smmt.co.uk

- Aleona Krechetova, 020 7344 9215, akrechetova@smmt.co.uk

- James Boley, 020 7344 9222, jboley@smmt.co.uk

- Emma Butcher, 020 7344 9263, ebutcher@smmt.co.uk

Comments are closed.