March 2020 UK Commercial Vehicle Manufacturing

March 2020 UK Commercial Vehicle Manufacturing

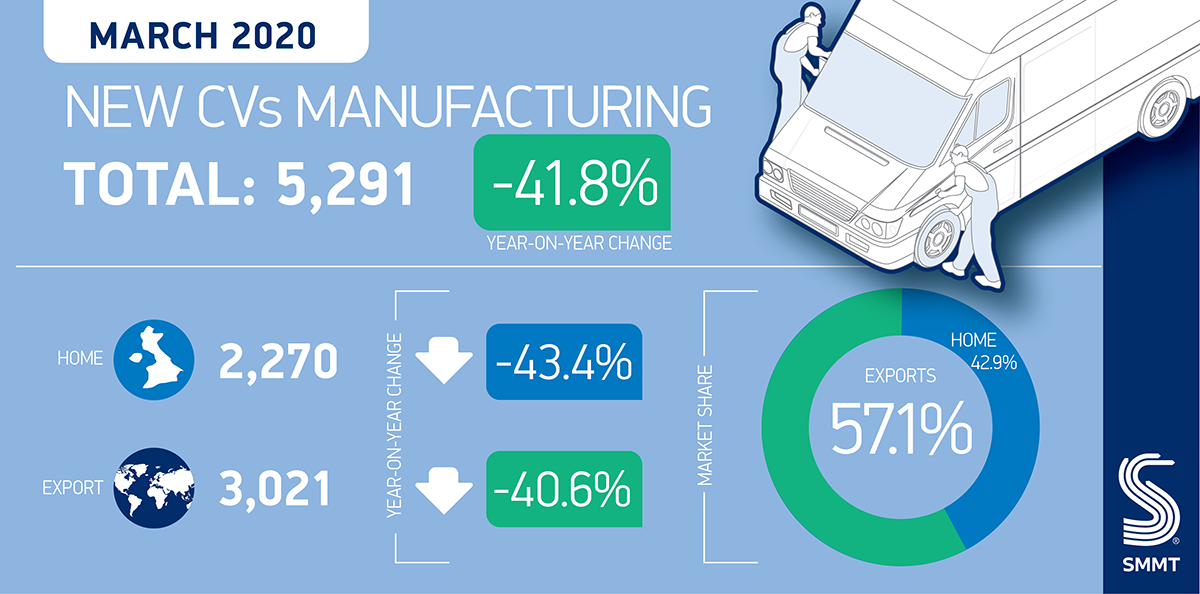

Commercial vehicle production down -41.8% as coronavirus takes toll on UK manufacturing

- British commercial vehicle output falls -41.8% in March, as coronavirus lockdown measures cause plant closures nationwide.1

- Production falls for both domestic and overseas markets, down -43.4% and -40.6% respectively.

- £82 billion auto manufacturing sector calls on government to support safe and sustainable restart to drive UK economic recovery.

Monday 30 April, 2020

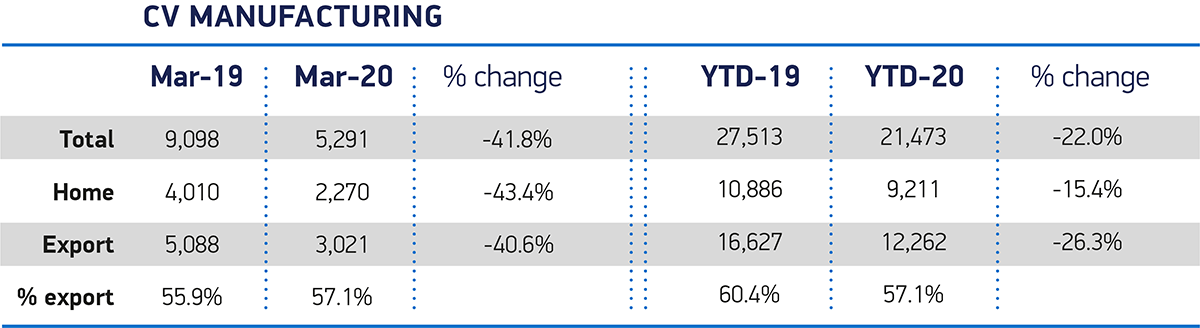

UK commercial vehicle (CV) production fell -41.8% in March, with 5,219 units leaving production lines, according to the latest figures released today by the Society of Motor Manufacturers and Traders (SMMT). Some 3,807 fewer vans, trucks, taxis and buses left factory gates than in the same month last year, as nationwide coronavirus lockdown measures forced plants to close partway through the month.

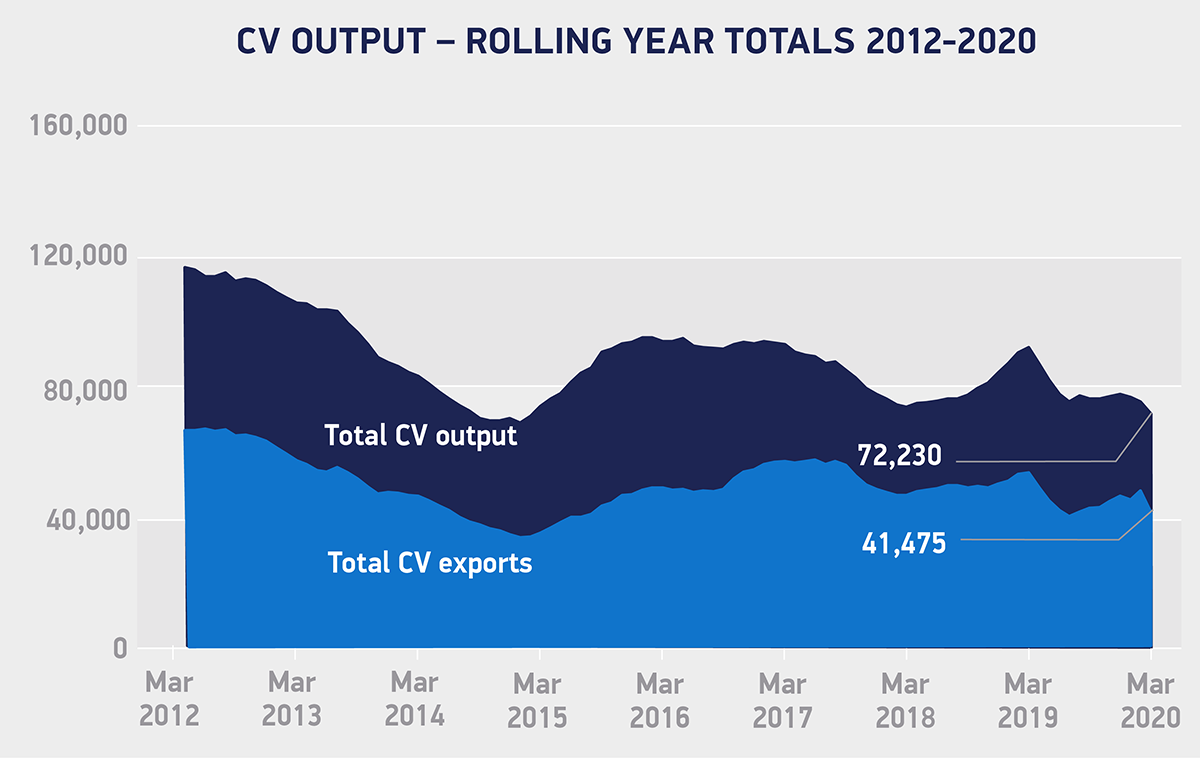

Output for the domestic market fell -43.4%, while production for export declined -40.6% as the pandemic caused business closures and dented confidence around the world. The EU, the UK’s biggest trading partner for commercial vehicles, saw a drop in exports of -43.3%, with 2,762 units shipped to Europe. Year-to-date commercial vehicle production has now fallen -22.0% with 21,473 units manufactured in the first quarter, some 6,000 fewer than in Q1 2019.

The news comes as SMMT publishes the results of a survey looking at the impact of Covid-19 on UK businesses across the automotive sector. 42.1% of all commercial vehicle manufacturers that responded believe a full recovery from the coronavirus crisis will take them at least 12 months with a third (36.8%) expecting a loss in revenue of 30% or more by the end of 2020.

However, government schemes such as the Coronavirus Job Retention Scheme (CJRS) have offered a vital lifeline to many businesses, protecting thousands of jobs, with 57.7% of permanent staff in the CV manufacturing sector on furlough and able to return to work when the time comes.

Mike Hawes, SMMT Chief Executive, said,

The foundations of UK commercial vehicle production are strong, but manufacturers have been hit hard by the pandemic and factory shutdowns are costing the sector and economy billions. While many businesses have stayed open to ensure continued production of parts so that essential vehicles can stay on the roads to support nationwide response, we need to get all production lines rolling and delivering for the economy again. This means implementing a package of measures that supports the entire automotive industry, from retail through supply chains to vehicle manufacture. This should be seen as long-term investment into the underlying competitiveness of a sector critical to the health of the UK economy and the livelihoods of thousands of households right across the UK.

The wider CV sector has been crucial to the delivery of essential goods and services during the pandemic, but a successful restart of vehicle production will require a clear plan and close coordination and cooperation between government and industry built on four pillars. These include re-opening automotive retail and stimulating demand, a ramping up of safe and sustainable production, securing and supporting resilient supply chains and ensuring a supportive regulatory framework is in place. Particularly crucial for the CV sector is guidance on what a safe restart would look like for manufacturers, and a plan for a whole sector restart to restore operator confidence so that they can continue to invest in the latest, most efficient and cleanest technology for their fleets.

Notes to editors

1. Due to coronavirus-related shutdowns, production figures for March incorporate estimates for a very small proportion of plants where final data is not yet available. Estimates calculated using historical data, known production run-rates and shut-down dates in March. Figures will be revised if necessary and published in the April data set, issued on 29 May.

2. SMMT survey issued online 20 April across the automotive sector, CV respondents highlighted

File Downloads

- March 2020

March 2020

| Title | Description | Version | Size | Hits | Date added | Download |

|---|---|---|---|---|---|---|

| UK CV production Mar 2020 | 96.84 KB | 396 | 21-10-2020 | DownloadPreview | ||

| UK CV production Mar 2020 | 51.34 KB | 387 | 21-10-2020 | DownloadPreview | ||

| SMMT_UK CV manufacturing data for March 2020 | 219.62 KB | 347 | 21-10-2020 | Download | ||

| SMMT Twitter graphic CVs Manufacturing | 262.29 KB | 406 | 21-10-2020 | DownloadPreview | ||

| CV output rolling year totals March 2012-2020 | 137.86 KB | 392 | 21-10-2020 | DownloadPreview | ||

| CV output rolling year totals March 2012-2020 | 64.35 KB | 396 | 21-10-2020 | DownloadPreview |

Comments are closed.