Drive home Brexit deal for Christmas or risk £55bn manufacturing hit

Drive home Brexit deal for Christmas or risk £55bn manufacturing hit

24th November 2020

Drive home Brexit deal for Christmas or risk £55bn manufacturing hit, warns UK auto sector

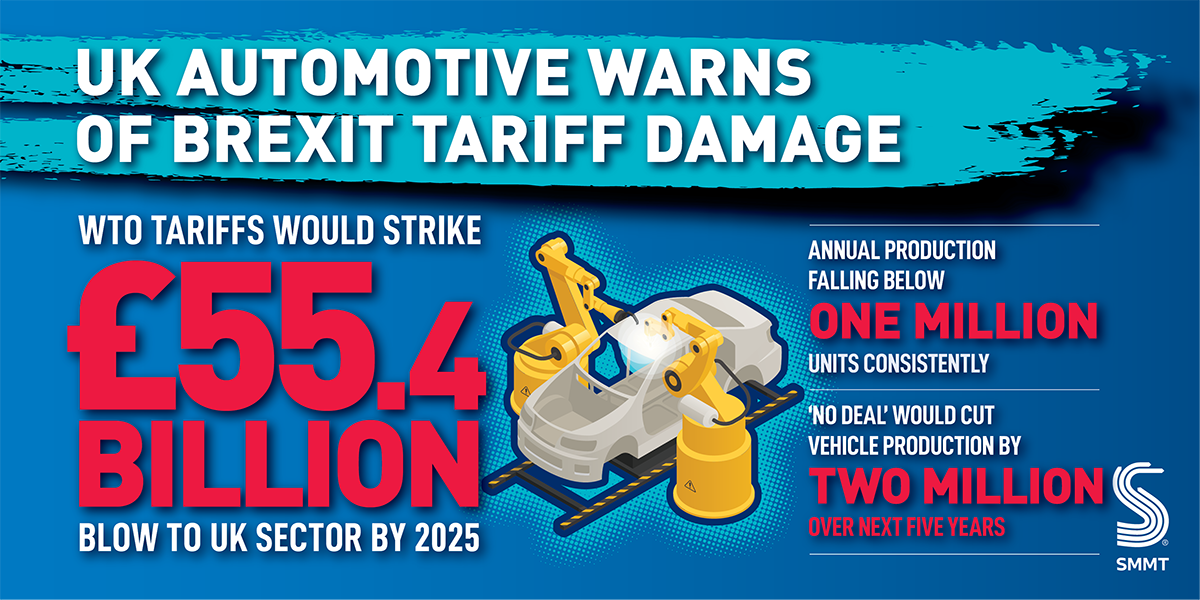

- UK Automotive warns of Brexit tariff damage as new figures reveal ‘no deal’ would cut vehicle production by two million over next five years.

- WTO tariffs would strike £55.4bn blow to UK sector by 2025 with annual production falling below one million units consistently.

- Brexit deal must work for automotive to sustain competitiveness, help drive green recovery and jobs and keep the UK at forefront of global decarbonisation agenda.

- UK sector comes together at special online event as SMMT calls on government to keep car showrooms open, agree a Brexit deal and ‘build back together’ after coronavirus crisis.

Tuesday 24 November, 2020

As Brexit talks enter the final stretch, the Society of Motor Manufacturers and Traders (SMMT) today made a last call for negotiators on both sides to keep the health of automotive at the heart of discussions and stretch every sinew to get a deal in place by Christmas that avoids tariffs, or risk damaging one of Europe’s most valuable manufacturing industries.The entire European sector, including the UK, has already lost €100 billion to the pandemic and has repeatedly called on EU and UK leaders to ensure the sector will not face further damage from the imposition of tariffs from 1 January 2021, which would deliver another €110 billion blow to manufacturers on both sides of the Channel.1

For the UK industry alone, new figures reveal that production losses could cost as much as £55.4 billion over the next five years if the sector was forced to trade on WTO conditions long-term.2 Even with a so-called ‘bare-bones’ trade deal agreed, the cost to industry would be some £14.1 billion,2 reinforcing how, for the automotive sector, Brexit has always been an exercise in damage limitation. With scant time left for businesses to prepare for new trading terms, the sooner a deal is done and detail communicated, the less harmful it will be for the sector and its workers.

Addressing an audience of industry executives, politicians and global media at SMMT 2020 Update Live, an online event held on the day the 104th SMMT Annual Dinner would have taken place, SMMT President and Executive Chairman HORIBA MIRA Dr George Gillespie OBE, said,

“We need a future trading relationship that works for automotive. We’ve already spent nigh on a billion pounds preparing for the unknown of Brexit and lost twenty-eight times that to Covid.3 Let us not also be left counting the cost of tariffs, especially not by accident.”As well as affecting livelihoods in all regions of the country, ‘no deal’ would have a severe impact on the sector’s ability to develop and manufacture the next generation of zero emission cars and vans, as well as holding back market uptake of these vehicles at a critical time with a new ICE end of sale date just nine years away.

“Industry can deliver the jobs growth we need and help rebuild a devasted economy, but government must work with us to create the environment for this success. That starts with a favourable Brexit deal and a bold strategy to help transform automotive production in the UK, attract new investment, upskill our workforce and build world-leading battery capability to future-proof our manufacturing. When Covid lifts, we need to be ready; ready to support government to engineer an economic – and green – recovery.”

Mike Hawes, SMMT Chief Executive, said,

“The government’s plan for a green industrial revolution is an immense challenge – for automotive, the energy sector, consumers and for government itself. We are already on the way, transforming an industry built on the combustion engine to one built on electrification. But to complete the job in under a decade is no easy task. And with showrooms closed, choking factories of orders, the ability of the sector to invest further is severely constrained. Automotive is nothing if not determined, adaptable and resilient, yet, as the clock ticks ever closer to midnight on Brexit negotiations, the competitiveness and employment we need get back to growth – green growth – hangs in the balance.”WTO tariffs would add an average £2,000 to the cost of British-built electric cars sold in the EU, making UK plants considerably less competitive and undermining Britain’s attractiveness as a destination for inward investment, at the precise moment when building domestic battery manufacturing capability via ‘gigafactories’ and an electrified supply chain is essential. Meanwhile, these tariffs would mean a £2,800 hike per EU-built vehicle for UK consumers,4 all but cancelling out the current £3,000 plug-in car grant.

UK Automotive is one of the country’s most valuable economic assets, supporting some 180,000 often high-skilled and high-paid manufacturing jobs in communities across every nation and region of the UK, including those regions hit hardest by the economic impact of the pandemic. The sector is worth some £78.9 billion, exporting more goods than any other UK industry and providing an annual £15.3 billion in added value every year to the UK economy, while investing £3.72 billion in R&D.5

Notes to editors

1:Only weeks left to save EU and UK auto sectors from €110 billion ‘no deal’ Brexit disaster, 14 September 2020: SMMT calculations covering cars and LCVs. Tariffs’ impact on prices resulting in -18.9% drop in demand.

2: Independent AutoAnalysis Production Outlook Report November 2020. AutoAnalysis now expects car and van output to fall by more than two million units between 2021-2025 in a WTO scenario with tariffs, compared to a deal with zero tariffs and quotas, which means a loss in value (factory gate prices) of £55.4bn over the five years and £14.1bn with a bare bones deal.

3 UK Auto counts £735 million cost of Brexit preparation, 10 November 2020: Figures derived from SMMT member survey conducted 2019; £500 million and 2020; £235 million. 2020 survey conducted online and via telephone 26 October to 6 November with responses from companies across the sector.

4: ‘No deal’ tariffs would undermine Britain’s green recovery with £2,800 drain on electric car affordability, warns SMMT, 22 October 2020: Based on WTO tariff of 10% applied to a JATO average new BEV car price of £43,920.

5: SMMT Motor Industry Facts 2020

File Downloads

Download all

- Brexit cost to manufacturing

Brexit cost to manufacturing

| Title | Description | Version | Size | Download |

|---|---|---|---|---|

| SMMT No Deal Brexit Tariff Damage | 549.53 KB | DownloadPreview | ||

| Drive home Brexit deal for Christmas or risk �55bn manufacturing hit, warns UK auto sector | 101.76 KB | Download |

Supporting & promoting the UK automotive industry

Comments are closed.