March 2023 UK Commercial Vehicle Manufacturing

March 2023 UK Commercial Vehicle Manufacturing

CV manufacturing up in Q1 despite March fall

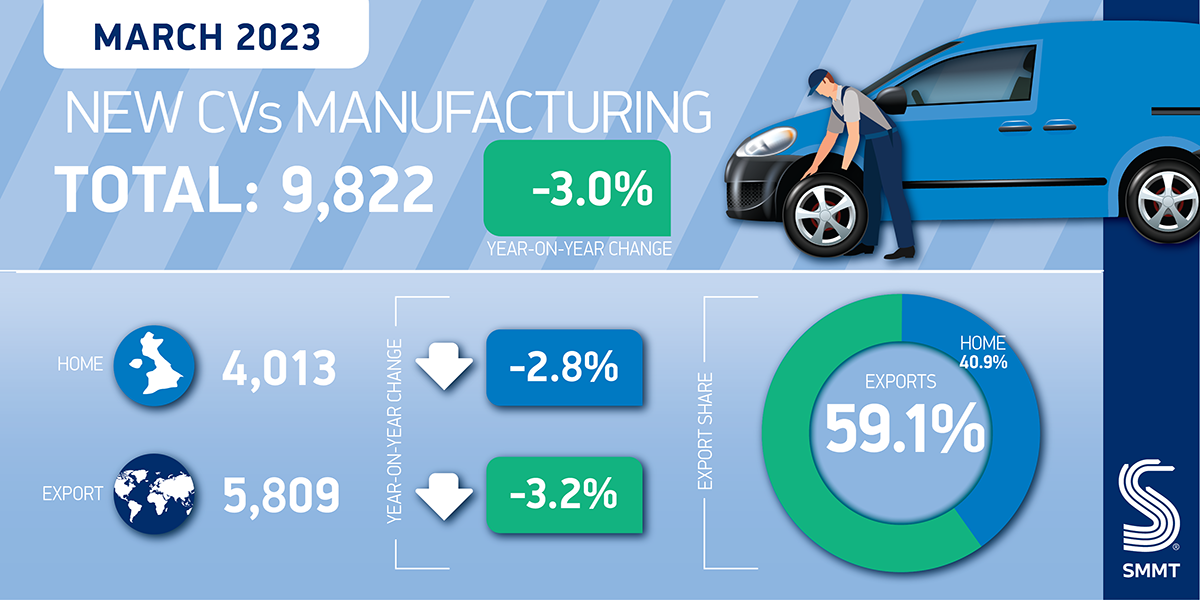

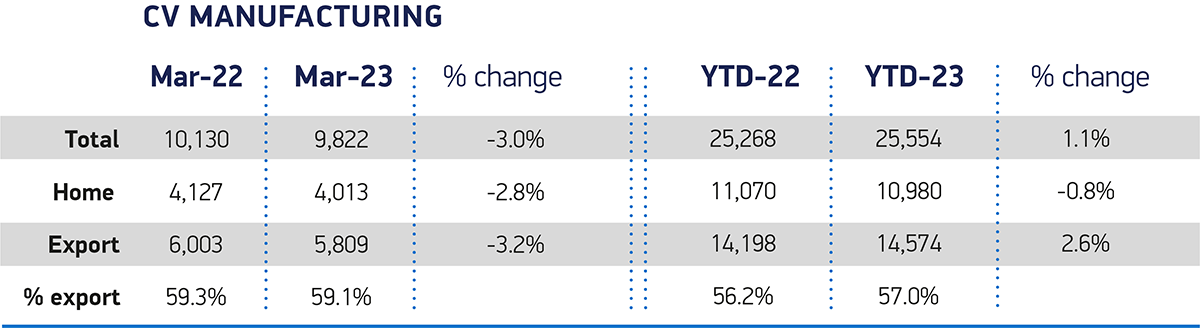

- CV production falls -3.0% to 9,822 units in March, marking a second consecutive monthly decline.

- Both home and export volumes down in the month, falling -2.8% and -3.2% respectively.

- Output rises 1.1% in the year to date due to strong January performance and overseas focus.

Friday 28 April, 2023

UK commercial vehicle (CV) manufacturing output decreased by -3.0% in March, with 9,822 vans, trucks, taxis, buses and coaches produced, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). The decline of just 308 units must be set against March 2022, which was the best March since 2011, and draws an uneven first quarter of the year to a close, with a large rise in January followed by declines in February and March as temporary supply shortages continued to affect output.

Vehicles produced for overseas markets declined in March, with exports decreasing by -3.2% to 5,809 units – with 92.8% heading for the EU.1 Output for the domestic market also fell, by -2.8% to 4,013 units. Production volumes are expected to increase in the coming months as new electric van manufacturing comes on stream and supply chain constraints ease.

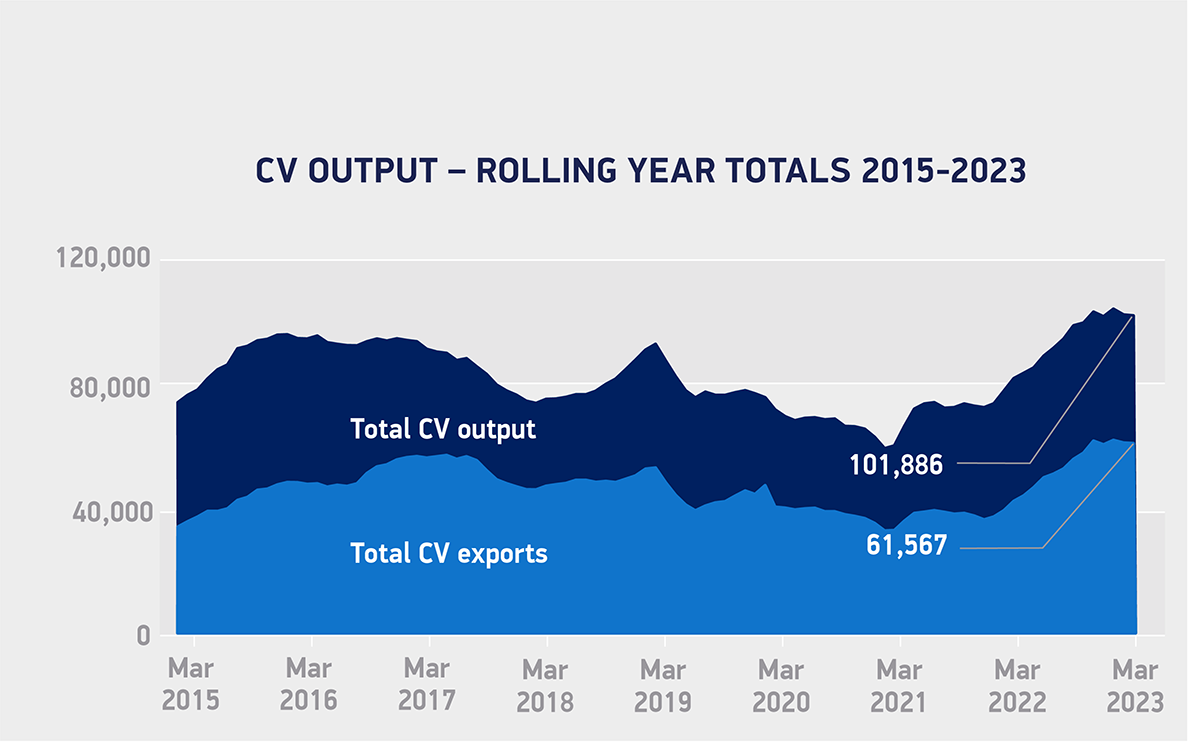

Even with the March fall, manufacturing output remains up 1.1% in the year to date, at 25,554 units, with the growth driven primarily by a strong January performance and overseas demand. Exports are up 2.6% in Q1 to 14,574 vehicles with 91.8% destined for EU customers, while production for the domestic market declined marginally by -0.8% to 10,980 units.

Mike Hawes, SMMT Chief Executive, said,

Despite some incidents of supply chain turbulence, UK commercial vehicle production kicked off 2023 in decent health and the overall trend is one of growth with volumes expected to rise as the year goes on. To secure long term success, however, given the once-in-a-generation challenges involved in transitioning to new, zero emission technologies, the sector must remain competitive. We therefore need government to introduce measures that stimulate fresh investment, with the UK’s high cost of energy the biggest barrier to competitiveness, and action to reform business rates essential.

Notes to editors

1 UK exports to the EU: 5,393 units

File Downloads

- March 2023

March 2023

| Title | Description | Version | Size | Download |

|---|---|---|---|---|

| UK new CV production Mar 2023 | 143.55 KB | DownloadPreview | ||

| UK new CV production Mar 2023 | 95.35 KB | DownloadPreview | ||

| SMMT UK CV manufacturing data March 2023 | 385.10 KB | Download | ||

| CV output rolling year totals Mar 2015-2023 | 179.79 KB | DownloadPreview | ||

| CV output rolling year totals Mar 2015-2023 | 136.92 KB | DownloadPreview | ||

| CV Manufacturing twitter graphic Mar 2023-01 | 279.44 KB | DownloadPreview |

Comments are closed.