Only ambitious Brexit deal will safeguard jobs and Britain’s green future

Only ambitious Brexit deal will safeguard jobs and Britain’s green future

Only ambitious Brexit deal will safeguard jobs and Britain’s green future

- Industry calls on next government to put sector at heart of economic and trade policies, and agree an ambitious Brexit deal to deliver on UK’s green growth ambitions.

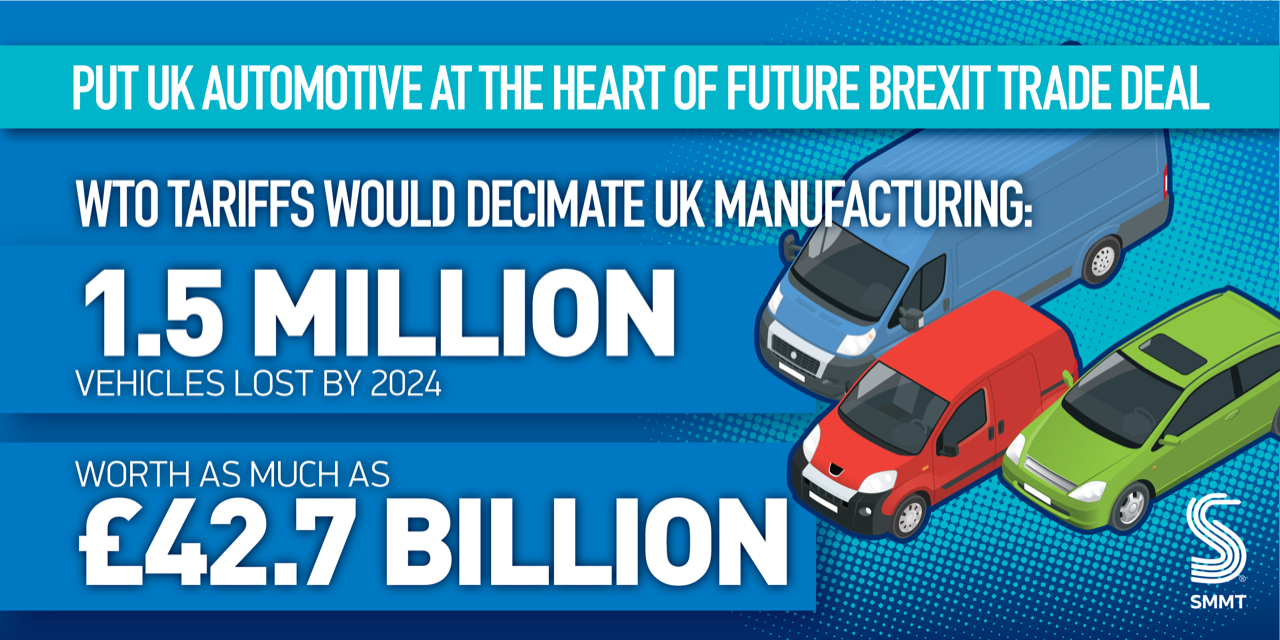

- New figures show tariffs would decimate UK manufacturing, with 1.5 million vehicles lost by 2024 at a cost of £42.7 billion.

- UK Automotive can lead in global green mobility revolution but needs collaboration to drive progress, prosperity and jobs.

- Industry launches ’key priorities for a new government’ at 103rd Annual Dinner to secure sector’s future success and competitiveness. 1

Tuesday 26 November, 2019

The Society of Motor Manufacturers and Traders (SMMT) has this evening urged all parties to put UK Automotive at the heart of their economic and trade policies. Setting out the industry’s priorities for a new government, the trade body called for an ambitious, world-beating Brexit trade deal to maintain the sector’s competitiveness and ability to deliver innovation, productivity and prosperity for Britain.

Speaking at the 103rd SMMT Annual Dinner in London, SMMT President George Gillespie outlined the industry’s vision for a better, safer and cleaner future, saying,

The automotive sector is going through a period of unprecedented change and we must not let the pressure of Brexit deflect from our focus on a coherent national industrial strategy. Collaboration between industry and government must be stronger than ever… We want to work closely with the next government, as we have in the past; united in a common purpose to keep UK Automotive a global player that drives employment, creates wealth and gives all of us pride in what we can do here.

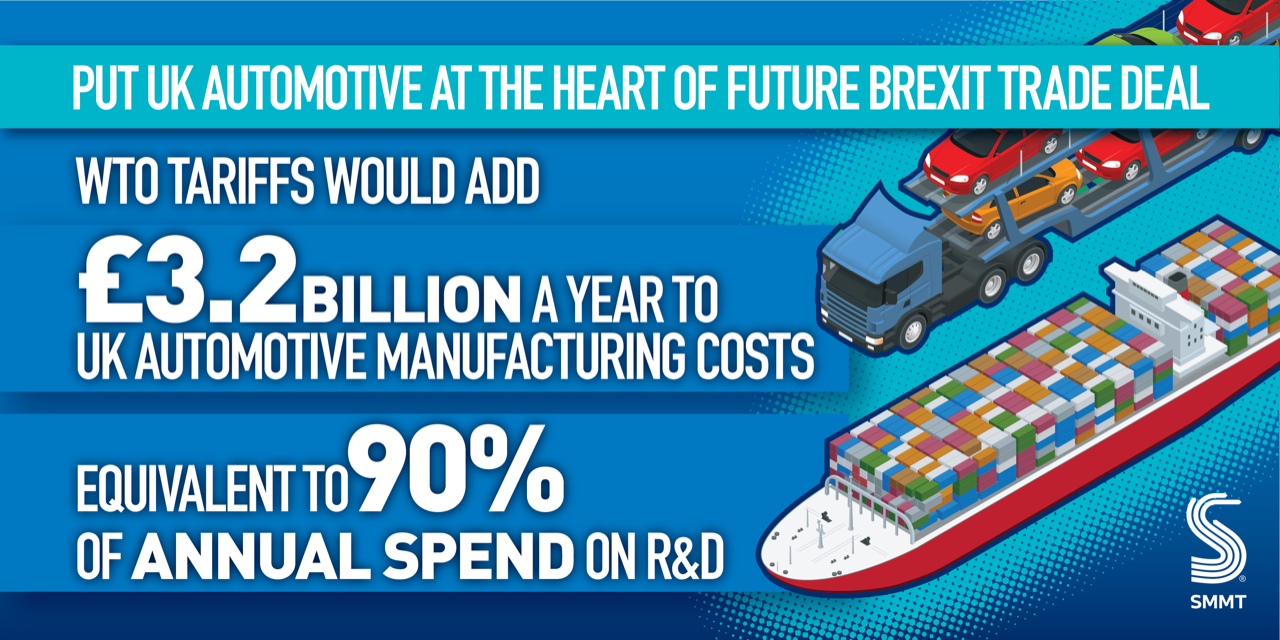

He spoke as SMMT revealed new figures showing the devastating impact of Brexit without an ambitious trade deal. Independent research commissioned by the trade body shows WTO tariffs on imported components and exported vehicles would add more than £3.2 billion a year to UK automotive manufacturing costs.2 Such a colossal increase – equivalent to almost 90% of the sector’s annual spend on R&D – could not be absorbed, forcing prices to rise and global demand to shrink. At a time when additional investment in ever safer, cleaner and more intelligent mobility technology is essential, this would be a tragic waste.

The analysis estimates the impact of such tariffs could result in the cumulative loss of more than 1.5 million units from UK production volumes over the next five years, worth some £42.7 billion at factory gate prices. Under this scenario, by 2024, falling demand and model reallocation to more competitive and welcoming production locations would see annual output falling to just 1 million vehicles per year.

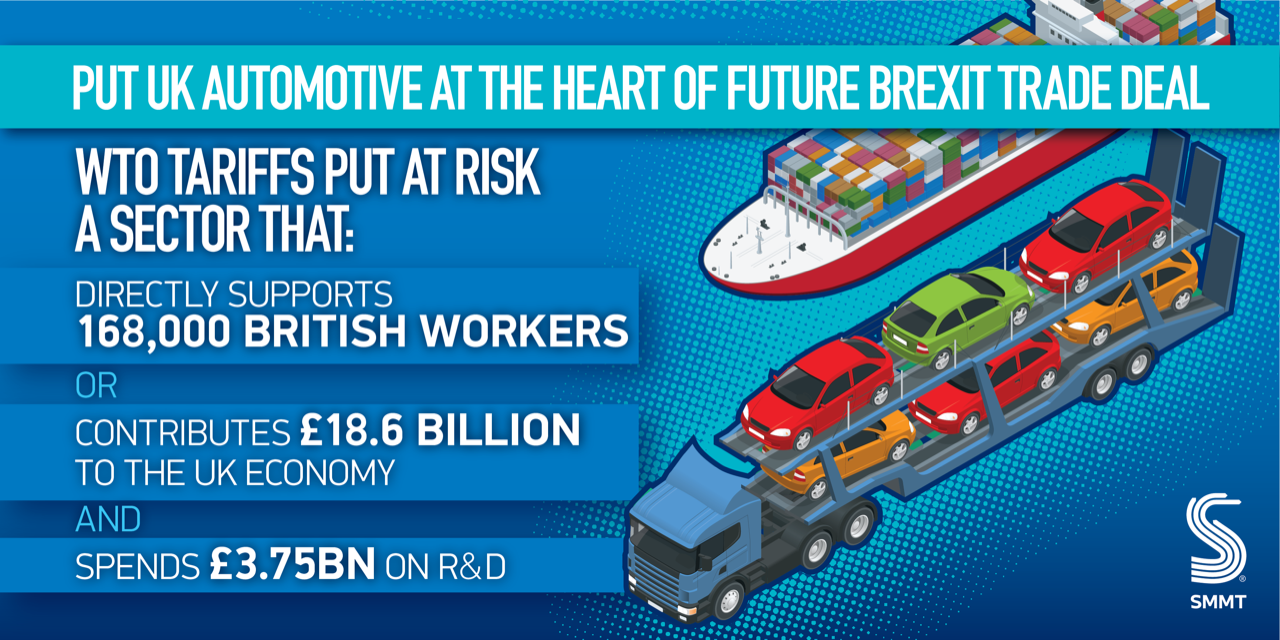

Automotive is one of the UK’s most valuable economic assets, exporting more goods than any other sector to over 160 countries worldwide. The manufacturing sector is directly responsible for putting food on the tables of 168,000 British workers and their families. The sector provides high value, highly skilled jobs right across the country, with wages typically 21% higher than the UK average.

In addition, with its annual economic contribution of £18.6 billion, the sector contributes enough to the economy to pay for the salaries of England’s NHS nurses twice over, or the entire NHS spend on medicines.3 Leaving the EU without an ambitious deal that eliminates tariffs, delivers frictionless trade, maintains regulatory alignment and secures access to talent from across the globe would jeopardise this contribution, causing serious economic damage and putting thousands of jobs and progress at risk.

Mike Hawes, SMMT chief executive, said,

UK Automotive’s needs are clear: frictionless trade free of tariffs, with regulatory alignment and continued access to talent. Detailed trade negotiations have yet to begin. They will be complex and they will take time. But a close trading relationship is essential to unlock investment so we can deliver our goals: cleaner air, zero carbon emissions, and the ability to go on building our products and marketing them globally.

Rather than producing two million cars a year by 2020, a no trade deal, WTO tariff worst case scenario could see us making just a million. The next government must deliver the ambition, the competitive business environment and the commitment needed to keep automotive in Britain.

Over the past decade, thanks to massive investment and collaboration with governments through a comprehensive industrial strategy, UK Automotive has undergone tremendous growth. It is globally competitive and a hotbed of innovation, providing the platform from which the industry can develop, manufacture and deploy electrified, connected and autonomous vehicles – with a £62 billion economic opportunity up for grabs if it succeeds.4

To realise this potential, however, sustained government support will be vital, starting with an ambitious Brexit deal, and including a long-term commitment to secure giga-scale battery manufacturing investment and to bolster the market for ultra low and zero emission vehicles through substantial incentives and infrastructure spending.

Notes to editors

1. SMMT UK Automotive Priorities for new government.

2. Independent analysis conducted by AutoAnalysis for SMMT based on 2018 production volumes.

3. Based on ONS and NHS data. Average nurse’s weekly wage of £627.30 x 52 weeks. NHS workforce statistics show 287,458 nurses working in England in August 2019. The Kings Fund report £17.4 billion spent on medicine in 2017

4. SMMT Report 2019 – CAVs: The Global Race to Market

File Downloads

- May 2020

May 2020

| Title | Description | Version | Size | Hits | Date added | Download |

|---|---|---|---|---|---|---|

| Mike Hawes car regs May quote | 426.90 KB | 603 | 23-09-2020 | DownloadPreview | ||

| May registrations 2004 to 2020 | 825.41 KB | 523 | 09-10-2020 | DownloadPreview | ||

| May Sales 2020 and YTD cars | 328.10 KB | 564 | 09-10-2020 | DownloadPreview | ||

| May Fuel 2020 and YTD cars | 514.02 KB | 554 | 09-10-2020 | DownloadPreview | ||

| Car regs summary infographic May 2020 | 284.07 KB | 531 | 23-09-2020 | DownloadPreview | ||

| Car regs by manufacturer May 2020 | 145.50 KB | 1262 | 23-09-2020 | DownloadPreview | ||

| Car regs best sellers May 2020 | 232.73 KB | 509 | 09-10-2020 | DownloadPreview | ||

| Car regs best sellers May 2020 | 208.93 KB | 559 | 23-09-2020 | DownloadPreview | ||

| Car regs YTD fuel May 2020 | 390.38 KB | 800 | 23-09-2020 | DownloadPreview | ||

| Car regs YTD by sales May 2020 | 219.76 KB | 547 | 23-09-2020 | DownloadPreview | ||

| Car regs SMMT press release May 2020 | 1.94 MB | 511 | 23-09-2020 | Download | ||

| Car regs May 2004 to 2020 | 95.30 KB | 678 | 23-09-2020 | DownloadPreview |

Comments are closed.